By Barlow Mann

With the IRS reporting record levels of noncash charitable gifts, an organization’s fundraising strategy could benefit from encouraging these gifts.

According to the latest information from the IRS, noncash charitable gifts have recently increased to all-time record levels. The report, in the summer 2017 Statistics of Income Bulletin, analyzes millions of individual federal income tax returns filed for 2014 and reveals a marked rise in gifts of stock and other noncash property. While the number of noncash gifts rose 3.9 percent from the previous year, the dollar amount of such gifts rose significantly more—30.1 percent.

The 22.2 million taxpayers who itemized deductions in 2014 reported $65.3 billion in gifts other than cash, some 25 percent of all individual giving reported by Giving USA for the year 2014. The actual figure is likely several billion dollars larger when noncash gifts by nonitemizers and those whose gifts are in excess of AGI limitations are considered. Of the 22.2 million total, some 8 million taxpayers used Form 8283, which is required to itemize noncash gifts that total more than $500. This smaller group of itemizers was responsible for $60.4 billion in noncash charitable gifts in 2014.

Noncash gifts weighted in stock

Almost half of noncash gifts came in the form of corporate stock. Following the rise in the stock market, the value of such gifts increased 48 percent from the previous year to $29.2 billion. Additionally, gifts of mutual funds increased 29.1 percent to $2.1 billion. Gifts of other investments totaled $1.9 billion. Combined, gifts of stock, mutual fund shares and other investments totaled $33.2 billion, or more than 50 percent of all noncash gifts on Form 8283.

Charitable recipients

While charitable organizations of all types received noncash gifts, large nonprofits and foundations gained market share overall at the expense of educational institutions, health and medical research nonprofits and public and societal benefit organizations as a whole. Arts and cultural, environmental and animal-related and religious groups, as well as donor advised funds, all saw an increase in noncash contributions.

Seniors lead the way

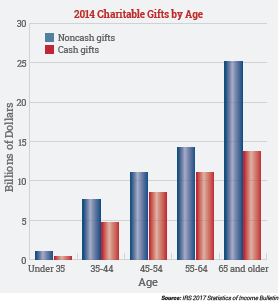

Taxpayers 65 years and older who reported noncash contributions on Form 8283 gave the most in total contributions (both cash and noncash) reported as itemized deductions on Schedule A (see chart below). These seniors gave 35 percent of the $39.4 billion total of cash gifts and 41.6 percent of the $60.4 billion in total noncash gifts claimed on Form 8283. Some 72.1 percent of the noncash gifts from this group of seniors came in the form of corporate stocks

mutual funds and other investments.

These numbers are even more surprising considering that this group represented only 19 percent of the 8 million individual income tax returns reporting noncash gifts on IRS Form 8283. Their average contribution was $16,419, more than twice the average amount for all taxpayers. Thus, it is clear that those over 65 are among America’s most generous donors.

The next most generous group was between 55 and 65 years of age, with an average contribution of $7,097. Those in the 45 to 55 age category averaged contributions of $5,060 per return, and those under 45 reported less than $5,000 in total noncash contributions.

What this may mean for 2017

It appears from industry data that the recovery in charitable giving demonstrated by these 2014 filings has not abated. The number of affluent and wealthy households in the U.S. is on the rise. One household in ten now has a net worth greater than $1 million, excluding personal residences, and U.S. household net worth has grown to a record $96.2 trillion in 2017, fueled largely by stock market gains and recovery in real estate values.

With continued growth in the economy and low unemployment, 2017 may well be shaping up to be the best year ever for charitable giving. That being said, not all fundraising programs will benefit equally. Those that take the time to encourage charitable gifts of stocks, mutual funds and other appropriate noncash gifts this year will likely see greater success than those that do not.

How can you claim your share? Start by identifying your best prospects for noncash gifts, and then develop an effective communication strategy to reach them. Sharpe Group can help with every stage of the process. Contact Sharpe at info@SHARPEnet.com or click here to get started.