The June 2013 Give & Take reported the results of a Pew Research Center study on household wealth in America. The study found that the top 7 percent of households added 28 percent to their net worth between 2009 and 2011. By contrast, the remaining 93 percent of households actually lost 4 percent of their average net worth in the same time period.

The rich got richer because they benefitted from a strong recovery in stock market values. During the time period covered by the study, the S&P 500 stock index rose an estimated 34 percent, and the market continues to rise. In just the first seven months of 2013, the Dow Jones industrial average rose 18 percent to reach levels above 15,500. In addition, a recent Federal Reserve report attributed 62 percent of the $14.7 trillion total recovery between early 2009 and late 2012 to gains in the stock market.

Profile of stock owners

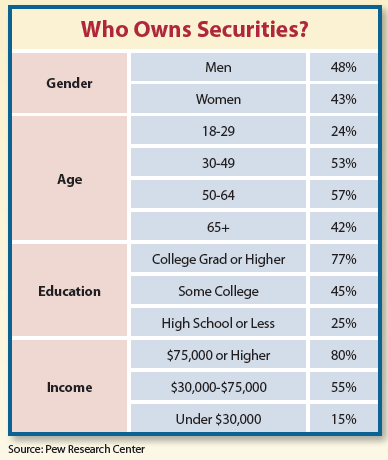

According to a recent Pew Research Survey, 45 percent of respondents indicated that they have assets invested in the stock market. The survey also revealed other information about who is invested in the market (see chart above).

Note the high percentages of Americans over age 30 and those with higher incomes who hold stock market investments. For example, 80 percent of those who earn $75,000 or more own securities. A similar percentage (77 percent) of college graduates are likewise invested. In addition, 57 percent of those age 50 to 64 have money in the stock market, and 42 percent of those over 65 are invested.

Know your donors

Those charged with raising funds for America’s nonprofits need to know who is benefitting from the rising stock market. When these survey results are combined with IRS data, the most likely candidates for gifts of appreciated securities are higher-income college graduates who are middle-aged and older.

If you are not sure who your best prospects are for outright or planned gifts of securities, you might wish to consider utilizing SharpeNet Data Services.