Test yourself with the following True/False questions involving the sum of $10,000.

1. $10,000 is the amount that may be given free of gift tax each year to individuals.

T ( ) F ( )

2. All gifts of stock valued at more than $10,000 require a qualified appraisal.

T ( ) F ( )

3. $10,000 is the size of the average charitable gift annuity.

T ( ) F ( )

4. Cash gifts of $10,000 or more must be reported under IRS anti-money-laundering rules.

T ( ) F ( )

Congratulations if you answered “False” to all four questions in our $10,000 Trivia Test. Let’s look at an explanation of each question and how each relates to gift planning.

New and old rules

Since 1982, the amount that could be given annually exempt of gift tax from one individual to another was $10,000. As a result of 1999 tax law changes, this amount has been subject to annual indexing rounded to the nearest $1,000. Through 2001, this provision resulted in no change in the annual gift tax exemption amount. Beginning in 2002, however, this amount increases to $11,000. The unlimited marital deduction remains unchanged. Be sure to check your publications and correspondence for references to the old provision.

While non-cash charitable gifts of all sorts are reported on Form 8283 and gifts greater than $5,000 generally require a qualified appraisal, special rules apply to gifts of securities. The value of gifts of publicly traded securities is determined by calculating the average between the high and low sales for the date of the gift based upon exchange transactions. In the case of closely held stock that is not traded on public exchange, other rules apply. Charitable gifts of such property valued at more than $10,000 must be substantiated by a qualified appraisal which will be summarized on side B of Form 8283 for income tax purposes. The donor’s failure to have a timely appraisal or to include a summary of this information with his or her tax return may result in the disallowance of the deduction for tax purposes. Be sure to remind donors of their responsibility to substantiate various types of gifts.

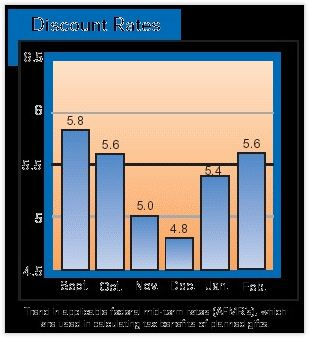

While $10,000 is a widely used amount for gift annuity illustrations and gift acceptance minimums, the average gift annuity is closer to $30,000. According to a study by the American Council on Gift Annuities, the average gift annuity was $30,182 in 1999. In recent years, we have noted a marked increase in the number of larger gift annuities (click here for one gift planner’s opinion). If this trend continues, the average size of gift annuities should continue to grow. If your donor base or list selection is appropriate, you may wish to consider using larger examples in your marketing materials and gift calculations.

Federal law requires that business transactions involving more than $10,000 be reported to the IRS on Form 8300. The law was originally enacted to combat crime and reduce money-laundering activity. Contrary to what some may believe, charitable gifts are exempt from this filing requirement. Charitable cash contributions greater than $10,000 need not be reported because the exempt organization is not deemed to have received cash in the course of a trade or business. As a practical matter, larger gifts of cash greater than $10,000 should be handled and receipted carefully.