From our experience, those who enjoy the greatest success in major and planned gift development succeed in part because they spend the time necessary to learn and understand not only the “who” and “why” of the gift, but also the basics of the “what,” “when” and “how” of the giving process.

This can be easier said than done, however. Given all the elements that can converge in the process of effectively planning a charitable gift, even the most experienced fundraiser can easily become overwhelmed. And if you are organized with separate major gifts and planned giving departments, it makes it that much more difficult, as each department may naturally be focusing on their own area instead of providing a holistic focus based on the donor’s wishes.

The Focus on the Donor

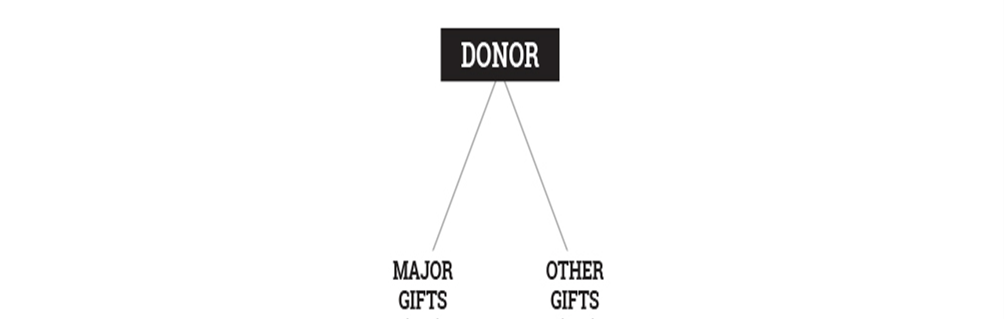

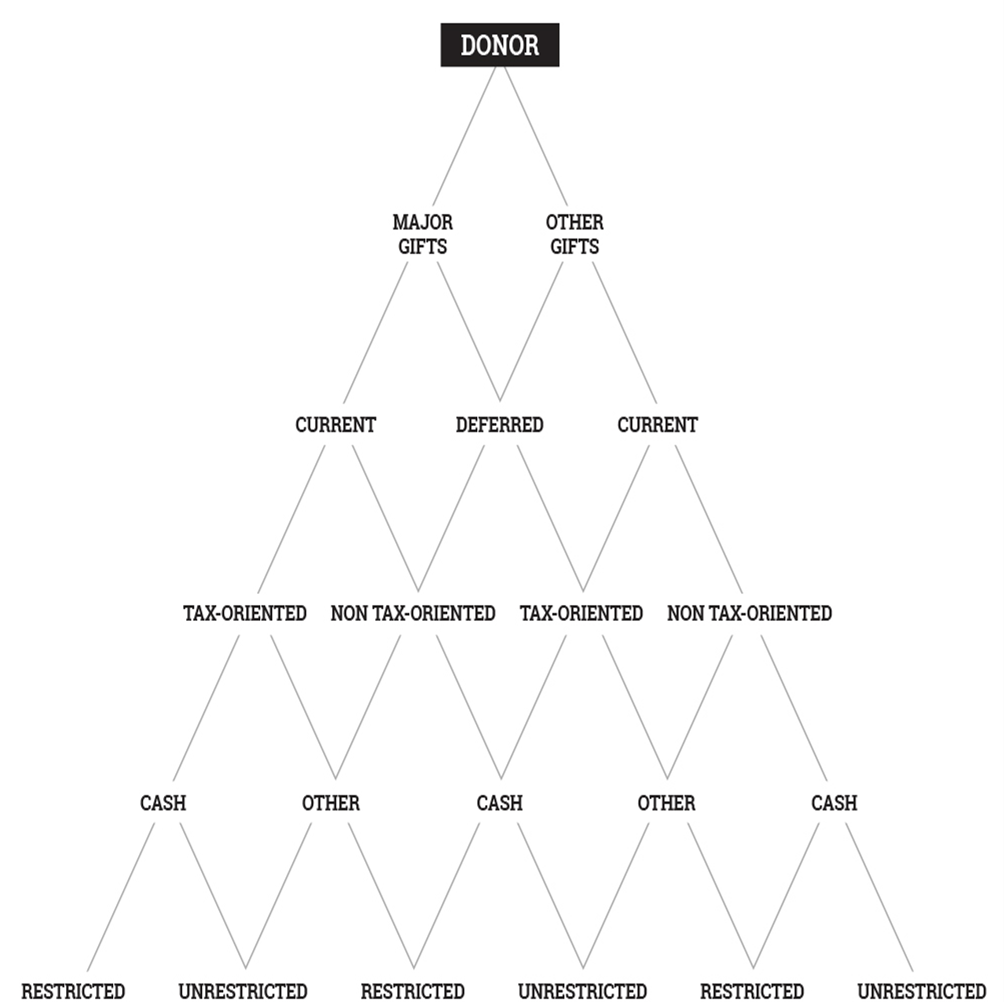

To help organize our thinking about the gift planning process, we encourage a “donor-centered” approach that uses the Sharpe Gift Planning Pyramid TM as the framework through which to view the art of helping people give most effectively. It’s important that we think of charitable gift planning as a rational process. Every gift works its way along a path through the pyramid.

