A common belief in many gift planning programs today is that the majority of planned gifts should be irrevocable; in other words, gifts that the donor would be unable to change or terminate once they are established. While irrevocable gifts are indeed of vital importance to many programs and are typically very large gifts when they are completed, they have, in total, historically accounted for the smallest portion of realized planned gift income, even in the oldest, largest, and most successful programs.

The reality is that most of the funds given to charity through donors’ long-range financial plans are realized as bequests through wills and revocable living trusts, with remainders from life insurance, retirement plans, and similar sources gaining in importance in recent years.

These “revocable” plans are popular for many reasons, chief among them that they make it possible for donors to maintain control by enabling them to change their minds during life, guarantee that other heirs are provided for first, and serve to distribute funds to their charitable beneficiaries only at such time when they no longer need them.

Common reasons for this myth

There are a number of reasons why many organizations and institutions believe success in gift planning is largely centered around irrevocable gifts.

Based on our experience, the primary reason is that many programs are under constant pressure to show tangible results within a relatively short time frame.

Most nonprofit boards and management are interested in assuring that investments being made in any fund development program are producing tangible results quickly—results that can be counted on to actually “mature.” As a result, many programs have traditionally begun by promoting irrevocable charitable remainder trusts, pooled income funds, and charitable gift annuities.

With these plans, marketing efforts can be directed to a select group of people and within a matter of months a report can be delivered to management showing the amount expended and the actual “irrevocable gift dollars” raised as a result of the effort.

Another factor underlying overreliance on irrevocable gifts is that organizations are often involved in campaigns designed to reach specific goals, and have wanted to have strong guarantees before counting a gift or providing public recognition in such campaigns. This naturally leads to a focus on irrevocable gifts, as they are contracts, trusts, and vested remainders in real property, and thus provide greater certainty that funds will be available to the program at a future date.

Finally, tax considerations also come into play. That is because tax benefits are only allowed if a gift is outright or made in the form of an irrevocable deferred gift. Therefore, many come to conclude that most prospective donors will wish to make a planned gift in the form of an irrevocable commitment in order to take maximum advantage of all possible tax savings.

What is the reality?

Many years ago, when being challenged by board members and staff leadership to develop a successful planned gift program,I began researching other institutions to see where the majority of their funds were derived, and also what marketing and staffing activities they were using to maximize their income. I found that the organizations I identified as a peer group were averaging 20 to 30 percent, and in some cases more, from activities that are traditionally referred to as “planned giving.”

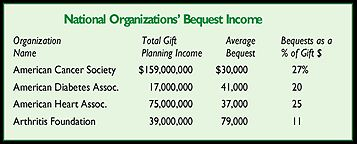

Note the following chart that illustrates bequests as a percentage of overall revenue for a number of health-related organizations.

After analyzing those numbers in greater detail, I was fascinated to discover that 80 to 90 percent of the realized or matured funds were generated from revocable instruments, primarily bequests via wills. Looking further, I discovered that this trend appeared to be prevalent across the nonprofit sector, including the nation’s leading educational, cultural, religious, healthcare, and social service organizations.

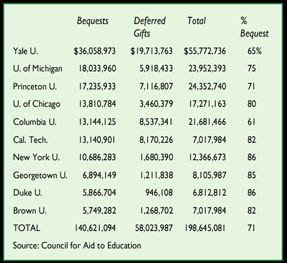

Note the chart below. As you can see from the list of many of the nation’s leading educational institutions in recent years, a substantial percentage of revenue, averaging 71 percent of total planned giving income for this selected group, comes from bequests that are revocable prior to death.

Revocable gift donor profile

Why is it that despite the attractive benefits of irrevocable deferred gifts, most funding for most organizations continues to come from bequests and other revocable gifts? Experience reveals that most donors and prospective donors, while they may be deeply committed to their charitable interests, are not likely to put themselves or their loved ones at financial risk during their later years in order to make a large charitable gift. For a number of reasons, many donors prefer to be able to change their mind when making a major gift commitment, in order to protect themselves and their loved ones during the remainder of their lifetime.

In addition, many persons who choose to make substantial charitable gifts as part of their long-term estate and financial planning desire to remain anonymous.

During a recent marketing focus group study for an environmental organization, several group members who were long-term donors revealed that they had included this organization in their will. When asked if they had told the institution of their gift decision, however, almost all of the donors said they had not informed the institution. When asked why, each had the same basic answer. While they knew they could always change their mind about the bequest, they felt that by telling the organization of their plans, the organization would come to rely on the funds. These donors indicated they didn’t want to let the organization down if something happened to prevent them from making their gift.

Others wish to remain anonymous to maintain privacy regarding their gifts. For such persons, the recognition that they think may be associated with revealing their intentions is a negative factor.

Keep in mind, however, that a substantial number of persons who have made provisions in their wills and other long-term plans will, in fact, tell you. The psychology is totally different in these situations and a great deal of attention and recognition may be appropriate and without them an organization may actually lose an eventual bequest! For this reason, regular, appropriately managed attempts to discover bequests are a vital part of many successful planned gift development efforts.

Irrevocable gifts vital

There will, of course, always be exceptions to the “revocable gift” rule. Each year, billions of dollars are generated from charitable gift annuities, charitable remainder trusts, and other types of irrevocable gifts. These types of gifts should, if possible, always be a part of your overall gift planning program. Irrevocable gift planning can often lead to “gifts of a lifetime.”

Keep in mind also that many donors who are initially attracted to the features of a trust or gift annuity, and afford you an opportunity to discuss their long-term plans in that context, will ultimately decide to make their gift in the form of a bequest or other revocable gift. The contact would have never come, however, if the organization had not offered irrevocable deferred gifts that afford a less personal context in which to discuss a donor’s long-term plans.

Conclusion

When working in the area of planned gifts, you are involved with a special group of people who are motivated by your mission and many of the other factors that also tend to underlie the decision to make current, outright gifts. But it is important to be very careful in your approach when dealing with gifts that are made as part of the estate and financial planning process. We believe that in the future, as in the past, a large percentage of realized planned gifts, especially from the broad middle of our constituencies, will no doubt continue to come from gifts that enable our donors to control their assets and protect those who depend on them for financial support.