Over 100 years ago, in 1900, the average life expectancy in America was under 50 years of age. Dramatic improvements in health and healthcare opportunities during the 20th century have led to a 50 percent increase in life expectancy. Today, the average U.S. life expectancy is approaching 80 years of age.

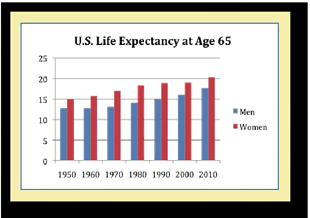

Males have come close to closing the gap with females in recent years. In the 20 years from 1989 to 2009, male life expectancy increased 4.6 percent while female life expectancy rose only 2.7 percent. U.S. males are now expected to live to 76.2 years while women can expect to live to 81 years.

Quality and quantity

Collectively, mature adults are much different today than they were 25 or 50 years ago. Older people are now regularly playing sports and delving into other activities that until recently were primarily the province of younger people. Improved healthcare and a more active lifestyle have allowed the senior population greater freedom generations at the same age.

As life expectancies have risen, the age at which someone is classified as middle-aged has shifted as well. The boomers, who in their youth defined “middle-aged” as 30 and argued that anyone over that age was not to be trusted, would now classify 60 as solidly middle-aged. It may be time to look at age not in terms of the number of years already lived but in terms of the number of years yet to come.

Americans currently age 65 can expect to live even longer. According to 2008 data from the United States Census Bureau, a 65-year-old man can expect to live to age 83, while the average 65-year-old woman should live to age 85 or beyond.

What this means for philanthropy

With some 70 million baby boomers in their late 40s through late 60s, most are still working and many have just reached their peak earning years. In spite of setbacks experienced in the Great Recession, they are likely to be the wealthiest U.S. generation yet.

Many boomers live in two-income households, own their homes and participate in one or more retirement plans. With net household wealth at an all-time high, this segment of the population and their “elders” control most of the individual wealth in America.

This combination of income and wealth (and soon-to-be-inherited wealth) should bode well for gifts from estates, but there may be a long wait. Boomers are expected to live longer than any previous generation. Young boomer couples are barely halfway through their combined life expectancy, while even the oldest boomer couples should enjoy a 25-year combined life expectancy.

No doubt this generation will continue to give-and give generously—but gift planners will need to acknowledge the challenges that increased life expectancies can pose on financial and estate planning.

Meeting multiple needs

When working with baby boomers, remember that larger gifts will often have to meet multiple objectives. Consider suggesting a gift that will help the donor:

- Assist parents, children and grandchildren

- Supplement retirement income, or perhaps serve as a bridge to retirement

- Make a charitable gift with funds that will ultimately be returned to aid loved ones

Wait on bequests

According to IRS data, over 75 percent of charitable bequests come from persons who pass away over the age of 80. Bequests from boomers, and other gifts that are tied to life expectancy, are not likely to provide any charitable benefit for at least another generation.

In the years ahead, it will be important to continue to inform, educate and motivate older generations to make charitable bequests while discovering other ways to help boomers fulfill their charitable and financial goals.