In its annual study of wealth in America, the 2013 Capgemini World Wealth Report shares valuable information that should be helpful to those involved in securing large gifts for charitable purposes now or in the future.

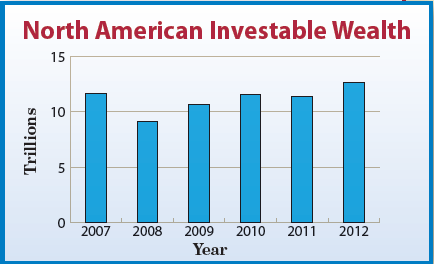

In 2012, the North American high net worth population (defined as those with $1 million or more in investable assets) reached 3.73 million, an 11.5 percent increase over 2011. This record number of individuals held over $12.7 trillion in investable assets.

U.S. has the most high net worth individuals

More than half of the global population of wealthy individuals is concentrated in just three countries, the U.S., Japan and Germany. Of the 3.7 million high net worth individuals in North America, 3.4 million are residents of the United States. In fact, the U.S. has more high net worth individuals than Japan (1.9 million) and Germany (1 million) combined. With a 12 percent rise in the number of high net worth individuals between 2011 and 2012, the number of wealthy Americans seems poised to continue record growth.

View the report in its entirety at www.capgemini.com/resources/ world-wealth-report-2013.

What this may mean for U.S. philanthropy

Even though substantial uncertainty remains, economic growth appears to be on track to continue through the rest of 2013. The resulting rebound in philanthropy will likely be driven by the relatively small number of higher income and wealthy donors that account for the majority of giving each year. Early indications from IRS reports on itemized gifts in 2010 and 2011 bear this out.

Special care should be taken to identify the individuals among your donors and prospective donors who have the capacity to make a larger gift. New tax considerations ushered in by the American Taxpayer Relief Act, enacted earlier this year, mean that individuals who are in a higher income tax bracket this year or are subject to higher capital gains tax rates and the new Medicare Contribution Tax will generally enjoy greater tax savings on charitable gifts than last year.

Will you receive your share?

IRS reports have shown that most charitable gifts in America typically come from individuals, not corporations or foundations, and a high percentage of those gifts come from wealthy persons and those with higher incomes. As the economy improves and the number of high net worth indi-viduals increases, there are simply more assets and discretionary income that might be available for charitable purposes.

The Sharpe Group can help you find the high net worth individuals on your donor list. Call 901-680-5300 to find out more about SharpeNet Data Services.