When I’m 64! Many among the Baby Boom generation will remember listening to those famous lyrics from the Beatles and wondering what, in fact, it would be like to be 64. Like it or not, next year the first of them will be finding out!

In 2010, those born in 1946 will turn 64 and will represent the cutting edge of a huge new segment of retirees. As one of the largest generations in American history, the Baby Boomers have impacted our society and culture from the cradle on. As they look to the future, their past experiences will no doubt influence their priorities in later years.

Recall the events that helped form the collective consciousness of the Baby Boom generation. Many of the most iconic moments of the 1960s—Woodstock, the first moon landing, the escalation of the Vietnam War, the inauguration of Richard Nixon, the Beatles’s last performance, and the introduction of the Boeing 747—all occurred 40 years ago this year. For some readers, those events may seem like yesterday. Others of you were not yet born.

For the Boomers who experienced these moments during their formative years, the events of 1969 helped to shape their priorities for the future, which in many cases differed strikingly from those of their parents and grandparents.

Given their large numbers and unique life experiences, Boomers have always made their own path. As that path now slowly leads to retirement, fundraisers may need to treat Boomers will special care.

Love me do

The key to effective fund development efforts over the next 30 years may very well be our ability to continue to “love” Baby Boomer donors and help them continue to feel like an integral part of our programs as they begin to enter their “golden years.” Recall also that the largest numbers of Baby Boomers are now in their early to mid-fifties. This has traditionally been the prime time for major gift activity and campaigns.

Following the Baby Boomers into their retirement years is not really optional. The size of the Boomer generation dwarfs both the Silent Generation that preceded it and the Gen X group that follows, making this moment the first time in decades that there isn’t a larger supply of younger donors coming behind to replace those currently facing retirement.

This realization is just now beginning to dawn on the management of many of the nation’s leading nonprofits. The implications are universal and far reaching.

Unfortunately, the economy has hit a significant bump in the road just as many of the Baby Boomers are entering their prime giving years. Quips about “201K funds” now ring too true to be humorous in the context of capital campaign planning meetings.

All those years ago

Fortunately, amid the turmoil of 40 years ago, Congress passed the Tax Reform Act of 1969. This legislation now promises to be of great help to some of us as we begin to work with Baby Boomers and others who would like to make gifts, especially larger ones, in today’s economic and demographic context. At the time it was enacted, the 1969 Tax Reform Act included many of the most radical changes in our nation’s tax law history, particularly as it impacted charitable gifts.

This far-reaching legislation ushered in many of the rules and regulations now taken for granted as standard planned giving operating procedure. Minimum payouts for charitable remainder trusts and private foundations, self-dealing rules, and other new safeguards were introduced along with many new and exotic forms of giving such as charitable remainder unitrusts, pooled income funds, charitable lead trusts, and others.

Of course, along with gift annuities, many of these techniques had existed in one form or another prior to the 1969 Act, but the new legislation gave them the form in which we know them today. It also laid out the various rules concerning payout amounts and time periods we have now lived with for over four decades.

Consultants and others at the time began to see that a much more integrated approach to fund raising would be required to deal with the realities that were beginning to unfold. In fact, in the January 1969 issue of Give & Take, readers were first advised to consider a “planned giving” approach for 1969. The rest is history.

We are now fortunate that generations of development officers and professional advisors have been trained in the basics of how these plans work. And since passage of the 1969 Act, Congress has continued to tweak the 1969 law to add other requirements such as appraisal requirements in 1983 and minimum charitable deduction amounts in 1997.

Get back

Fast forward to the fall of 2009. Where do we go from here? As is so often the case, the key can be to return to the basics. Last month’s review of the Sharpe Gift Planning Matrix© (see the September 2009 issue of Give & Take) revealed that much can be gained by simply addressing the needs of various age and wealth groups with ideas that are appropriate for them while taking care to avoid mismatching ideas in your marketing efforts.

As we begin to explore how to help Baby Boomers better plan their gifts as they enter their later years, let’s not forget that there are still millions of donors in the 65 and older age range making regular outright gifts. In fact, for many charities the majority of their donors are beyond the age of 65.

For example, the American Council on Gift Annuities (ACGA) reports that the average age donors enter into a gift annuity is 78. The average age at which people execute the will that actually acts to distribute their assets to charity is about the same. You might have heard in anecdotal blogs and elsewhere that people don’t change their wills or add and remove charities (and relatives) after age 70. Empirical evidence simply doesn’t support this myth as it defies both logic and common sense—not to mention hundreds of studies by leading charities.

Experience reveals that wills are in many cases updated and revised for the last time following the passing of a spouse, partner, close relative, or friend. The final will often results in the most significant changes to the will since it was originally drafted! A five-minute conversation with any experienced estate planning attorney or trust officer will shed important light on this matter. The importance of concentrating your marketing efforts for bequests and gift annuities and other plans that take place at death with persons over the age of 65 to 70 cannot be overstated.

We can work it out

What about the younger groups? Should you be encouraging Baby Boomers in the 45 to 65 age range to name your organization for bequests, remainders of retirement plans, insurance policy beneficiary designations, and similar gifts? Absolutely.

Should you market immediate payment gift annuities to that group? Probably not. Deferred gift annuities may be more appropriate.

How should you handle a bequest notification from a 45-year-old? Such gifts are important and should be periodically pursued and stewarded by major gift officers or other appropriate staff. From a cost-benefit analysis, however, some may question how much of scarce budget resources should be devoted to that pursuit—the benefits of which may not be realized for 40 years or more, if at all. It’s a simple question of cost-benefit analysis—it makes more sense to use lower cost media to communicate to younger donors.

