An analysis of split-interest trust returns recently published by the Internal Revenue Service Special Studies Special Projects Section provides useful insight into the state of charitable trusts in America.

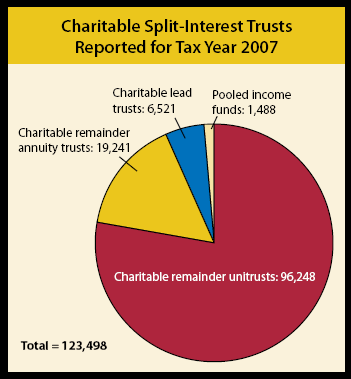

Provisions of the Pension Protection Act of 2006 resulted in significant revisions to IRS Form 5227, the informational return required to be filed each year by various charitable trusts, including charitable remainder annuity trusts, unitrusts, lead trusts, and pooled income funds. IRS Form 5227 returns for tax year 2007, the most recent available, contain information about 123,498 charitable split-interest trusts. See chart below for specific breakdowns.

The total number of charitable trust returns fell a negligible 0.1% in 2007 from 123,659 in 2006 to 123,498 in 2007. The number of charitable remainder trusts and pooled income funds decreased while charitable lead trust returns increased.

Charities received over $3 billion in distributions from these trusts. Charitable distributions from such trusts tend to continue even during difficult economic times as existing remainder trusts terminate or charitable lead trusts make mandatory charitable distributions each year they are in existence.

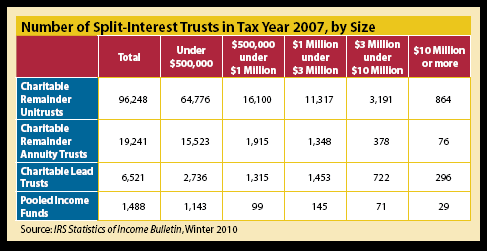

Of the 19,241 charitable remainder annuity trusts reported for tax year 2007, the vast majority were valued at less than $500,000. About 10%, or 1,915, fell between $500,000 and $999,999. Only 1,802 CRATS exceeded $1 million. Of the annuity trusts greater than $1 million, 76 had a value of $10 million or more.

Approximately two-thirds of the charitable remainder unitrusts fell into the smaller trust category of under $500,000. The rest were almost evenly divided between those valued between $500,000 and $1 million and the larger trusts of $1 million or more.

Some 62% of lead trusts were valued at less than $1 million. This group averaged $352,000. Most of the lead trusts valued at less than $1 million were actually under $500,000. Most of the larger lead trusts were valued between $1 and $3 million.

Only 344 pooled income funds were valued at $500,000 or more. See the chart above for additional details on the distribution of charitable trusts by size.

Based on the fact that the majority of charitable trusts of all types are valued at less than $500,000, it would appear that the potential market for this gift option may be significantly broader than just the ultra-high-net-worth group assumed by many. Charitable remainder and lead trusts may thus be useful planning tools for the less affluent or near-wealthy prospect pool and not just multi-millionaires.

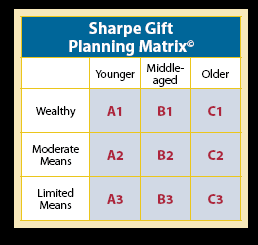

If your gift planning marketing for charitable trusts is targeted only to the highest wealth levels, you may be missing the mark. Instead, consider testing the inclusion of those who are middle-aged and older of above-average income and wealth levels.

Such a sampling might include a very select group of the best and most loyal donors from among your B2 constituents and then a broader selection of regular contributors that fall into the upper reaches of the C2 box in the donor matrix. Marketing should also continue across the top of the matrix using the appropriate marketing channels for each audience.

Early indications from the more detailed IRS reports on charitable trusts is that they may offer opportunities for donors who in the past may have made mid-six-figure gifts on an outright basis over a pledge period of a few years but may be reluctant to do so during challenging economic times. We may expect to see continued growth in these gift options as more donors and their advisors realize the power of these tools for those who would like to make significant gifts but can only do so if they or their loved ones can retain access to income and/or corpus for some period of time.