For many years, charities have lobbied to allow assets held in IRAs to be a source of funds for remainder trusts and gift annuities. They may be on the cusp of achieving this goal.

HR 2954 Securing a Strong Retirement Act of 2021 will directly—and perhaps indirectly—impact charitable giving of donors 70.5 and older. As discussed in my previous post, Sec. 309 provides a “one-time election for qualified charitable distribution up to $50,000 to split-interest entity” that includes remainder trusts and gift annuities. Distributions from a split-interest arrangement to the annuitant will be fully taxable because of the inapplicability of the tier accounting and recovery of basis rules.

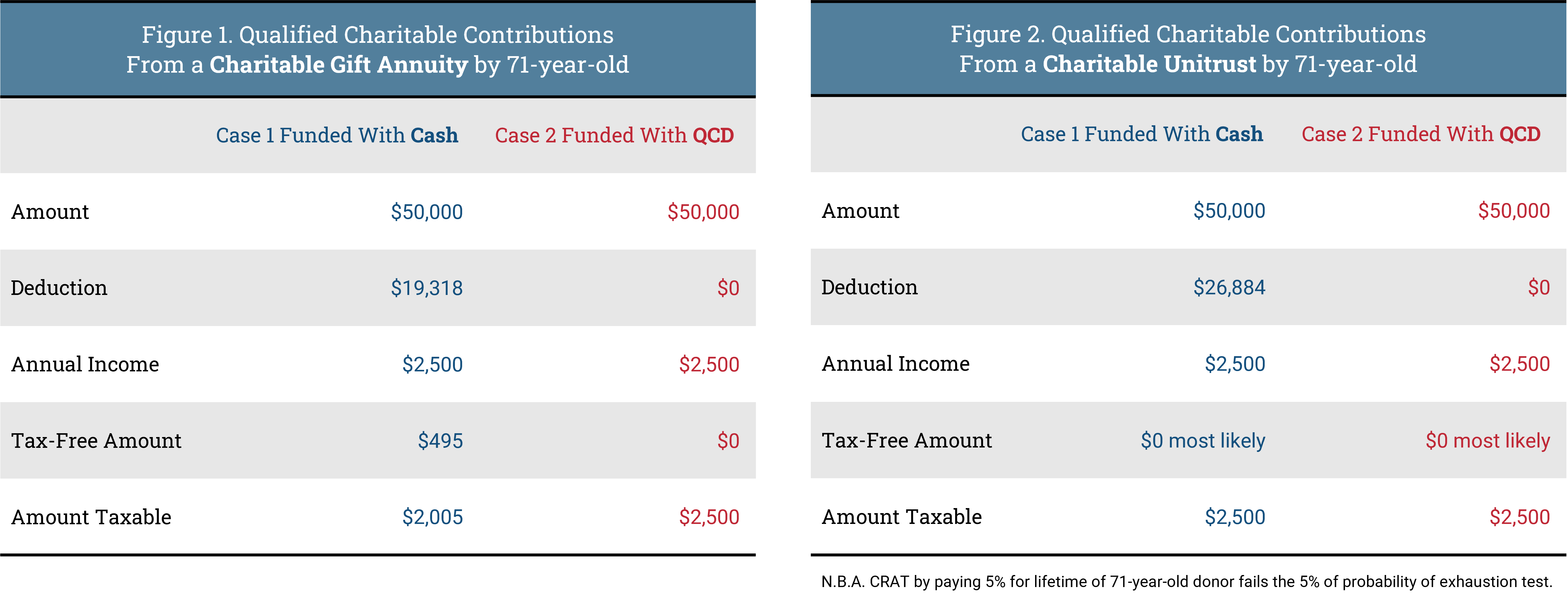

Let’s examine how these new rules reduce the after-tax flow from the gift annuities Here, we assume a 71-year-old donor who is willing to accept a 5% payout from both a gift annuity and unitrust.

In light of the above analysis, some rules of thumb might be:

- Gift annuities funded with assets other than QCDs will result in more cash flow to the donor because of the ability to receive tax-free returns of principal during the donor’s lifetime. QCDs funding gift annuities provide less spendable income. The QCD might be the funding asset of last resort for the charitably inclined.

- Charitable unitrusts funded with assets other than QCDs might result in more cash flow to the donor depending on the ability of the trust to generate preferentially taxed qualified dividends. Funding a unitrust with a QCD prevents any such possibility. Whatever advantage might be possible through a conventionally funded unitrust would be reduced by the annual administrative expenses to a small trust ($50,000 or less).

- Charitable annuity trusts are not a viable option in the current very low Sec. 7520 interest rate environment because of failing the probability of exhaustion test.

In addition to reducing the after-tax cash flow from a charitable gift annuity, the Act has other provisions which could have the unintended effect of making the QCDs less attractive.

Over the next ten years, Sec. 105 of the Act would phase in an increase in the age for a required mandatory distribution from 72 to 75.

Sec. 107 would permit higher catchup amounts of up to $10,000 at ages 62, 63 and 64.

Sec. 202 would repeal the current 25% limit on qualified longevity annuity contracts. This means an account balance up to $135,000 will be permitted with a delayed distribution date to age 85, which may disincentivize QCDs as a way of reducing RMDs.

The net effect of these provisions would be larger amounts to defer to a later year of drawdown while permitting greater additions and extension of deferral.

By Professor Chris Woehrle, Chair & Professor of Tax & Estate Planning Department, College for Financial Planning, Centennial, Colorado

Sharpe Group will continue to post helpful information for you here on our blog and on our social media sites. If this blog was shared with you and you wish to sign up, click here.

We can be found on Facebook, Twitter and LinkedIn @sharpegroup.

We welcome questions you’d like us to address. Email us at info@SHARPEnet.com and we’ll share your question and our thoughts in this blog and on social media.