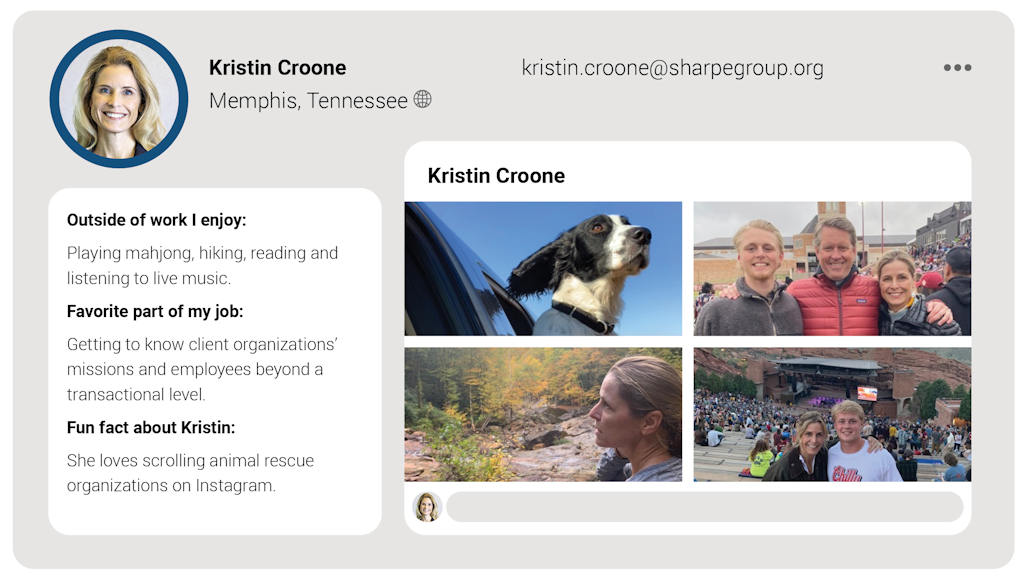

Kristin Croone, JD

Senior Consultant

Popular Speaking Topics:

- Tax matters.

- Charitable estate planning.

- Noncash gifts.

- Life income gifts.

- Staff training on planned and major gifts.

- Board training on planned giving.

- Gift planning programs for planned giving professional groups.

- Community and private foundations.

Contact Kristin.

901.490.0911

Kristin’s Recent Blogs:

- Is It Time to Call In a Professional? The Value of a Mentor

- Women and Charitable Giving

- Hold On Loosely: Challenges of Receiving IRA Gifts

- Happy Birthday! Celebrate Your Donors

- The (Not-So-) Secret Gift Planning Sauce

- Getting to Know the Advisors (5-part series)

Learn more from Kristin on our new Sharpe Insights podcast now available on our site or wherever you get your podcasts.

Learn more from Kristin on our new Sharpe Insights podcast now available on our site or wherever you get your podcasts.

Featured Podcast Episodes:

- Year-End Giving for the Years Ahead (Coming Soon!)

- Good Gifts Gone Bad

- Planned Giving Perspectives With John Jensen

- Why Planned Giving Should Be Your Nonprofit’s Long Game

Biography

Kristin is a Sharpe Group senior consultant with a JD. She has worked for both law and accounting firms in the areas of tax and estate planning and has served as director of planned giving and legal counsel for the Community Foundation of Greater Memphis. She brings valuable experience in donor stewardship as well as tax and estate planning law.

A graduate of Vanderbilt University and the Case Western Reserve University School of Law, Kristin provides her Sharpe clients with consulting expertise and strategic planning in the areas of major and planned giving as well as assistance with estate gift settlement and administration.

She has particular experience working with community foundations, national health-related and environmental organizations and educational institutions, including both higher education and private high schools.

Upcoming Events

- Oct. 8-9, 2025 | Sharpe Virtual Academy: Planned Giving #201

- Nov. 12-13, 2025 | Sharpe Virtual Academy: Planned Giving #301

- Jan. 12-15, 2026 | Sharpe Charitable Giving SUMMIT