Donors and board members looking for new ways to support charity need look no further. The flexible deferred gift annuity offers several key benefits.

First, charitable gift annuities allow unlimited contributions to enable a donor to meet current and future income needs. The IRS regulations limit contributions to IRAs, 401(k)s, 403(b)s and other retirement plans including those makeup provisions for people over 50. The creation of one or multiple flexible deferred gift annuities is not constrained by those limits.

Second, a donor can create a deferred gift annuity that maximizes their current income-tax deduction while retaining the flexibility to elect payments earlier than may be planned.

Third, a flexible deferred gift annuity provides “protection” should an income need arise due to some unforeseen emergency or an important life event.

Additionally, a donor facing an uncertain future event (such as placing a relative in an assisted living facility or helping someone with in-home care) can use the flexible deferred gift annuity like a “flip” arrangement which enables them to elect the payments to start if or when the need arises.

Example:

Jane Maximus, a 60-year-old corporate executive and a board member of the charity, has extra resources to supplement her retirement income. She needs more income-tax deductions, and she appreciates the charity’s work in the community. However, she also has an 80-year-old mother who may need assisted living in about five years. With the flexible deferred gift annuity, she can manage all the above!

Jane considers creating a two-life flexible deferred gift annuity using $150,000 cash and wants the option of electing the additional payments beginning at age 65 (or her mother’s age of 85). She sets a target date for the deduction of 10/31/2031 with a start date for elective payments of 10/31/2026. For her gift, she will receive an income tax charitable deduction of $82,286. Since she itemizes, she may be able to deduct this gift amount up to the limit allowed against her adjusted gross income (with a five-year carry over of any excess amount).

What goals can be met for Jane?

- Jane will know she has met part of her charitable giving goals and has a large deduction to use against her current income.

- Should her mother need help with assisted living costs, Jane can elect the payments to begin as early as 2026.

- Should Jane pass away, her mother can elect the payments whenever she needs them.

- Should her mother pass away, Jane can elect the payments for her retirement needs be delayed until 2041 when she reaches age 80.

- Jane may elect to rescind her payments from the flexible deferred gift annuity to meet more of her charitable giving goals and would receive an additional income tax deduction for that gift.

Since Jane is making a gift for her mother for the value of her mother’s interest that is in the future, she would need to retain the right to revoke her mother’s interest in order to avoid the gift tax consequences.

Most importantly, the charity now has established a long-term relationship with Jane, which opens the door for additional giving opportunities provided the charity stewards the relationship over the years. If larger payments were needed beginning in 2026, Jane could choose that alternative and receive a smaller income tax deduction.

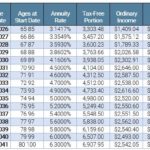

Here is the chart to show the results of her gift.

The flexible deferred gift annuity gets very little publicity, but in some conditions, it may be an outstanding option for giving. Learn more about flexible deferred gift annuities from our previous blog posts:

- How to Be Fixed and Flexible During Inflationary Times (Sep. 26, 2021)

- Flexible Payments From Flexible Funding (Oct. 18, 2021)

By Lewis von Herrmann