From Twitter to Instagram to TikTok, the web is exploding with regular people who have found ways to create fortunes in real estate. Whether by “flipping” houses utilizing the BRRR Method (Buy, Renovate, Refinance, Reinvest), creative financing or just adding one rental property, the past 10 years have provided a wealth-building opportunity for regular people to become the Millionaire Next Door as a “side hustle” or full-time work.

From Twitter to Instagram to TikTok, the web is exploding with regular people who have found ways to create fortunes in real estate. Whether by “flipping” houses utilizing the BRRR Method (Buy, Renovate, Refinance, Reinvest), creative financing or just adding one rental property, the past 10 years have provided a wealth-building opportunity for regular people to become the Millionaire Next Door as a “side hustle” or full-time work.

The Federal Reserve has been printing money at breakneck speed for more than a decade, and the cost of borrowing capital has been historically low, providing amazing investment results as rents and prices of homes have skyrocketed.

In Austin, Texas, the average rent increased approximately 30% in 2021 alone, with most major cities seeing increases in rent and home values of over 10%. This type of growth in one asset class over a decade or more also provides great opportunities to reach out to your donors with several ways for them to make large gifts through tax-wise charitable gift planning tools.

Here is a simplified example. As always, donors should consult with their financial and legal advisors before structuring a gift such as real estate.

If a donor has held a property for a decade and still wants the income without the hassle, perhaps they might be interested in hearing how a charitable remainder trust (CRT) allows them to gift the rental property for someone else to manage while utilizing the full value of the property to create income.

If the donor owns multiple properties, the charitable deduction on the gift of a property to a charitable remainder unitrust (CRUT) may be used to determine the timing of selling other properties as well. The bottom line for every fundraiser is “knowing their donor” and communicating with them regularly while seeding conversations with questions and, when appropriate, charitable and tax-wise options for their planning.

By Tom Grimm, Sharpe Group Senior Consultant

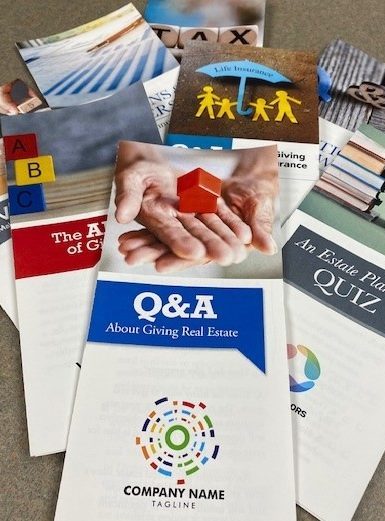

Sharpe now has an extensive Gift Planning Library of personalized brochures, booklets and pocket guides for you to help your donors make tax-advantageous gifts that allow them to support your mission while meeting personal needs. Our variety of publications feature numerous gift planning topics, including wills and bequests, charitable gift annuities, retirement plans, trusts and gifts of life insurance and real estate. Our library provides in-depth information and examples for donors, and some contain a special technical section for professional advisors. All Sharpe publications are reviewed regularly by experts to ensure technical accuracy. Click here for more information.