by Barlow Mann

In March 2014, the IRS released its latest annual review of split-interest trusts for filing year 2012. The study chronicled a recent seven-year decline in the number of charitable remainder trusts (CRTs) between 2005 and 2012. Could it be that the recent decline in CRTs will be followed by a new period of growth?

Background information

While charitable remainder trusts have existed for many years, charitable remainder annuity trusts and unitrusts were codified in the Tax Reform Act of 1969 with the goal of allowing and encouraging trusts for charitable purposes that provide income for one or more persons for their lifetime or certain other periods of time.

Faced with new code section 664 and associated regulations, many estate planners, banks and traditional trustees initially shied away from the new category of qualified charitable trusts. A small number of larger colleges, universities and other charities created the necessary infrastructure to encourage these gifts throughout the 1970s and early 1980s, but a variety of factors limited the attractiveness of these plans in the years immediately following passage of the legislation.

The ‘last game in town’

By the mid-1980s, banks, trust companies and other financial service companies had reentered the charitable trust services market in greater numbers. The trend accelerated after the Tax Reform Act of 1986, which eliminated or curtailed most tax shelters and other tax-favored planning techniques.

When the dust settled, the charitable deduction remained intact. Suddenly, larger numbers of tax and financial planners began to appreciate the benefits of charitable remainder trusts. Financial service providers spent millions of dollars to train their financial consultants in the workings of these trusts, and they began promoting plans such as the build-up unitrust with wealth replacement as the “last game in town” from a tax planning perspective.

The broad availability of tax deduction calculation software allowed both the for-profit and nonprofit communities to promote these plans during a period of relatively higher income and capital gains tax rates. The value of the tax savings against higher tax rates, the ability to bypass capital gains tax at the time the trust was funded and the creation of a tax-exempt trading or investment platform created a very attractive planning opportunity at the same time that stocks and real estate values were rapidly increasing during the 1990s.

After the bubble burst

During this period, a growing number of CRTs were created by the financial planning community with little or no active involvement by charitable organizations and institutions. Unfortunately, many such trusts featured build-up unitrusts with high payouts and even higher earning assumptions. After a period of better-than-average returns during the 1990s, the tech bubble burst and a number of build-up unitrusts failed to meet expectations. In the late 1990s, the IRS also became vigilant in identifying new types of abuses and regulating them through minimum charitable remainder percentages, maximum payout rates and other adjustments.

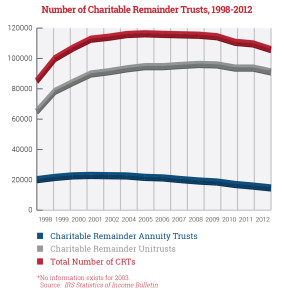

As the 21st century began, additional tax reforms resulted in lower income tax and capital gains tax rates. Lower tax rates in turn reduced the tax savings associated with charitable remainder trusts. Nonetheless, the number of charitable remainder trusts continued to grow from around 85,000 in 1998 to just over 116,000 in 2005 before trending downward. By 2012 the number of charitable remainder trusts had fallen off 9 percent from its peak.

This drop was due to a number of economic influences in the wake of the Great Recession that led to years when more trusts were terminated than were created. Charitable remainder unitrusts, the most popular type of charitable trust, peaked in 2008 just prior to the market crash. Unitrusts survived the Great Recession relatively intact, with only a 5 percent drop by 2012 from their peak in 2008. Charitable remainder annuity trusts, on the other hand, peaked in 2001 and then fell by over 36 percent by 2012. The decline of annuity trusts was due in large part to a lack of confidence in the ability to earn the 5 percent minimum fixed payout rate for annuity trusts as required by law.

Even through charitable remainder trusts experienced a decline in the Great Recession, they fared well compared to much larger declines in major outright gifts and other forms of charitable giving during the period. Charitable remainder unitrusts in particular remained relatively popular even while the economy as a whole struggled. More donors will be likely to turn to unitrusts in coming years as the economy continues its rebound and other factors combine to make such gifts more attractive.

A renaissance for CRTs?

The environment for the creation of new charitable trusts has changed considerably since 2012. Household net worth has recovered to an all-time high, and the numbers of millionaires and multi-millionaires are once again at record levels. Many of these wealthy individuals are likely to have experienced unpleasant tax increases as a result of the American Taxpayer Relief Act of 2012, which was enacted in 2013. Those in the highest income and capital gains tax brackets now have greater incentives to minimize those taxes.

The environment for the creation of new charitable trusts has changed considerably since 2012. Household net worth has recovered to an all-time high, and the numbers of millionaires and multi-millionaires are once again at record levels. Many of these wealthy individuals are likely to have experienced unpleasant tax increases as a result of the American Taxpayer Relief Act of 2012, which was enacted in 2013. Those in the highest income and capital gains tax brackets now have greater incentives to minimize those taxes.

In addition, the prime age group for charitable and retirement planning is growing rapidly as 10,000 baby boomers turn 65 every day. Studies suggest that 68 is the most common age at creation of charitable remainder trusts. The combination of increased tax rates, asset values for the wealthy and numbers of age-appropriate prospective donors could and should lead to a resurgence of CRTs. For charitable organizations and the planning community, the key will be to reach the right people at the right time for the right gifts.

This time around, trusts are likely to be created using more reasonable earnings and payout assumptions, thereby protecting both individual and charitable beneficiaries.