Note that the donor—not the institution—is at the top of the pyramid. It’s a good idea to have various types of programs designed to produce funds for different needs at different times and make available services that help in the process of planning your donors’ gifts. The most successful programs, however, are those that stay focused on the giving process from the donor’s perspective.

To start, imagine yourself at the top of the pyramid and the reactions you might have as you perceive numerous initiatives working their way up the pyramid toward you. Put yourself in your donor’s shoes. The key is to make all the various ways of making gifts available and help the donor choose the most appropriate way to make a gift at a given time in life.

It can be less than productive to think of “planned gifts” as deferred gifts, property gifts, endowment gifts, tax-oriented gifts or as taking on the characteristics of any of the numerous outcomes at various decision points in the planning process. Planning charitable gifts is a process. The planned gift is the outcome from the institutional perspective. Gift planning describes the process from the perspective of the donor.

Step 1: Sizing Up the Gift

All gifts can be broken into two broad categories: major gifts and other gifts. For most organizations and institutions, the vast majority of gifts will fall into the “other” category, with a relatively small number of major gifts each year often comprising a large percentage of overall funding. The first step for a donor, after deciding to make a gift, is to consider whether he or she would like to make a large gift or a smaller gift. These terms are, of course, relative to the donor’s means, with some considering $1,000 to be a major gift while others see that as a relatively modest gift.

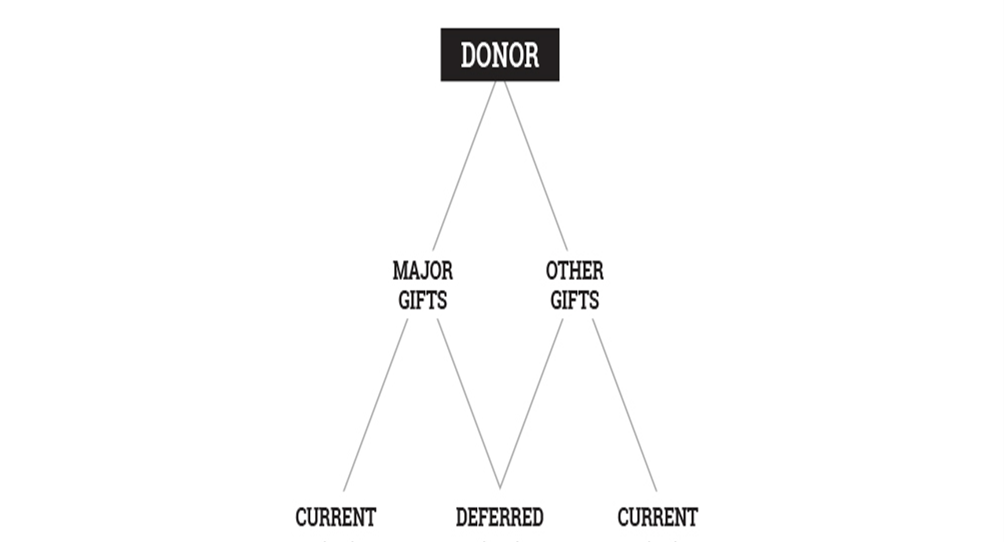

Step 2: Determining the Timing

The next step in the process is timing. Some who are capable of forming the donative intent to make a major gift are able to complete the gift right away. Others may wish to make a larger gift but, because of various financial circumstances, do not believe they are in a position to make the gift immediately. In that case, a donor may decide to defer the gift for a period of time.

A gift such as a pledge to a campaign over a number of years may be deferred for a short time or it may be deferred for years or even the lifetime of one or more persons (in the case of a bequest pledge or gift with retained income for life).

Smaller gifts may also be deferred. An example might be a donor who, when asked by their attorney if they have charitable interests, replies that they would like to divide the remainder of their estate, if any, among charitable interests after first providing for loved ones. In that case, the donor may intend for a relatively small portion of their estate to be eventually devoted to charitable use. Another example might be a gift annuity of a relatively small amount.

