In recent weeks, many have raised questions about the ways current economic conditions may affect charitable giving. History teaches us much of what we may expect and suggests proactive steps we can take today to adjust our fund development efforts for the remainder of this year and beyond.

Looking back at the numbers

First, abundant evidence suggests charitable giving overall has not declined significantly during periods of recession over the past 40 years. According to Giving USA Spotlight, Issue 3, 2008:

“Total giving has increased in current dollars in every year but one since recording began. The exception is 1987, when a tax law change in 1986 prompted some people to ‘give early’ in order to maximize the value of tax deductions they could claim. Economic changes, such as slowed growth or a decline in gross domestic product, occur without economic recession. When the economy shows stress, whether it is a recession or not, giving may grow more slowly. It is important to note that giving still grows. In current dollars, before adjusting for inflation, giving has increased an average of 8.4 percent in years without a recession. In years with a recession, giving has increased 6.2 percent (also in current dollars).”

When adjusted for inflation, Giving USA reported in the same publication that giving holds steady or declines only slightly during periods of economic recession:

“The average rate of change in giving during a recession is a drop of 1 percent. This decline compares with the total 40-year average of [inflation adjusted] growth in giving of 2.8 percent for 1967 through 2007. During years without a recession, giving has increased an average of 4.3 percent.”

The report goes on to state that many charitable entities continue to see increases in giving even during recessions:

“Not all charities, or even all types of charities, experience the ‘national average rate of change’ in any year, let alone in recession years. In fact, Giving USA surveys from 2001 through 2007 found that in all years, 49 to 59 percent of charities saw growth in giving. Even in the worst year surveyed (2002), less than half saw a drop in total gift dollars received.”

History reveals giving continues

Despite all of the evidence regarding giving during recessionary periods, some have questioned whether we are now in an economic situation different than the past and whether the history of the last 40 years is still relevant. Are we in “uncharted territory?” Recently, commentators have likened the current economic situation to the Panic of 1907 that lead to the Depression of 1908. In a September 2008 interview, former Federal Reserve chairman Alan Greenspan stated the financial crisis that began with the collapse of the subprimemortgage market last year “is probably a once-in-a-century event.”

Does this mean we may be encountering a more serious set of challenges to philanthropy than any of the more recent recessionary periods? Is there a need to look farther back in history? Evidence suggests that fund raising was alive and well even during the Depression of 1908. In fact, Texas Christian University (TCU) announced the following in its 1908 annual report on its fund-raising efforts:

“Endowment is the key to the campaign. Resting awhile from brick and mortar, it is purposed to concentrate on obtaining an impregnable financial backing, as the surest guaranty, not only for permanency, but for the highest grade of work as well…One of the brightest hopes lies in the increasing number of able people who are remembering TCU with large donations in the form of annuity gifts, named endowment funds, and bequests…The day of larger accomplishments is at hand.”

In 1992, at a time when the U.S. was grinding through a deep recession and some were actually predicting conditions approaching another Great Depression, The Sharpe Group prepared a historical report outlining research on philanthropy during the Depression of the 1930s. “Philanthropy in Uncertain Times” examined fund raising in America during that era based on contemporary reports and studies completed shortly after the end of World War II.

While no one knows the exact extent of the economic crisis we now face, we can take to heart some of the lessons of the Great Depression.

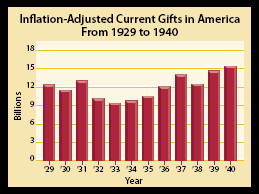

Giving was, in fact, negatively impacted somewhat at the outset of the Great Depression. Note trends in giving by living individuals included in a landmark 1950 report, Philanthropic Giving, published by the Russell Sage Foundation. Totals have been adjusted to 2007 dollars:

Indications are that giving did not decline dramatically in the immediate aftermath of the crash of 1929. In fact, The New York Times reported on December 8, 1931 that giving to 155 Community Chests (predecessors in many cases to United Way organizations) rose some 14.9% between 1930 and 1931. The 1950 Sage Foundation report also indicated that charitable giving increased overall in 1931.

