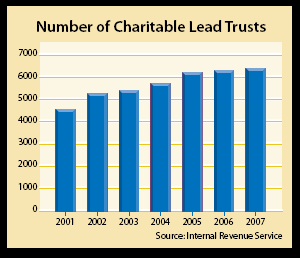

It may come as a surprise to many gift planners, but charitable lead trusts have proven to be the fastest growing type of charitable trust in the new millennium. According to IRS figures, the number of charitable lead trusts increased almost 40% between 2001 and 2007. It’s likely that the combination of depressed asset values and historically low AFMR discount rates will add new fuel to the attractiveness of this gift planning strategy among more sophisticated donors and their advisors.

What is a lead trust?

Conceptually the charitable lead trust operates in the reverse of a charitable remainder trust. Instead of individuals receiving income for life or a term of years with a nonprofit organization receiving the remainder, the charity receives its gift first and the donors or others receive the trust assets at the end of the trust term.

Many donors and planners became intrigued with charitable lead trusts after learning about a provision in Jacqueline Kennedy Onassis’ will that would effectively eliminate gift and estate transfer tax on a significant fortune by providing income interests to charity for a number of years.

Facts and figures

The chart illustrates the growth in the number of charitable lead trusts that filed informational returns with the Internal Revenue Service between 2001 and 2007.

Not only did the number of charitable lead trusts grow by 40%, but the amount of assets held in lead trusts grew by 74%. During the same period, the number of unitrusts grew 13% and the assets in unitrusts grew 20%.

What may be surprising to many gift planners is the size of charitable lead trusts. IRS figures reveal that 63% of charitable lead trusts report assets of $1 million or less. The average size of those trusts is $374,000. Some 85% of charitable remainder unitrusts hold less than $1 million and these trusts average $343,000 in size. When looking at the $1 million to $10 million size range, lead trusts averaged $2.86 million while unitrusts averaged $2.74 million. It thus appears that charitable lead trusts are being created in similar amounts as the most popular form of charitable remainder trusts.

How much to charity?

Each year, thousands of new charitable trusts are created and thousands of existing charitable trusts terminate. With a remainder trust, charities typically receive their benefit when the trust ends. In the case of a lead trust, the charity receives benefits every year the trust is in existence. As the number of charitable lead trusts has grown, so has the amount of annual distributions. As a result, charitable lead trusts now provide more funds to charity in a given year than either terminating annuity trusts or unitrusts.

Now may be the time

As mentioned earlier, a number of factors may contribute to an increased interest in lead trusts in the coming year. Donor psychology as it relates to the current economic challenges may play an important role.

For example, wealthy donors who would have made sizeable outright gifts a year ago may feel it is no longer as feasible to do so, especially if their investments have lost 20% to 40% of their value over the last year. Some of those persons may still consider making a significant gift if the underlying assets used to fund the gift are eventually returned to them or their loved ones.

Because a gift to heirs is considered complete at the time a lead trust is created, some advisors have reportedly been urging donors to fund lead trusts today at lower asset values so that future appreciation passes to their heirs outside their estate and free from additional taxation. Keep in mind that a lead trust, unlike an outright gift, also affords advisors an opportunity to continue managing assets for a period of time.

Also consider the potential impact of a new administration in Washington. Recent announcements that the new administration does not intend to allow the repeal of the estate tax may create greater interest in strategies that can help donors minimize potential gift or estate taxes.

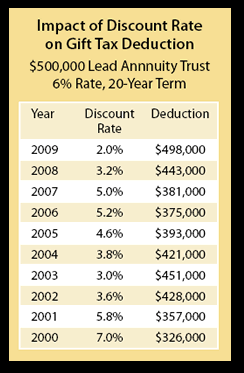

Impact of discount rate

Finally, the discount rate used in calculating the benefits for lead trusts is the most attractive that it has ever been. This means that trusts can have a lower annual payout and shorter term to “zero out” gift and estate taxes.

The chart illustrates how gift tax deductions have increased in recent years for a 6% charitable lead annuity trust for a term of 20 years.

In conclusion, the charitable lead trust may provide a very attractive gift option to a larger number of gift prospects in today’s environment.

Development officers should try to identify donors who may not be able to give in the same manner that they would have a year ago, but would consider an alternative gift option that allows them to fund a meaningful gift while returning assets to them or others they designate.