The final weeks of the year normally prove to be among the most critical time periods for nonprofit organizations and institutions. The fall months have traditionally been a time when a large percentage of the year’s contributions are received. This year, however, the events of September 11, combined with ongoing investment market fluctuations, present an environment that may be unprecedented. Some organizations are now wondering whether traditional patterns of giving will be repeated this year.

Are you prepared?

We believe that nonprofits that are proactive at this point and take the lead in helping their donors decide how to best make their gifts before the end of this year may find that their results could actually equal, or possibly exceed, those of prior years!

Never in recent memory has greater attention been focused on the important role the nonprofit sector plays in our society. The outpouring of generosity in the wake of September 11 has been a source of inspiration heralded as evidence of a reawakening of the American spirit. History reveals that Americans have traditionally been more generous in the wake of catastrophic challenges. For example, giving increased some 46% in America in the year following the attack on Pearl Harbor (Source: The Chronicle of Philanthropy, October 4, 2001).

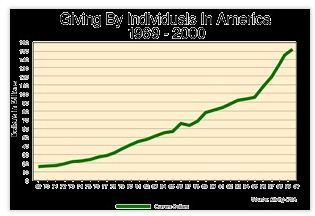

On the other hand, economic uncertainty and investment market fluctuations continue to present a challenge to charitable giving for 2001. As in the case of war, records show that in times of recession Americans do not stop their charitable giving. See the chart below for a depiction of charitable giving in America since 1969. Note that there have been periods of slow growth. Yet, only in 1987, a year that featured the worst stock market crash since 1929, did giving by living individuals drop, and then only 4.5%.

Act now to facilitate giving

The key to assuring that giving in 2001 equals or exceeds 2000 gift totals is to act now to make sure that donors are given the opportunity, information, and assistance necessary to make their gifts. Resist the temptation to take a “wait and see” attitude. If donors are asked, they may choose not to give. But if they are not asked, the odds are much greater they will not give!

When making your plans, remember there are five components to a gift. Who makes it, why do they give, what do they give, when, and how. This year, perhaps more than ever, it is important that we carefully address all five factors, especially when communicating with those who traditionally make larger gifts.

WHO will give?

Each year, the bulk of charitable contributions comes from individuals in the form of outright gifts and bequests. Early indications are that giving from corporations and foundations may be affected by economic conditions, but as noted earlier, history indicates that gifts from individuals remain constant or grow, even during all recessions since 1969. When seeking gifts this fall, therefore, focus special efforts on individuals who have made gifts in the past and those you have reason to believe may choose to begin supporting you now.

WHY will they give?

Surveys have shown that the desire to support a well-articulated mission is the primary reason people give. While recognition, peer pressure, and other factors may influence giving, now may not be the time to overly rely on those motivators. In your appeals this fall, focus on your mission and why it continues to be relevant in today’s environment, perhaps more than ever.

Don’t worry about “competing” for relief dollars. Americans have been generous in supporting relief organizations since September 11, and rightfully so, but totals donated in support of relief efforts as of late October are still well less than 1% of the $204 billion Americans donated to charity in 2000. Therefore, giving to relief organizations should have only a minimal impact on other giving.

WHAT should be given?

While focusing your appeal primarily around the mission that motivates gifts, also give your donors information that is designed to help them decide what may be best for them to give. Many donors will choose to give cash this year rather than appreciated securities. Donors give what they have, and this year there are trillions of dollars “sitting on the sidelines” in the form of cash. Others will continue to give securities that have increased in value. Many own securities that have fluctuated or declined in value over the past year, but are still worth far more than they paid for them. This is particularly true of older donors who have pursued a “buy and hold” strategy over the past decade or longer.

There are very effective strategies that can be employed when giving non-cash assets in the midst of the current environment. Some may wish to sell securities, take a loss, and give the cash proceeds. Others may choose to donate securities that still have an appreciation element and use cash to diversify their market holdings. For those over the age of 59 1/2, it may make sense to take make a withdrawal from a qualified retirement plan to fund their gifts this fall. See the enclosed copy of “Your Guide to Effective Giving in 2001” which outlines these and other strategies, especially in light of the recent tax act.

WHEN should they give?

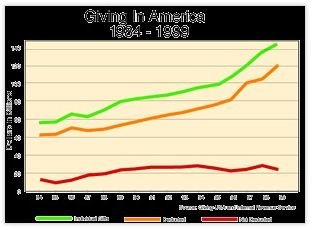

This year it will be important for many persons to complete their gifts before December 31. This is because tax rates are scheduled to fall next year, resulting in a larger after-tax cost of making charitable gifts. Discussions of accelerating future tax rate reductions into next year may make it even more critical that gifts be completed this year for maximum tax benefits. Evidence is that tax savings from current gifts are increasingly important in influencing the amount of gifts as well. More donors than ever before are now itemizing their income tax deductions, including their charitable gifts. Note the following chart, for example, that indicates that virtually all of the in-crease in charitable giving since 1984 has apparently come from those who take tax deductions for their charitable gifts.

In light of current events, the lower after-tax cost of gifts this year and the “deadline” of December 31 to qualify for these greater tax savings may give a needed boost to appeals for gifts this fall. This will allow you to construct a more forceful message that augments your appeal based on mission with important and time sensitive financial considerations of a gift. Of course very careful consideration should be given to balance all of the elements of an appeal. An appeal letter may best be focused on the mission elements, while a P.S. and ancillary materials may be used to convey information aimed at helping donors make gifts most effectively.

HOW should they give?

As noted above, today’s turbulent environment may result in greater receptivity to communications built around the various financial considerations that donors are currently facing. Some gifts will be outright and others may be through some type of planned gift arrangement.

Conclusion

To maximize gifts this year-end, you must be prepared to ask for gifts in person, by telephone, by direct mail, and all other appropriate avenues. Remember that the majority of your gifts from individuals will come from a relatively small group. Some fundraisers have referred to this as the 80/20 or 90/10 rule, meaning that 10% to 20% of your contributions account for 80% to 90% of your giving totals. This November and December consider providing special attention and information to this critical group. While some major donors may understandably delay their gifts this fall, failure to reach this important group quickly may result in some organizations’ being skipped in major contributors’ annual giving cycle. In that case it may be Fall 2002 before many of these donors will again be receptive to appeals for significant sums.

As what may be a subdued holiday season approaches, and the events of September 11 recede in time, many donors may decide that significant gifts in the final weeks of the year are an appropriate way to end 2001 on a positive and proactive note. Be there for them, and be pre-pared to facilitate and/or accept gifts during the final weeks of the year. Steps taken in the next few weeks can and will make the difference between a good year and a great year for charitable giving.