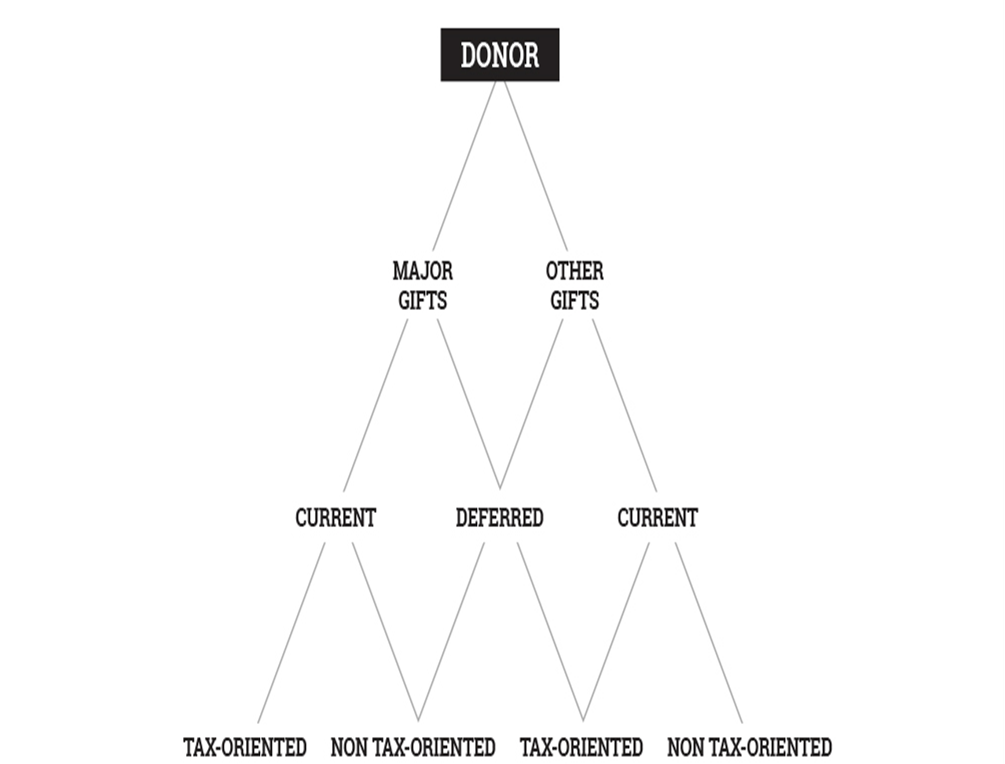

Step 3 – Evaluating Tax Implications

After deciding how much to give and when, it can be wise for a donor to consider the tax consequences of the gift.

Note that larger and smaller gifts, whether current or deferred, may or may not be made in light of tax considerations. Consider the case of a donor with assets of $10 million and an adjusted gross income (AGI) of $300,000 who made a $250,000 gift of appreciated securities to a charitable interest last year. That donor would have been allowed to deduct just $90,000 last year (due to the 30 percent of AGI limitation for gifts of appreciated property). The donor would be able to carry over and deduct another $90,000 this year, leaving $70,000 to carry over and deduct next year.

Now suppose this donor has also made cash gifts this year that bring him up to the total of 50 percent of AGI limitation. If he were driven strictly by tax considerations when considering whether to make an additional gift of any size, this donor would not make it because it would not be deductible and would have to be made from after-tax income. Experienced fundraisers know that donors will sometimes make a gift regardless of their ability to deduct it. A wealthy donor may have a large amount of tax-exempt income that is not considered part of his or her AGI and will use cash from this source to make a gift. Not reporting the income and giving it away with no tax deduction is the equivalent for tax purposes of reporting the income and then taking a charitable deduction.

Most donors of small amounts make charitable gifts that do not exceed the amount of the standard deduction and are not deductible for income tax purposes. This is why tax considerations do not come into play for many smaller gifts.

Overemphasizing tax savings to those who are not motivated by this aspect of charitable giving for whatever reason can be a serious mistake. Ignoring tax considerations when dealing with donors or their advisors for whom this factor is crucial can be an equally damaging error. In fact, after consideration of tax savings, some donors may actually decide to increase the size of the gift they had planned to make. Maintaining perspective and balance is key when addressing the role of taxation in charitable giving.

