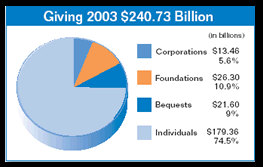

Newly released Giving USA 2004 figures for calendar year 2003 indicate that total giving in the United States reached an estimated $240.73 billion. This figure represents a new record for philanthropic giving in America in the wake of a period of economic slowdown, and it may bode well for continued growth in 2004.

Of particular interest to gift planners is the estimated $21.6 billion in bequest giving for 2003, compared to a revised estimate of $19.15 billion for 2002. Overall, bequest income now accounts for some 9% of giving in America, compared to 74.5% from living individuals, 10.9% from foundations, and 5.6% from corporations. (See chart at right.) It should be noted that some organizations receive little or no income from bequests while others receive much higher percentages of their support from this source.

It is not unusual for organizations that have long emphasized the importance of planned giving to receive upwards of 30% of their philanthropic support in the form of bequests. For example, according to reports published earlier this year by the Council for Aid to Education (CAE), bequests to higher education during the 2002-2003 time period represented some 24% of giving by individuals.

While many programs that have recently begun placing emphasis on bequests are experiencing rapid growth in this area, mature programs typically report larger percentages of income from bequests while their growth rates have naturally slowed over time. Experience shows that only a handful of programs that rely on bequests for over 20% of their gift income regularly enjoy double-digit growth rates. The CAE report announced, for example, that bequest income to higher education (where many planned giving programs are relatively mature) actually declined slightly from $2.3 billion in 2001-2002 to $2.2 billion in 2002-2003.

It should also be noted that gifts in the form of charitable remainder trusts, gift annuities, and other split-interest gifts established by donors during lifetime are included in the “giving by individuals” category. Thus, a third or more of the planned gifts received by many of the nation’s more mature planned giving programs are not reported by Giving USA in the “bequest” category.

What lends special importance to the continued growth overall in bequest income is the fact that this may be an early indicator of the resilience of bequest giving in the face of estate reforms ushered in by the Tax Reform Act of 2001. Provisions of the 2001 legislation increased the estate tax exemption equivalent to $1 million for 2002 and 2003. This had the immediate effect of removing approximately one half of the decedent estates that in prior years would have had to file an estate tax return. (See “Declining Returns” in the June Give & Take for additional information.) Thus we are beginning to see indications that previously planned bequests were not removed from newly nontaxable estates following reductions in estate taxes for the masses of Americans.

It would appear that the much-anticipated wealth transfer is continuing to gain momentum, and that charitable organizations continue to be grateful recipients.

How they fared

According to a Giving USA survey of a broad range of non-profit organizations, some 55% of charitable recipients experienced an increase in giving for 2003. Another 8% reported virtually no change in giving, and 37% reported a decline in giving. This is an improvement over 2002, when just 50% of non-profit organizations reported overall increases in philanthropic support.

For more information about bequests and other forms of giving, the full Giving USA 2004 report (researched and written by the Center for Philanthropy at Indiana University) may be ordered from the AAFRC trust for Philanthropy/Giving USA Foundation at www.AAFRC.org.