Most experienced fund-raising professionals have some familiarity with non-cash charitable contributions. Oftentimes, this type of gift is routed to a senior development officer under the omnibus clause in their job description: “and such other duties which may be assigned.” Collections of various types, art, antiques, and automobiles may be offered as well as publicly traded securities and real estate. Such gift opportunities frequently surface during the busy year-end giving season.

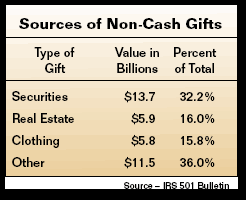

It may sometimes seem that non-cash gifts are more trouble than they are worth. But have you ever wondered about the importance of these gifts in the overall scheme of things? According to a first-time study conducted by the IRS, gifts from individuals who itemized their tax deductions and made non-cash gifts valued at $500 or more totaled $37 billion in 2003. According to IRS Form 8283, where gifts were reported, over half of the total amount contributed fell into three categories: securities, real estate, and clothing.

With real estate and securities values generally increasing since 2003, it is likely that non-cash gifts exceeded $40 billion last year and may well increase again in 2006. Record high stock market levels may well serve to increase these totals. To put this in perspective, in 2005 gifts to higher education from all sources totaled just under $26 billion.

- As we enter the year-end giving season, it may be useful to study additional information about this important type of gift. According to the IRS:

- The average stock contribution was $79,279.

- Less than one-third of the contributions were made to foundations (that percent may increase in 2006 and coming years because of Warren Buffet’s contributions).

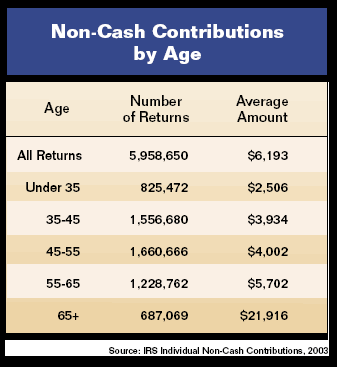

- Non-cash contributions increase with the age and income level of the donor.

Types of gifts

All told, there were nearly 6 million tax returns reporting over 14 million non-cash contributions. In addition to corporate stock, individuals contributed over $1.65 billion in mutual funds and other investments. Another 2,179 returns reported contributions of conservation easements valued on average at $688,000 for a total of $1.5 billion above and beyond other gifts of real estate. Over 800,000 individual tax returns reported gifts of automobiles or other vehicles valued at $2.35 billion.

The average amount claimed was almost $3,000, well below the $5,000 value required to obtain a qualified appraisal to support the deduction under the rules applicable in 2003. Note that provisions included in the Pension Protection Act of 2006 apply to gifts of automobiles, boats, and airplanes valued at $500 or more, which may limit the donor’s charitable deduction to the amount that the charity receives if the item is sold. The charity is to report this amount to the donor on Form 1098-C or other statement within 30 days of the sale of the vehicle.

The most popular non-cash gifts reported were clothing and household items. Over 4 million returns claimed deductions for clothing, and almost 2.5 million claimed deductions for other household items. The combined total of contributions for these categories exceeded more than 10 million gifts valued at approximately $9 billion dollars, an average of $900 per deduction.

In addition to the gifts of publicly traded securities reported on side A of Form 8283, almost 100,000 other contributions greater than $5,000 were reported on side B. Securities and clothes reported on side A of Form 8283 were valued at $12.7 billion and $5.8 billion, respectively, while real estate and easement contributions were the largest dollar volume on side B at $5.4 billion and $1.4 billion. Together, these four categories of non-cash gifts totaled some $25.3 billion. Even though Congress has been studying what some consider abuses of conservation easements, the Pension Protection Act of 2006 provides enhanced treatment for certain contributions by farmers and ranchers.

Income considerations

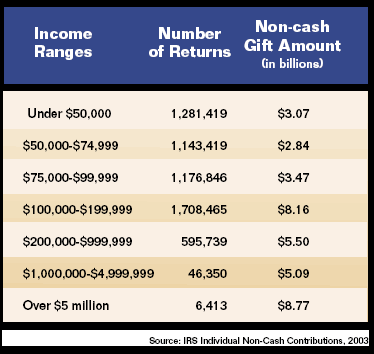

The chart below indicates trends based upon income levels.

Taxpayers with incomes from $100,000 to $199,999 had the largest number of contributions, totaling 1,708,405 gifts worth $8.16 billion. There were only 6,413 taxpayers with incomes of at least $5 million that reported non-cash gifts, but the value of their gifts was $8.77 billion. Those with incomes between $200,000 and $999,999 made 595,739 gifts totaling $5.50 billion. Those with incomes less than $100,000 reported gifts worth $9.38 billion on 3,601,684 tax returns.

Age matters

In general, it appears that the older the person, the larger the value of their non-cash contributions to charity. The total amount claimed and the average value of each gift both increased with age. The type of contributions made also varied with the ages of the donors. The 65+ age group was more likely to contribute stocks, other securities, real estate, and art and collectibles. Taxpayers in the 45 to 55 age group appeared to give more food, clothing, household items, and vehicles. Those donors age 65 and older contributed over 40% of the total given in spite of the fact that this age group reported the smallest number of gifts of all age groups.

What to do?

With certain exceptions, it would appear that a combination of income and age information will serve as effective tools, when combined with actual gift history data, to help identify your best candidates for larger non-cash gifts. Depending upon the sophistication of an organization’s fund development efforts, it may be possible to use different combinations of selections for direct mail versus personal solicitation strategies.

Editor’s note: Sharpe year-end giving brochures with information regarding gifts of non-cash properties have been designed for use as part of a mass yearend appeal, whereas the booklets “Giving Securities,” “Giving Real Estate,” or “A Guide to Giving” may be targeted to smaller groups or used as part of a proposal or follow-up package. See page 7 for more information on publications that address the benefits of giving non-cash property.