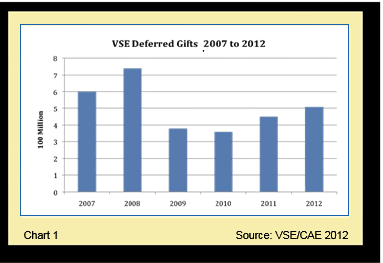

Estimated contributions to colleges and universities in the fiscal year that ended June 30, 2012, rose by 2.3 percent to a total of $31 billion. Leading the way were reports of gift annuities, charitable trusts and other deferred gifts, which were up 15.3 percent.

This dramatic increase continues a trend that started a year earlier in 2011, when the present value of deferred gifts such as charitable remainder unitrusts, annuity trusts, pooled income funds and gift annuities increased by over 23 percent. The 41 percent growth in deferred gifts since low points in giving reached in 2009 represents nearly five times the 8.5 percent growth in other individual gifts.

The Council for Aid to Education’s Voluntary Support of Education Survey began reporting the present value of deferred gifts in 2003. In that year, the face value of those gifts was $1 billion and the present value of remainder gifts was $455 million. The present value amount increased every year before peaking at $740.474 million in the 2008 report. After a sharp decrease in 2009 and 2010 during the Great Recession, the rebound began in 2011 and continued in 2012.

Upward trend should continue

As the stock market continues to grow along with the household wealth of affluent Americans (see Page 6), this trend is likely to continue as larger numbers of baby boomers consider their retirement needs in coming years. Additionally, higher-income taxpayers will find that the immediate income tax charitable deductions associated with such gifts may provide them with greater savings and incentives than they enjoyed before the passage of the American Taxpayer Relief Act (ATRA) earlier this year.

Among those who will find deferred gifts most appealing after ATRA are wealthier, upper-income donors with highly appreciated, low-yielding assets. The new 39.6 percent income tax rate, 20 percent capital gain tax rate and 3.8 percent Medicare contribution tax will provide an opportunity for greater tax savings today along with the possibility of tax-advantaged payments in the future. Record stock market values and recovery in real estate prices will also serve to accelerate these trends.

Bequest giving

In contrast to irrevocable deferred gifts, the value of realized bequests to higher education was basically flat, slipping slightly from $2.3 billion in 2011 to $2.1 billion in 2012. Last year’s figure was slightly lower than the 2010 total of $2.16 billion (see Chart 2), and bequest income continues to fall in the wake of economic troubles that began in 2008.

In addition to economic challenges, smaller class sizes as a result of the Depression and WWII continue to place a drag on bequest income to higher education. A recent Sharpe study of the bequest income of a major doctoral university revealed that the median age at death for bequest donors was 85. Over the past decade, colleges and universities have seen downward pressure on the number of estates as they “cycled through” the smaller class sizes of the early 1930s to the late 1940s.

The unprecedented growth of class sizes in the post-WWII era at many colleges and universities should fuel dramatic future growth in bequests as these graduates approach their 80s and 90s in coming years.

For more information about the latest 2012 Voluntary Support of Education Survey results and estimates, visit cae.org.