Surveys and research by various organizations over the years indicate that Americans give most generously to their favorite charities during the final months of the year. Sources include studies by the Association of Fundraising Professionals, The Chronicle of Philanthropy, Charity Navigator, Fidelity Charitable Fund and others.

Collectively, this research shows that some three out of four adults make charitable gifts during the holiday season. Among adults who regularly make charitable gifts, more than 90 percent give during this time frame. A survey by Charity Navigator found that, on average, charities receive 41 percent of annual contributions during the final few weeks of the year. Other estimates from the nonprofit sector find that 30 to 40 percent of gifts from individuals occur from mid-November through Dec. 31.

A report by the Nonprofit Research Collaborative found a strong surge in year-end giving in 2011. The same report found that most nonprofits use a variety of fundraising approaches or communications channels, including direct mail, major gift solicitations, online appeals, events and more.

Plans deserve attention

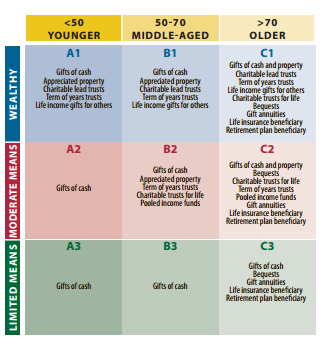

Given the vital importance of year-end giving, those responsible for overall fundraising should give special attention to their plans for the critical holiday giving season. It may be useful to consider the Sharpe Gift Planning Matrix© as a tool to assist in this process.

Most nonprofits have a relatively small number of wealthy donors who have the capacity to make special or major gifts of cash, securities or other property. They are found in the A1, B1 and C1 boxes and should be segmented for special attention. For example, IRS figures reveal that 98 percent of gifts of appreciated securities are made by wealthier donors age 45 and older. If that group is overly large, it may be wise to focus on the 65-plus age segment that made 63 percent of gifts of appreciated securities in recent years. These wealthier donors are more likely to itemize their tax deductions and to be negatively affected in the future by pending and proposed tax law changes. Based upon IRS tax return data, these higher income donors account for the majority of all charitable giving dollars in America each year.

While you should not ignore the masses of regular donors of more moderate means, it may be wise to give extra attention to a small number of donors who have the capacity to make larger gifts. A combination of communications channels should be considered for the highest-capacity donors and prospects. Depending upon staffing and organization considerations, personal visits, telephone calls, group meetings or special events, direct mail and online approaches all may be appropriate.

This year it may be wise to consider taking steps to directly counter tax and economic uncertainty. While taxes are rarely the primary motivation for a charitable gift, tax considerations may influence the size, timing and form that a gift may take. Many high-income donors have been advised or have read about the possibility of putting off gifts until next year because of possible future tax rate increases. Unfortunately, this advice could prove to be erroneous if pending or proposed changes are enacted to limit the tax savings for charitable gifts.

You should be prepared to inform and educate high-end donors who are likely to itemize charitable deductions that putting off gifts this year will result in higher taxes next spring. Further, those who anticipate realizing additional income or capital gains this year may be relieved to learn that charitable gifts this year may serve to reduce taxes that would otherwise be due.