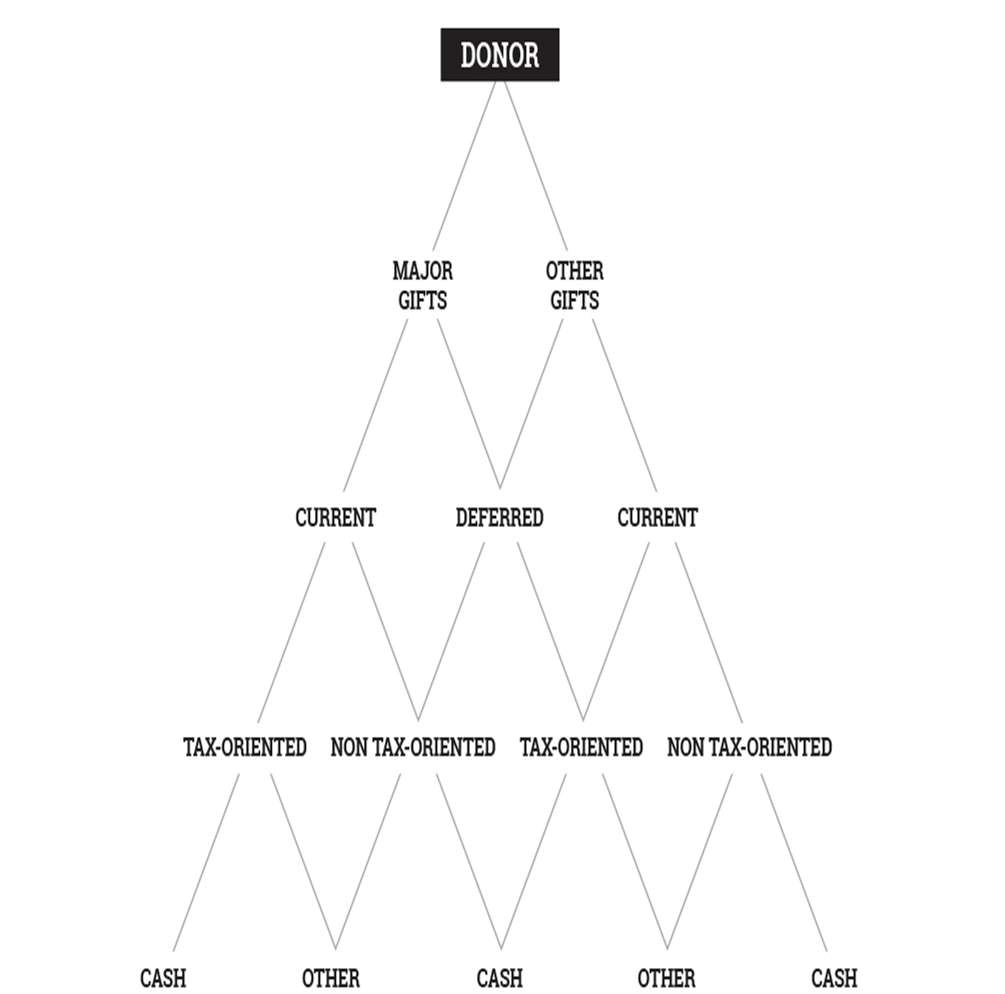

Step 4 – Determining What to Give

Tax and other financial considerations can also help a donor decide the type of property used to make the gift. Once a donor has decided to make a large or small gift, whether current or deferred, and they have considered the tax ramifications, the donor must then decide whether to give cash or other property.

Because wealthy individuals tend to have their assets invested in non-cash assets, the larger the amount of a gift, with or without tax considerations, the more likely it is the gift will be made in a form other than cash. Where donors are in a position to take advantage of the capital gains tax savings inherent in gifts of appreciated assets, this form of property will often be the gift of choice. In other cases, donors will sell assets that have declined in value, take a capital loss and make their gift in the form of cash that is subject to the 50 percent of AGI limitation.

Avoid the common mistake of thinking donors always make gifts of appreciated property for tax savings reasons alone. Imagine that a donor owns 20 investment properties worth an average of $500,000 for a total of $10 million. If the donor wanted to make a gift of $500,000, with or without tax considerations, would the donor be more likely to give cash or one of the properties worth $500,000? It would depend, but one can imagine a situation where the donor did not have $500,000 in liquid assets readily available and decided instead to transfer one of the investment properties to satisfy a pledge. In our experience, donors sometimes give what they have, regardless of tax consequences. Most wealthy donors do not become wealthy or stay wealthy by keeping hundreds of thousands or millions of dollars in checking accounts. For this reason, asking for larger gifts is usually the same as asking for a non-cash gift.

Step 5 – Determine Why the Gift is Made

Finally, we come to why people give. Any of the previously described gifts can be for restricted or unrestricted purposes.

