Recent reports reveal that members of the “G.I. Generation” are passing away in large numbers. Of the 16 million who served in World War II, fewer than 4 million are still alive. The youngest of this generation are in their early eighties and are dying at the rate of 1,000 per day. According to the U.S. Department of Veterans Affairs, most will be deceased by 2008.

Although many have spouses who will survive them, soon America’s nonprofits will no longer be able to count on current and deferred gifts from this group—one of the most philanthropic generations in history. The passing of this generation marks the end of the first phase of the highly publicized intergenerational wealth transfer.

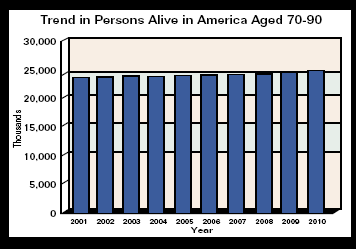

As a result, nonprofit groups may expect to see a lull in the growth of bequests and other planned gifts, making now the time to regroup and plan to ensure renewed growth in coming years. Data released by the U.S. Census Bureau (see www.census.gov) reveal that for the rest of this decade there will be little growth in the 70 to 90 age group that is critical to bequest and other planned gift development efforts.

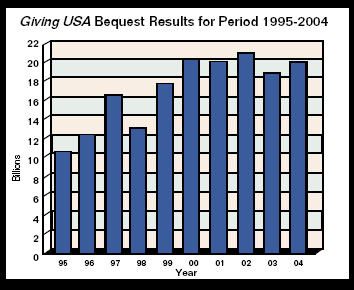

This factor, perhaps as much or more than the lackluster economic performance in recent years, has contributed to an interruption in the growth of bequest income as reported by Giving USA—after bequests had doubled between 1995 and 2000.

Fewer planned gift donors?

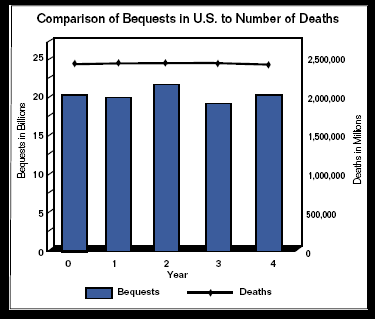

The lapse in bequest income growth is due in part to the relatively small size of the “Silent Generation,” born between 1925 and 1942 and now age 63 to 80. The Silent Generation is smaller than both the G.I. Generation it replaces and the large generation of Baby Boomers coming behind. Fewer numbers of persons in this age range may be contributing to a recent decline in the number of deaths in the U.S. See below for a comparison of the number of deaths to the Giving USA bequest totals for the past five years.

According to the American Council on Gift Annuities (see the August 2005 issue of Give & Take and www.acga-web.org), the average age of persons at the time they fund a gift annuity is 78. The average age of persons who give in the form of charitable remainder annuity trusts and other popular forms of planned gifts also falls in the range of 75 to 84—the same age group that will actually be shrinking slightly over the next five years.

Meeting the challenge

With planned giving prospects currently spanning three generations, it is more important than ever for development officers to strive to meet the needs of different age groups. It will be vital to strengthen relationships with the oldest donors, who in many cases will be making their final estate and financial plans over the next few years. Working with widows in this group will be especially important as they are often the ones who make the final decisions regarding the distribution of assets accumulated over a lifetime.

But it is also time to begin thinking of how members of the Silent Generation will differ from the G.I. Generation. Those born after 1925 came of age in the 1940s and 1950s and are a more educated group. They also have longer life expectancies. The oldest of this group will live another five to ten years, and many will live for twenty years or longer. Because of their longer life spans, consider encouraging gifts that produce useable funds in the shortest possible time frame. Gifts that take place only at the death of one or more persons in this age range will take many years to yield results.

Many in the younger generations were in mid-career when IRAs, 401(k) plans, and other qualified retirement planning vehicles gained wide popularity with changes in the tax laws starting in the 1970s. A large number of major donors and prospective major donors in the 55 to 70 age range have built up sizeable balances in these plans. Retirement plan assets along with wealth that is tied up in one or more homes may thus constitute the bulk of this generation’s assets. While they may be enjoying their peak income earning years, their assets may not be as readily “donatable” as those of the generation that preceded them. Those responsible for major and planned gift development should thus become well versed in ways to use retirement plan assets and real property to make charitable gifts.

For over five years, the charitable community has eagerly awaited passage of the CARE Act, which would make it easier for donors to make current and deferred gifts using funds from their Individual Retirement Account (IRA). While we all hope this bill passes soon, keep in mind that proposed legislation only applies to IRA assets and not to funds held in 401(k)s, Simplified Employee Pensions (SEPs), Keogh plans, and other plans where the bulk of retirement funds are now held. With proper planning, it is possible under current law to make generous gifts from these retirement plans as well as IRAs for persons over the age of 59 1⁄2. Development executives must learn all they can about these opportunities.

Estate tax repealed for most

It is still uncertain whether or not the estate tax will eventually be repealed. Regardless, however, most Americans are already exempt. For instance, only 28,600 of the 2.4 million Americans who died in 2003 left taxable estates—just 1.2%. So for all practical purposes, the estate tax no longer exists for the vast majority of the new generation of seniors who are now beginning to seriously consider their estate plans for the first time. They will be able to plan their estates without being “forced” into standard plans that were designed over the years to eliminate taxes on middle and upper middle class estates.

Some have speculated that reductions in the estate tax along with a lackluster investment market performance may already be contributing to the flattening of bequest income in recent years. In any event, the vast majority of those who leave charitable bequests will have to have reasons for making such gifts other than estate tax avoidance. Knowing how to motivate bequests without estate tax incentives will thus be key to success in bequest and other planned gift development in coming years.

Retirement plan boom?

Reductions and/or elimination of the estate tax will make charitable gifts at death from retirement plans even more likely to be the “bequest” of choice for many in the future. Without estate tax considerations, the best tax planning may increasingly be to leave charitable gifts at death through retirement accounts, as these assets will be subject to income tax when received by heirs. While the double taxation that decimates retirement plan balances for funds subject to both estate and income taxes will no longer exist after the elimination of the estate tax, federal and state income taxes of up to 35% or more will still be due on retirement plan accounts when received by others at death. This factor will come into play for donors of all wealth levels, as there is no exemption from the income tax on these funds, no matter how small an amount may be left. The tax-wise choice will be to leave charitable bequests from retirement funds and provide for heirs from funds that will not be subject to income tax when they are received.

The next phase of the wealth transfer

The projections for the coming $41 trillion intergenerational wealth transfer are based on the 55-year period from 1998 to 2052. At this point we are less than seven years into the projection period. According to Giving USA, during this initial period bequests to charity have totaled $128.6 billion, growing Through some 53% from $12.9 billion in 1998 to $19.8 billion in 2004.

To continue to benefit from the wealth transfer from this point forward, gift planners must accomplish two goals. First, they must carefully manage efforts targeted to the remaining members of the G.I. Generation. At the same time, they must develop approaches that will appeal to members of the new generation who are now at the stage of life where they may be contemplating their largest gifts of a lifetime. The nature of these gifts will vary depending upon circumstances and will include larger outright gifts, bequests and other end-of-life gifts, and split interest gifts using trusts and other planning vehicles.

By broadening their focus, those who take a “generational” approach to gift planning can expect to succeed in this exciting and challenging new environment.

This article is excerpted from “Navigating the Perfect Storm,” the first session in Sharpe’s latest seminar. Visit www.sharpenet.com/seminars/ for more information