Nudge theory suggests positive reinforcement and indirect suggestions can influence the behavior of an individual. The concept became mainstream with the 2008 book “Nudge: Improving Decisions About Wealth and Happiness” by professors Richard H. Thaler and Cass R. Sunstein. They argued that more people would have more saved for retirement if employers created default retirement options for employees. Though employees could adopt any plan they choose—or opt out altogether—they would automatically be enrolled in the default plan. In other words, it would require action to leave a plan.

Changing incentives at the federal level

In my blog post dated August 20, 2021, Encouraging Americans to Save Act, I reviewed the proposed reforms to the saver’s credit and how a federal matching contribution for certain middle- and low-income employees would work. The Treasury would need to coordinate it with state and local efforts to enroll workers into retirement savings plans. Additionally, the Secure Act of 2019 made it easier for small businesses to “band together” to offer sec. 401(k) plans through pooled employer plans.

New incentives at the state level

There are extremely promising retirement income security reforms emerging at the state level. Oregon, Illinois and California have launched auto-IRA programs, which require most employers without qualified plans to enroll their workers. These privately managed plans are Roth IRAs with the ability to opt out of the Roth IRA option. All three states have a default contribution rate of 5% of compensation. California has an escalating percentage of 1% per year to up to 8%; Oregon’s is up to 10%. Employees may elect out of the higher percentages. Illinois’s plan lacks an escalating contribution rate.

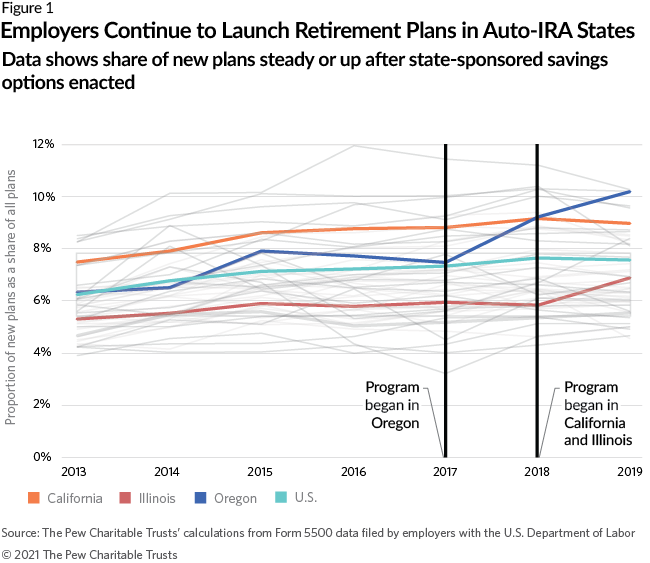

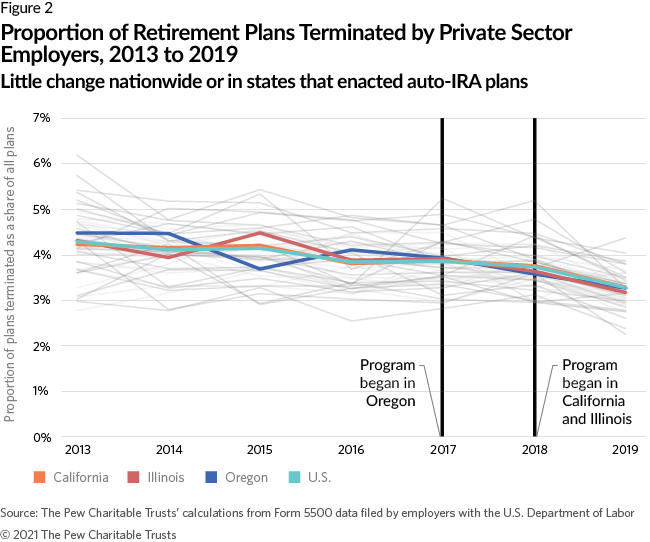

A recent Pew study of the programs in California, Oregon and Illinois suggests that auto-IRAs appear to complement the private sector market for retirement plans such as the 401(k). In analyzing the annual filings of employer-sponsored plans in states with auto-IRAs, it appears employers continue to offer qualified plans (see Figure 1). Those employers without qualified plans are adopting new ones at rates as high or higher than before the creation of a state option. There is not any evidence these state programs are “crowding out” the private market. Nor does there appear to be any increased termination of existing plans (see Figure 2).

Importance of multiple venues to save

The efforts at the state and federal levels to provide default vehicles represent yet another policy prescription to reduce the “access” gap of an estimated 57 million private-sector workers. Reduction of that gap is needed to improve the retirement income security of many who are presently unprepared for retirement.

Pew Research studies show that if employees are “nudged” through positive reinforcement and indirect suggestions by their employer, they are 15 times more likely to save for retirement. These incentives aim to prepare the unprepared for retirement without negatively affecting the private market, and in the long run, will directly reduce wealth inequality and allow communities of color and other historically underrepresented communities to build capital through an individual account retirement plan.

By Professor Chris Woehrle, Chair & Professor of Tax & Estate Planning Department, College for Financial Planning, Centennial, Colorado

Sharpe Group will continue to post helpful information for you here on our blog and on our social media sites. If this blog was shared with you and you wish to sign up, click here.

We can be found on Facebook, Twitter and LinkedIn @sharpegroup.

We welcome questions you’d like us to address. Email us at info@SHARPEnet.com and we’ll share your question and our thoughts in this blog and on social media.