Bequests more important

Similar to more recent periods of recession, patterns of giving were uneven during the Depression, with some organizations reporting better results than others. It was reported toward the end of the Depression in 1939 that a number of educational institutions raised more funds during the 1930s than during the preceding period of prosperity in the 1920s. The ways in which gifts were made also showed a shift. An article in The New York Times in April 1939 reporting on gifts to higher education noted that “although [outright] gifts showed a decrease in Depression years, the amount of bequests showed a sharp increase.”

Other reports at the time also indicated that where major gifts were concerned, bequests became a much higher percentage of reported gifts, peaking at some 70% of substantial gifts reported in 1933. By the end of the Depression and the beginning of World War II, the percentage of bequests had returned to more traditional norms of 10% to 20%, depending on the reporting source. It is interesting to note that over the past 25 years, bequests to higher education as reported by the Council for Aid to Education (CAE) have averaged 23% of individual giving with charitable remainder trusts and other life income gifts, bringing that total to the 30% to 35% range over time, depending on whether face value of trusts and annuities or present value is reported.

All indications from data summarized in the Sharpe report of 1992 as well as experience during the ensuing 16 years indicates that donors may be more likely to make commitments in the form of bequests and other planned gifts in lieu of outright gifts during times of economic uncertainty.

Mortality trends are presumably not affected by economic vicissitudes, so rates of bequest realization are unaffected. Studies also show that the time period between making bequests and receipt by charities may actually be reduced during periods of economic downturn as more older persons revise their plans very late in life based on changes in their economic circumstances.

In fact, the latest data from the Sharpe Estate Information Database, a compilation of statistics on thousands of recently received charitable bequests, reveals the average age at completing a will that actually leaves funds to charity is now 80, with a median age of 79. The average age at death is now 85, with a median of 84. While this data may seem contrary to other reports based on surveys of living donors of all ages, prudent organizations may wish to verify this information on their own through a study of a number of their most recently opened estates.

Back to relationship basics

Regardless of whether this economic slowdown reaches true recession levels, those in fund development may be wondering where to go from here. While there are specific ideas in the box below, in general, gift planning professionals should communicate the simple message “Near, Dear, and Clear.”

Make every effort to be as “near” to your donors as possible. See every important donor face-to-face as soon as is practical. If there are geographic limitations, use the telephone and any other means to create a sense of “nearness.”

Do all in your power to be “dear” to donors. In difficult times, donors continue to support the entities about which they really care. It is difficult to create those types of relationships in a short period of time. It is much easier to strengthen the ones that already exist.

Be prepared to make it “clear” why funding is needed. If you do not have a compelling case for support in this environment, it will be very difficult to raise funds.

In conclusion

No one can predict the future. We can, however, do all in our power to examine the current reality that confronts us, even as it changes on a daily, if not hourly, basis. History tells us that Americans are generous people. Charitable giving provides intangible rewards for many donors that are as fulfilling and lasting as fortunes can be fleeting.

Taken together, the nonprofit sector in America provides untold billions of dollars of vital services in health, religion, education, social services, science, conservation, culture and more, and as a sector is a critical partner along with the private and public realms.

Those privileged to serve in positions of leadership in America’s nonprofit community shoulder a responsibility every bit as great, if not greater, than those working to restore America’s economic vitality. Now is the time to look to the future with confidence that can be gained from the past and employed in appropriate ways to assure that our nonprofit sector remains strong and capable of delivering the tangible and intangible services that make a society great, regardless of immediate economic fortune.

Editor’s note: This article is excerpted from a memorandum distributed to Sharpe clients in late October. The complete document along with the Sharpe report on giving during the Great Depression and an article to help advisors with their clients may be accessed at www.sharpenet.com/uncertaintimes.