Those who have been following the progress of the Pension Protection Act’s charitable IRA provisions have compared the situation to watching a baseball game when a batter hits an infield pop fly that should easily be caught.* This should become an easy out to end an inning, since there are several players in position to reach the ball. However, the shortstop, second baseman, outfielder, and pitcher all assume that someone else will get the ball. As a result of the confusion of roles, the player reaches base and the inning continues.

Over $100 million given

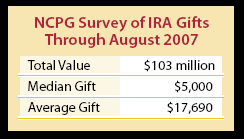

The National Committee on Planned Giving (NCPG) recently reported that charitable IRA istributions under special provisions of the Pension Protection Act of 2006 totaled more than $102 million as of August 30, 2007. Most of these gifts were reported to the NCPG by those responsible for gift planning at their institutions.

It is likely that many IRA gifts have not been reported to the NCPG. If only 10% to 20% of the IRA distributions have been reported, it is possible that actual IRA distributions to charity could be in the $500 million to $1 billion range. The $100+ million IRA gifts reported thus far could be the tip of the iceberg, or could represent the end of tax legislation to encourage such gifts.

The charitable IRA provision allowing those over 70½ to direct tax-free gifts from traditional or Roth IRAs to qualified charities is scheduled to expire on December 31, 2007. With each passing day, it is becoming increasingly unlikely that the legislation will be expanded or extended before the end of the year. Therefore, the time to encourage major outright gifts from IRAs may be running out.

Under current law, the $100,000 limit per individual ($200,000 for couples) has been an annual cap, so there are only a few weeks left to take advantage of this opportunity for gifts this year. Transfers must be completed by December 31. Last year, many IRA plan administrators were not equipped to deal with these requests and were unsure how to report distributions. Likewise, numerous tax and financial advisors, caught unaware, were not prepared to advise their clients. These factors should be much less of a challenge this fall.

Major gift strategy

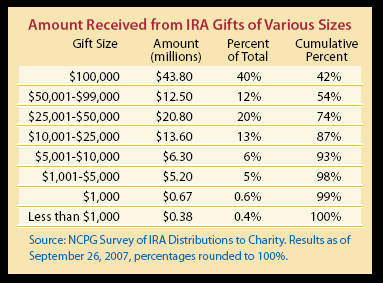

As we examine the data collected by NCPG, it is also clear that IRA giving has in reality become a major current gift planning strategy—the NCPG reports that only 17% of the number of gifts reported thus far fell below $1,000. Moreover, gifts under $1,000 accounted for just $378,000, or less than one-half of 1% of the total. The most popular distribution was $1,000, at 11% of all reported IRA gifts so far. But in dollar totals, less than 1% has come from donors of $1,000. In fact, more IRA gifts of over $25,000 were received than those under $1,000. Ten percent of IRA gifts were over $50,000 and 7% reached the $100,000 maximum gift amount. Perhaps most important, as the chart below illustrates, over 90% of the funds received thus far have come from gifts over $5,000.

While some qualified charitable organizations and institutions have received significant support from IRA gifts, others have received little or nothing. There are many reasons for this.

Some institutions are supported primarily by younger persons and have few donors over 70½. In other cases, IRA giving may have been seen as a planned giving strategy; yet any gifts received would be credited elsewhere, so there was little incentive to those responsible for planned giving to promote gifts that would likely be credited to the major or annual fund area. In other organizations, those responsible for major gifts did not understand the opportunity and did not take advantage of the resources available through their planned giving departments to capitalize on it. As is often the case, we have seen many of the gifts being received by relatively smaller shops that were able to communicate a clear and timely message to their constituency.

In some other instances, there may have been an overreliance on e-marketing. The latest Pew Internet Survey indicates that only 32% of those over 65 are online, and that number continues to decrease with age. Perhaps as many as 75% of persons over the age of 70½ do not have access to the Internet and studies show that the majority of those who do have access are limited to relatively slow dial-up connections. Therefore, those who relied largely on e-marketing to promote IRA giving may have missed a large portion of potential IRA givers.

Other organizations and institutions may have relied on postcards, buck slips, or receipt enclosures to communicate to mass numbers of donors this relatively complex new way of giving through IRAs. The chosen medium simply may not have featured enough information to effectively educate and motivate donors to participate in this novel form of giving. Attempts to use limited mail to drive readers to web sites may have been as ineffective as more direct e-marketing.

Regardless of the reason, senior managers responsible for overall fund-raising efforts may wish to consider promoting IRA gifts now, in a more appropriate and effective way, while there is still time to do so.

A bird in the hand?

Regardless of whether the current provision is extended, expanded, or allowed to expire, time is running out for PPA/IRA gifts in 2007. To avoid having a “pop fly” land between two infielders with a major “error” as the possible result, all players should consider their roles and the steps they can take to win the 2007 game in the final innings.

In addition to those prospects over 70½ that should be personally contacted between now and the end of the year, you may want to consider a multi-tiered strategy that involves various members of the development team. Those responsible for major, planned, and annual gifts should all be included in various ways.

Targeted mailings to IRA gift prospects capable of larger gifts this fall should contain materials explaining the benefits of the PPA. In addition to a special IRA mailing, consider including a brochure or flyer clarifying the IRA provisions with a year-end giving appeal that is already planned. This approach may uncover “needles in the haystack” who may not otherwise be found among the ranks of major donors. Make sure that your staff and key volunteers are aware of this opportunity and prepared to mention this strategy with appropriate donors. Designate someone on the development team as the IRA gift expert to whom questions can be channeled.

Final analysis

While each organization’s IRA communication efforts must address the needs of their own unique constituency and will have different game plans, the most important thing is to make sure your development team shows up to play the game in the first place! With limited time remaining to promote PPA benefits, if you seize the opportunity to educate the right donors about this special provision in the law, you may have a winning season in 2007.

*See comment by Sheila Hard on GIFT-PL, Sept. 3, 2007, www.listserv.iupui.edu/archives/gift-pl.html.