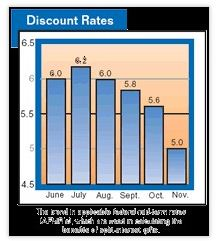

In recent months interest rates have dropped to levels not seen in recent years. Some interest rates are approaching the lowest level in 40 years, with the discount rate for planned gifts completed in November dropping to an unprecedented 5%. Many gift planners are familiar with the general effect of lower interest rates on the discount rate that is an integral part of calculations that determine the tax benefits of charitable remainder trusts, gift annuities, life estate contracts, and other gift planning vehicles. Basically speaking, low interest rates tend to increase the relative attractiveness of life estate agreements and charitable lead trusts, while higher interest rates lead to larger income tax deductions for charitable gift annuities and charitable remainder trusts. (See the April 1998 issue of Give & Take for more information at www.sharpenet.com.

Looking beyond the AFMR

Now may be a good time to further explore the impact of low interest rates on charitable giving.

Lower interest rates represent a “two-edged sword” that can affect middle-aged and older donors in very different ways. Many members of the baby boom generation are now benefiting greatly from lower interest rates. With homeownership at record high levels, many persons have, or plan to, refinance their home mortgages. A significant number of these persons have also been able to tap a portion of their equity to retire a portion of their consumer debt without increasing their total monthly outlay for interest payments. This technique may save significant amounts in future interest and increase discretionary income today.

Meanwhile interest rates on certificates of deposit, savings accounts, bonds, and many other interest-bearing instruments have continued to fall. Retirees on “fixed” incomes have seen their cash flow fall along with these rates.

Let’s examine the impact of this phenomenon on two gift situations. First, suppose an older donor has responded to a recent appeal with a personal note stating that on account of lower interest rates she can simply not afford to contribute any more. Based on her comments, you mention that a charitable gift annuity will pay approximately twice what she is earning on her CDs, and that only about half of each year’s payment will be taxable to her. The result: a six-figure charitable gift annuity and a resumption of her current gifts.

In a very different case, a middle-aged couple have just completed payment of college tuitions and recently refinanced their mortgage, significantly lowering their monthly payments. As a result, for the first time in their lives they feel they are able to become “major” donors by writing $1,000 checks to their two favorite charities. They derive great satisfaction from their personal, professional, and charitable commitments.

As we can see, the rise and fall of interest rates not only affect the charitable deduction amounts of various planned giving arrangements, but also the ability of different donors to give, depending on the circumstances in which they find themselves. The key will be to reach the right donors at the right time in their lives for different types of gifts that fit their current or future.