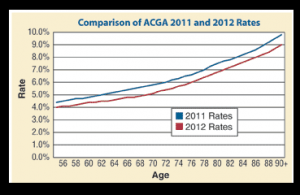

The American Council on Gift Annuities released new suggested rates for charitable gift annuities effective Jan. 1.

The new rates were announced after the semi-annual ACGA board meeting in November 2011. As part of an ongoing monitoring process, the ACGA continually reviews the various assumptions that underlie the recommended rate schedules. Based on this process, the new schedule of suggested maximum charitable gift annuity rates for this year is slightly lower.

Understanding the rates

Adjustments were made based upon revised investment earning assumptions, which were reduced from 5 percent to 4.25 percent.

The new rates were reduced in part to avoid problems with younger annuitants’ contracts failing to meet at least a 10 percent charitable remainder given AFMR/discount rates as low as 1.4 percent in 2011.

For one-life contracts, the rate reduction for persons over the age of 60 was in the 0.5 percent to the 0.8 percent range. Given the current economic environment, suggested rates for older donors should retain their appeal.

For one-life contracts, the rate reduction for persons over the age of 60 was in the 0.5 percent to the 0.8 percent range. Given the current economic environment, suggested rates for older donors should retain their appeal.

Although payment rates for a two-life annuity are slightly lower than rates for one person, donors may be interested to know that a portion of each two-life payment may be free from federal income tax for a longer time.

Charitable gift annuitants in the critical 76-86 age ranges will receive regular fixed payments between 6 percent and 8 percent. According to ACGA surveys, 80 percent of all charitable gift annuitants are 75 or older.

Further, when funded with cash, a significant portion of each payment will be received tax free over the recipient’s life expectancy. This is possible because that portion of the payments is deemed a return of part of the donor’s original investment in the contract. In effect, this is a return of the donor’s own money and not income per se.

Historically, charitable gift annuities have had a targeted “residuum” (amount to be realized by the charity upon completion) of 50 percent of the original contribution amount. The exact amount received will vary depending upon circumstances for each contract, including donor longevity, program expenses and investment returns.

Charitable gift annuities represent a well-proven method for donors to arrange a charitable gift while also retaining or reserving attractive fixed payments for life.

Deferred gift annuity rates

Deferred gift annuity rates are decreased even more than immediate payment gift annuities because of a reduction in the compound interest factor for deferred gift annuities from 4 percent to 3.25 percent. This change more adversely affects the rate when the deferral period is longer.

Charitable gift annuities are gifts and should be marketed as gifts rather than as investments. In fact, emphasizing the economic benefits of gift annuities may result in problems with state and federal regulations. Direct comparisons to commercial investments should be avoided to protect the charity and avoid misleading the donor.

Charitable gift annuities should continue to be attractive to both donors and charitable organizations in 2012. This will be particularly true for donors older than 75 and for organizations that monitor and manage their programs under sound underlying assumptions.

The ACGA rates committee has prepared a comprehensive report that explains the reasoning and underlying assumptions for the most recent revisions as well as historical and statistical background information. See www.acga-web.org.