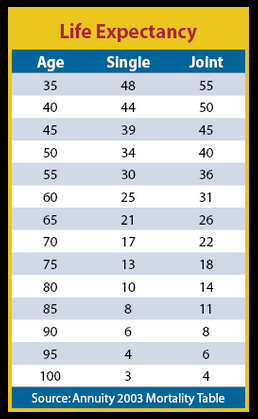

Note the present life expectancy of single persons and couples of various ages.

Despite the fact that final wills are normally revised when donors are in their late seventies, it is important to be named in the first will people make, if possible. In fact, the effort to encourage such activity should begin as early as possible, even in their twenties and thirties, the age at which many persons marry and make their first will. Others make their first wills around the same age when they begin to have children.

So if age is not a factor and time to realization is not in your equation, why not start as early as possible? Reaching the 20 to 40 age group can be done very cost-effectively through articles, advertisements, Twitter, Facebook, and other social media. More costly targeted mail drops should largely be reserved for the older age ranges where that channel is most effective and costs can be offset through results achieved in 20 years or less.

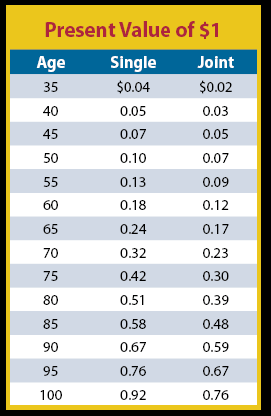

Many nonprofits are now counting certain bequest commitments from younger persons in capital campaigns. It is not uncommon for campaign guidelines to require those gifts to be reported in terms of their present value. If you anticipate current dollars could be invested in an endowment for a total return of 7%, for example, then the present value of $1 in a bequest commitment for people of various ages is as follows.

This chart tends to reinforce why the charitable deduction amount for a gift annuity funded by a 65-year-old couple is just 24% while of the amount for a 95-year-old annuitant is 72%.

Help! I need somebody

When looking for the most cost-effective ways for relatively younger persons to make gifts, we might best begin by helping them make outright gifts in the most effective ways. For example, anyone who writes a check for $10,000 and also owns securities that are still worth more than they paid for them a year or more ago should rethink writing that check.

You can (and should) in some cases advise the donor to cancel the check, give the securities instead, and then repurchase those, or other, securities and enjoy a new, higher cost basis. Such donor-focused advice will be remembered (and repeated) for years to come! There are numerous other examples.

Take the case of a donor over the age of 59½ who can take funds from a tax-favored retirement account without a penalty. That person might be best advised to make a gift of $10,000 from those funds, report the withdrawal income, and then deduct the same amount. This strategy can result in a “wash” for tax purposes for many donors, and no IRA rollover legislation is required to make that possible.

When considering larger gifts that take place over a longer period of time, let’s turn our attention back to examples of other gifts made possible by the 1969 Tax Reform Act.

The charitable lead trust offers a wonderful way for a wealthy individual of any age to make a significant gift over time while still providing for loved ones.

Unlike gift annuities, charitable remainder trusts can be created to last for a term of years, not just for one or more lifetimes. The same is true for gifts of remainder interests in homes.

For example, assume you are working with a very wealthy 50-year-old who is interested in funding a charitable remainder trust to diversify a stock holding and ultimately leave you the assets in the trust. The donor’s life expectancy is 34 years.

Under campaign policies, however, you credit estate-based gifts only for those 65 and older with a 20-year or shorter life expectancy. Under the rules of the 1969 Act, a trust can be set up to exist for up to 20 years or for one or more lifetimes or 20 years, whichever time period is longer, or shorter. In order to be able to credit the donor in the campaign, consider setting up the trust to run for the 50-year-old’s life or 20 years, whichever is shorter. If he passes away at age 60, the trust ends. If he is alive at 70, the trust will end at that point in time. By structuring the trust to terminate in any event in no longer than 20 years, the donor now qualifies for credit in the campaign.

Keep in mind that by constructing a charitable remainder annuity trust to run for a term of years it can, in effect, function much like a term-of-years gift annuity, something that is not possible under guidelines that govern the structure of gift annuities. One main difference, however, is that the remainder trust terminates exactly as scheduled, which may not be the case with a gift annuity.

How long will an 85-year-old gift annuitant live? Approximately 8 years, give or take a year or two. How long will a 10-year term of years annuity trust “live”? Ten years. This approach removes the possibility of a younger person outliving his or her life expectancy and can be structured to terminate early should the person not live for 10 years.

Other younger persons may wish to create a gift annuity or other life income gift for an older loved one. The possibilities are endless for development officers who are thinking from the perspective of both the donor and the charitable recipient and are familiar with the multitude of tools at their disposal or have access to those who are. All that is needed is the most basic understanding of what is possible. Many among the ranks of donors’ advisors are also prepared to “fill in the blanks.”

The long and winding road

Baby Boomers are among the most generous generations in our nation’s history. Many of them were the outspoken idealists of the 1960s. Some have since cut their hair and worked for decades to make their fortunes, while others are now sporting gray pony tails. Regardless, they cared in 1969 and they loved in 1969. And many will, in fact, still love you in 2010—when they’re 64.

Boomers may now be longing to give more than ever before—but some may not think it’s possible. Imagine how much fun it will be to help a whole new generation discover exciting gift planning possibilities and finally help them fulfill the ideals they formed all those years ago.

This article is based in part on a September 23, 2009, webinar entitled “Integrative Philanthropy,” presented by Mr. Sharpe for Trusts & Estates magazine. The complimentary webinar may be viewed at www.sharpenet.com.