While the official national numbers of record have not yet been released, every early indication predicts that overall giving in America was up again for 2015. See also 2015 Charitable Giving Report at the end of this article. The Giving USA report for charitable giving in America should be available in a few weeks, but in the meantime another study conducted by the Council for Aid to Education (CAE) has just been published

The report on charitable giving to higher education, known as the Voluntary Support of Education survey (VSE), found a 7.6 percent increase in contributions to colleges and universities in 2015. The $40.3 billion in gifts to higher education is the highest total ever reported since the inception of the annual survey in 1957.This amount was based on 983 institutions, the total number of respondents to the 2015 survey. For the purposes of this article, we will focus on a core group of 941 institutions, those that responded in both 2014 and 2015.

The report on charitable giving to higher education, known as the Voluntary Support of Education survey (VSE), found a 7.6 percent increase in contributions to colleges and universities in 2015. The $40.3 billion in gifts to higher education is the highest total ever reported since the inception of the annual survey in 1957.This amount was based on 983 institutions, the total number of respondents to the 2015 survey. For the purposes of this article, we will focus on a core group of 941 institutions, those that responded in both 2014 and 2015.

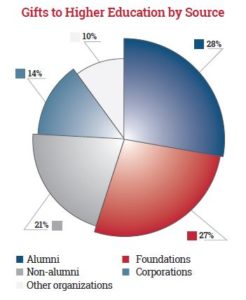

Alumni and non-alumni individuals gave almost half, or 49 percent, of the gifts reported. Foundations provided 27 percent of the giving total, followed by corporations at 14 percent and other organizations at 10 percent.

Bequests and deferred gifts

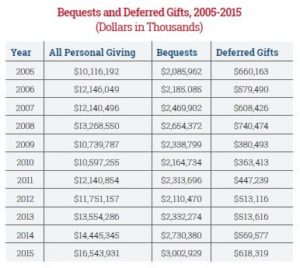

Between 2014 and 2015, the amount of charitable trusts, gift annuities and other irrevocable deferred gifts increased almost 9 percent, growing from $570 million to $618 million.

Between 2014 and 2015, the amount of charitable trusts, gift annuities and other irrevocable deferred gifts increased almost 9 percent, growing from $570 million to $618 million.

Some 428 survey respondents reported receiving an average of 22 realized bequests and 33 new bequest intentions. Of the 312 institutions that reported new bequest intentions at both face value and present value, the average value of realized bequests was over $4 million.

The significance of a small number of large bequests was apparent by the fact that the top three bequests from each institution accounted for 12 percent of all gifts from individuals and 65 percent of all bequests by responding institutions, which would amount to just over $3 billion in realized bequest revenue reported for 2015. Depending on the type of educational institution, the three largest bequests ranged from a low of 40 percent to 100 percent.

Appreciating gifts of securities

The total value of gifts of securities increased to $2.37 billion between 2014 and 2015. Over 50,000 securities gifts were reported in 2015, and the approximate average value per contribution was $53,000 both years.

If giving to higher education is any indicator, the Giving USA report should also reflect positive news for fundraisers.

Additional information and the reports may be found at cae.org and givingusa.org. ■

2015 Charitable Giving Report

The Charitable Giving Report: How Nonprofit Fundraising Performed in 2015, produced by Blackbaud, indicated that charitable giving reached a record level last year, but the rate of growth was slowing.

The 2015 Giving Report included overall giving data from 5,379 nonprofits that raised $18.2 billion, an estimated 5 percent of the total donated based on the latest Giving USA report released in June 2015.

Even though online giving represented a small portion of overall giving, online giving rose at a much faster rate than other sources and helped drive the overall increase. Online giving accounted for 7.1 percent of overall fundraising.

June and December were the most successful months for overall fundraising, driven by fiscal and calendar year-end giving efforts. Participants in the study indicated that the final quarter of the calendar year—October, November and December—accounted for more than one-third of overall giving, reinforcing the importance of year-end giving.

The Blackbaud report also includes other observations by size and type of organization. For example, international affairs and faith-based organizations showed the greatest increases in overall giving, while the educational sector led the way in online giving.

For more information, visit blackbaud.com. ■