The reason for the gift can sometimes affect the timing. For example, a donor who would like to make a large gift for endowment and long-term security of the charitable recipient may be more likely to make a deferred gift than a donor interested in funding an immediate need. On the other hand, a donor interested in funding an urgent mission might also consider a charitable lead trust to fund a pledge of a current gift over time while deferring a gift to family members who may have a longer-term need for the funds. Avoid confusing the why with the what, when, and how of the gift.

Using the Pyramid

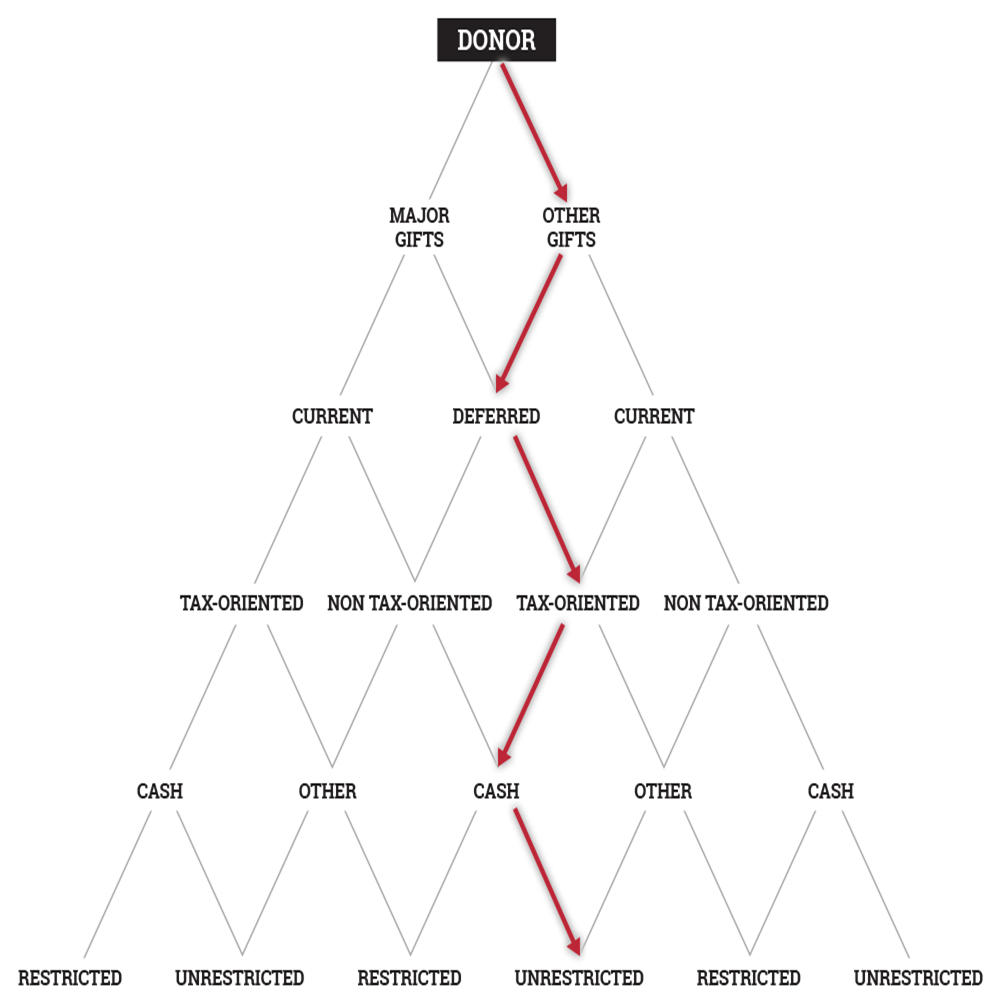

In terms of sheer numbers, most gifts will work their way down the right side of the Planning Pyramid. They are smaller, current, non-tax-oriented gifts of cash for unrestricted purposes. Contrast this with a larger, current, tax-oriented gift of cash that is restricted for a capital project. Most organizations are more familiar with and better able to work with gifts that travel down one slope of the pyramid or the other.

In an environment characterized in many cases by an aging donor base, investment uncertainty and other challenges, the most successful development efforts in coming years will be those with the capability to navigate the various courses a gift can take through the center of the funding pyramid.

For more information about how to apply this approach in the context of your fund development efforts, contact us. The Sharpe Seminar “Integrating Major and Planned Gifts” also features a number of sessions that explore case studies and how to use the Planning Pyramid to help discover the best solutions that help meet donors’ needs while fulfilling their philanthropic objectives.