By Barlow Mann

In good news for nonprofits, a number of critical economic, demographic and tax policy factors are converging to create what may be the best environment for fundraisers since 2007.

Economy on the upswing.

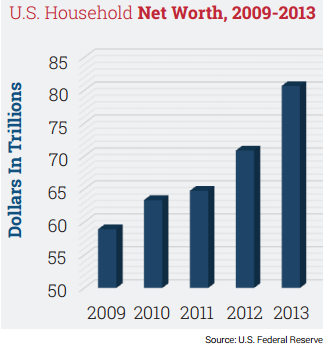

The Federal Reserve recently reported that household net worth in the United States is at an all-time high. The growth in 2013 alone was $9.8 trillion, or 14 percent. The ongoing economic recovery has led to a drop in unemployment figures and a rise in the value of real estate, stocks and other investments. Improving economic conditions such as these have historically led to a boost in charitable giving.

In May of this year, the Dow Jones stock index hit a record high, thereby increasing the amount of appreciated assets available to fund current or deferred gifts. Charitable gift planning can be employed to make gifts while also avoiding spikes in income that could lead to additional income, capital gains and healthcare taxes. Such gifts may also generate valuable itemized deductions.

Growth in generous generations.

Demographic trends also bode well for philanthropic activity. By the end of this year, all baby boomers will be in their early 50s to late 60s. Many are in the midst of their peak earning years and are seeing a significant increase in their personal net worth. As boomers reportedly give more to charity each year than any other age group, they are likely to share this prosperity with others.

In fact, according to federal estate tax returns, more charitable bequests are received each year from those 90 and older than from all persons under 80.

Meanwhile, according to the U.S. Census, the 85+ population group is now the fastest-growing segment of the population. The growing number of people in the later stages of life should provide a significant boost to the pool of traditional planned gift prospects.

Traditionally, the majority of charitable gifts that occur at death come from this group. In fact, according to federal estate tax returns, more charitable bequests are received each year from those 90 and older than from all persons under 80.

Taxing matters.

From a tax policy standpoint, the current environment is positive for charitable gifts made both during lifetime and at death. The American Taxpayer Relief Act (ATRA) extended the Bush tax cuts for the vast majority of taxpayers, preserving existing tax incentives for itemizers. This is welcome news for nonprofits since, according to Giving USA figures, those who itemize provide the majority of charitable gift dollars from individuals each year.

ATRA also increased the income and capital gains tax rates for America’s most affluent taxpayers. As a result, their charitable gifts may actually “save” more in taxes now than in recent tax years. Meanwhile, talks have begun again about possible future tax reforms, which could reduce or eliminate tax incentives for charitable gifts for many Americans. This means that the existing tax treatment for charitable gifts may make it more attractive to make charitable gifts now than to wait until the future. For more on recently proposed legislation and its possible implications for charitable giving, read Robert Sharpe’s latest contribution to Trusts & Estates magazine.

In summary, conditions have converged that create an environment that is more favorable for philanthropic planning than it has been for years or may be in the future. Fundraisers who understand these factors and act accordingly may well enjoy record levels of charitable gifts in 2014 and beyond.

If you are interested in learning more about encouraging charitable gifts in today’s environment, consider attending one of Sharpe’s upcoming seminars.