Next to cash, publicly traded securities are the most commonly used asset for funding charitable gift annuities. Usually the donor is the payment recipient, and any capital gains tax is bypassed at the time the annuity is funded. Then a portion of the payments will be taxed at favorable capital gains tax rates over the donor’s life expectancy. The balance of the payments will be taxed as ordinary income.

But is this always the best strategy? Consider the following situations involving the funding of gift annuities with securities. What if the gift is made with very highly appreciated securities; or if the gain in the stock’s fair market value is relatively small; or there is actually a loss in the securities’ value instead of a gain? In these and other instances, it may be more beneficial to sell the securities and use the cash proceeds to fund the annuity, or to take advantage of a “special election” for tax purposes.

Remember, gifts of cash are generally deductible up to 50% of one’s adjusted gross income (AGI) rather than the 30% limitation for gifts funded with appropriate appreciated property.

Consider a hypothetical retiree who is considering a six-figure gift annuity funded with stock. If she is subject to the 30% limitation, she would only be able to deduct 30% of her AGI in the first year, and any remaining deduction would be carried over for use in future years.

If the donor has a very modest income that does not include Social Security or certain other income, it is conceivable that she could not use all of the allowable deductions even over a six-year period! If the stock’s gain is large, that may be OK.

But, if the donor’s amount of gain in the stock is small, she may be better off deducting the charitable gift against the 50% of AGI limitation. In that case, she could base her deduction on the cost basis in the stock under a “special election.” The extra 20% deduction represents a 66% increased deduction per year over the 30% of AGI limitation and could serve to substantially accelerate the tax savings.

In cases where there could be a capital loss, the securities should be sold to generate a loss for tax purposes. The donor could then use the proceeds of the sale to establish the annuity and also take the resulting deduction against the regular 50% of AGI limit for cash gifts.

Three examples

Let’s look at several different scenarios that feature funding a gift annuity with securities—one where there is a large gain in the stock, another where the gain is small, and a third involving stock that has lost value.

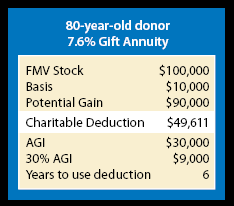

Scenario 1—An 80-year-old donor owns a growth stock worth $100,000 that was purchased 20 years ago for approximately $10,000. The stock pays no dividend and the donor does not want to trigger an immediate federal capital gains tax of up to $13,500 on the $90,000 increase in value. She is also concerned that the stock could go down in value.

If this stock were used to fund a gift annuity, here is what would happen:

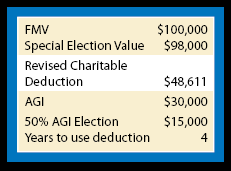

Scenario 2—Suppose our 80-year-old donor has publicly traded stock worth $100,000 that pays a very small dividend and was purchased several years ago for $98,000. She does not believe its future growth prospects are promising.

Here is what would happen if the donor used the special 50% of AGI election and based her deduction on the $98,000 cost basis rather than its market value:

Note that she is taking $45,000 in deductions in 3 years vs. 5 years to deduct $45,000 under Scenario 1. Her gift payments, on the other hand, are the same under each scenario.

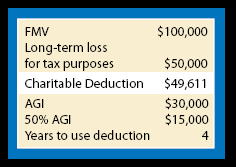

Scenario 3—Finally, an 80-year-old donor inherited a security several years ago that was valued at $150,000. The stock’s value has since fallen to $100,000. In this case, the donor should sell the stock and realize a capital loss for tax purposes. The loss can be used to offset other capital gains or even used against ordinary income at the rate of $3,000 per year.

Here is how the numbers look when funding a gift annuity in this way:

She is pleased to learn that the $50,000 loss can be used to offset $50,000 of long-term capital gain or to shelter $3,000 per year of ordinary income. She also enjoys potential additional tax savings of between $7,500 and $14,800 using 15% capital gains tax rate or 28% income tax rate.

Help them choose wisely

Depending upon the circumstances, those assisting in the gift planning process should consider whether the donor’s objectives will be better served by funding the gift annuity with stock, using the special 50% of AGI election to use a deduction more quickly, or selling the stock and funding the annuity with cash. The choice made can have an effect on the overall attractiveness of the arrangement.