The 29th Conference on Gift Annuities was held in New Orleans April 28-30. It was particularly timely in light of ongoing economic developments and how they have come to impact charitable gift annuity programs.

Since its inception in 1927, the central message of the American Council on Gift Annuities (ACGA) has been “Building Responsible Philanthropy.” Now in its ninth decade of service, the ACGA continued this theme with this year’s conference committed to improving philanthropy.

Amid the prolonged economic uncertainty brought about by the “Great Recession,” there could be no better time for the ACGA to address questions and issues that may be on the minds of donors and charities about charitable gift annuity programs. The ACGA has consistently dealt with difficult issues in a timely and professional manner during a long history spanning the Depression, New Deal, World War II, and the periodic recessions of the last several decades. The ACGA has met these challenges head on and developed practices to ensure that charitable gift annuities have continued to meet the needs of donors and the charitable organizations that they wish to support. These “best practices” may be downloaded at www.acga-web.org.

One of the primary functions of the ACGA is to periodically determine if its recommended gift annuity rates remain actuarially and economically sound. A thorough study of the actual experience of charities, economic indicators, annuitant mortality, and anticipated investment returns and expenses is conducted periodically and the results used to guide rate recommendations.

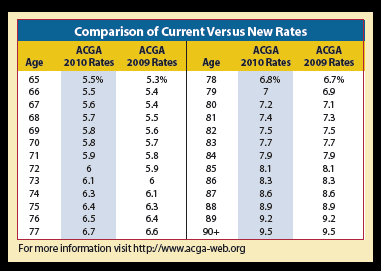

In a report to participants at the New Orleans conference, the ACGA announced slight revisions of 0.1% to 0.2% in recommended gift annuity rates for persons under the age of 82 (see the comparison chart below).

Exploring the rates

One of the primary components of charitable gift annuity payments is the assumed return of a portion of the “investment in the contract” over the payment recipient’s life expectancy. In effect, a substantial part of the payments received over time is the return of the donor’s money, with the overall objective being a 50% charitable gift remainder, or residuum, on average. Sometimes charities will have a larger or smaller residuum, depending upon the circumstances of each individual case. This is one reason that gift annuity rates can initially appear high to the uninitiated observer, especially rates for older persons.

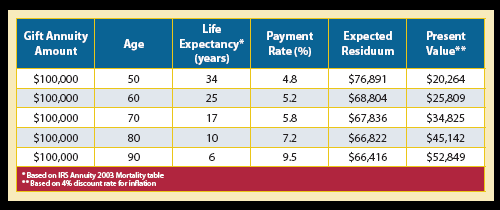

It is also worth observing that the recommended ACGA rates are somewhat suppressed for older persons. This is readily apparent when reviewing the anticipated residuum at various ages using new recommended rates, assumed life expectancy, a 4.50% return on annuity funds net of 1% expenses, and after discounting the expected residuum by 4% inflation over time to account for erosion of spending power.

Note that in all cases the expected residuum is greater than 50%, but the present value of a gift annuity from a 90-year-old, which is over 50% under the stated assumptions, is more than twice the nearly 26% present value of the same gift annuity from a 60-year-old.

For this reason, given the economic realities of gift annuities, some charities have decided to focus gift annuity marketing efforts primarily on the oldest members of their constituency. This strategy is in some cases intended to help bolster reserve funds and provide a cushion against future investment fluctuations.

Focusing on older donors

Gift annuities have historically been most attractive to donors in their mid-seventies to late eighties. An age-specific approach to marketing gift annuities may thus prove to be more cost effective over time than marketing to everyone over 50 or 60 years of age.

When marketing to older donors, also remember that fewer than a third of those in their seventies and eighties have Internet access, so most of these older persons prefer mail as a marketing channel. (See page 5 for more information about multi-channel marketing.) Charities may also wish to periodically review their marketing materials and disclosure statements to make sure that they are up to date and are donor friendly. Special care should be taken to avoid unintentionally misleading elderly donors and to guard against potentially fraudulent representations involving investment comparisons. Claims of “high income” and “guarantees” should be reviewed in light of relevant securities, tax, and elder fraud laws.

For almost 50 years, The Sharpe Group has prided itself on producing accurate and readable gift annuity marketing and communication materials for charities and donors alike.

Look for additional information on gift annuities and the most recent national survey conducted by the ACGA in future issues of Give & Take or visit www.sharpenet.com.