A recently completed survey commissioned by Convio provides interesting insights into the marketing preferences of multiple generations of donors. Released in March 2010, “The Next Generation of American Giving” focuses on the fund-raising and communication means that may be most effective with Gen Y, Gen X, Baby Boomers, and the mature market composed of the 65-plus generations. The complete study may be accessed at www.convio.com/nextgen.

The study begins with the premise that many fund-raising efforts are now optimized for those born before 1945, now age 65 and older. The authors then address the question of how charities should best attract the next generation(s) of donors without losing gift revenue from those now over 65.

The report suggests nonprofits continue with established fund-raising efforts with the mature 65-and-over market. For Baby Boomers and younger donors, the survey results point toward augmenting traditional acquisition efforts with marketing channels like Internet-based fund-raising efforts.

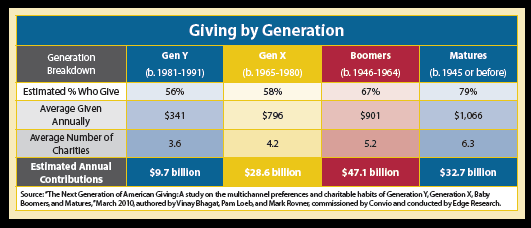

The survey reports on the response of over 1,500 donors who participated in an online survey and three focus groups held in late 2009 and early 2010. While the primary purpose of the study was to reveal strategies and techniques for engaging future generations of donors, it also contains a number of insights about older donors. For example, those born prior to 1945 are most likely to give (79%), followed by Boomers (67%). Gen X and Gen Y donors are almost equally philanthropic, at 58% and 56% respectively. The study reveals that direct mail is the preferred primary marketing channel for soliciting and collecting regular contributions from the 65+ age group. Total annual giving and the number of charities supported also increase with age.

Those in the 65-plus age bracket are significantly more likely to give to charity. These “mature” donors also support more charities and give at the highest average levels. According to survey results, most members of older generations prefer to make their charitable contributions by sending a check through the mail. Giving through the mail is also widespread for Boomers and Gen X, but significantly less so for Gen Y.

Contributions made during the payment process at retailers (“check-out” contributions) are used widely by all generations. Only 2% of those 65 and older report making contributions on a social networking site or by texting, while 13 to 14% of Gen X and Gen Y members report text contributions. Giving via Web sites is most attractive to Gen X and Boomers and less so for both Gen Y and those 65 and older. Mature donors are the most likely to respond to memorial or tribute gift requests and phone solicitations.

After a gift is made, the preferred channel for receiving information from the donor’s top charity is direct mail for every generation except Gen Y, for whom the charity’s Web site or e-mails are preferable. The most effective or appropriate solicitation channels for all generations include being asked by a friend, being mailed a letter from a known charity, and receiving e-mail from a known charity.

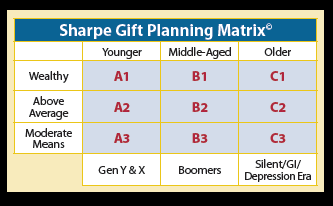

The overall take-away from Convio’s study is that fund raising is a multi-channel proposition and that the effectiveness of different communication channels may vary by age group. From a planned and major gift standpoint, it is essential to focus on the communication and solicitation methods that have proven most effective for the Boomer and 65+ donor population, while adding additional channels that will allow more donors both younger and older to receive and respond to the message in an appropriate manner. See page 2 for a chart illustrating the Sharpe Gift Planning Matrix©, a tool that may prove helpful in organizing a donor constituency. Matching correct communications and planning tools to each segment of the Matrix can be a key to success today and in future years.