Help Your Donors Make the Most of Their Gifts in 2019

Uses for Your Guide to Effective Giving in 2019:

- Send along with gift acknowledgments early next year for all 2018 donors of larger amounts.

- Make it the focus of a special mailing to top donors after April 15, 2019, when they may have encountered the way tax reform affects them for the first time.

- Insert in acknowledgments for larger gifts all year long.

- Enclose with gift proposals throughout 2019.

- Enclose with periodic pledge reminders.

- Feature in communications with gift recognition society members.

- Use as a leave-behind piece of follow-up to donor visits.

- Include in informational packets at special events or donor receptions.

- Provide in literature racks along with other materials.

- Distribute as an educational tool for volunteers and development staff.

- Use as a special end-of-year mailing to major gift prospects next fall.

Did you know that it is not unusual for charities to receive more in the form of stock gifts each year than the total received from charitable bequests?

Do your fundraising plans include devoting as much time and other resources to encouraging stock and other noncash assets as you do for bequests?

Are you aware that in a recent year the median age of the top donors of outright gifts in the U.S. was 74 or that the majority of gifts of securities are made by those over the age of 55?

Should major donors be receiving information designed to help them decide how best to make their gifts regardless of age and whether their gifts are made now or as part of their estate?

SHARPE newkirk is pleased to announce the new booklet, Your Guide to Effective Giving in 2019. Published by Sharpe every year since 1963, this time-tested publication is designed to help ensure your donors have the information they need when planning their gifts all year long. See the box at right for suggested uses and assistance in determining the quantity you would like to reserve.

SHARPE newkirk is pleased to announce the new booklet, Your Guide to Effective Giving in 2019. Published by Sharpe every year since 1963, this time-tested publication is designed to help ensure your donors have the information they need when planning their gifts all year long. See the box at right for suggested uses and assistance in determining the quantity you would like to reserve.

Maximize your fundraising success by making sure your top donors of all ages have the information they need to guide them through their many options when deciding what—and how much—to give.

Here are some things your donors need to know:

- Those who gave the majority of individual gifts last year will see little or no change in the tax deductibility of their gifts and the 2018 tax law changes may actually increase the value of deductions for some.

- How much they are able to give can depend on the timing of their gifts and the property they choose to give.

- Why it can be better to give noncash property regardless of whether they itemize their deductions.

- How they may benefit from bunching, boosting or bypassing the charitable deduction.

- That mature donors can make gifts while meeting personal financial needs that might otherwise stop them in later years.

- Why a decrease in estate taxes can actually make charitable gifts through one’s estate MORE attractive.

As with all Sharpe publications, Your Guide to Effective Giving in 2019 is designed to be personalized with your information on the front and/or back cover or may be fully customized if preferred. Read more about this booklet or contact us at 901.680.5300 or via email at orders@SHARPEnet.com.

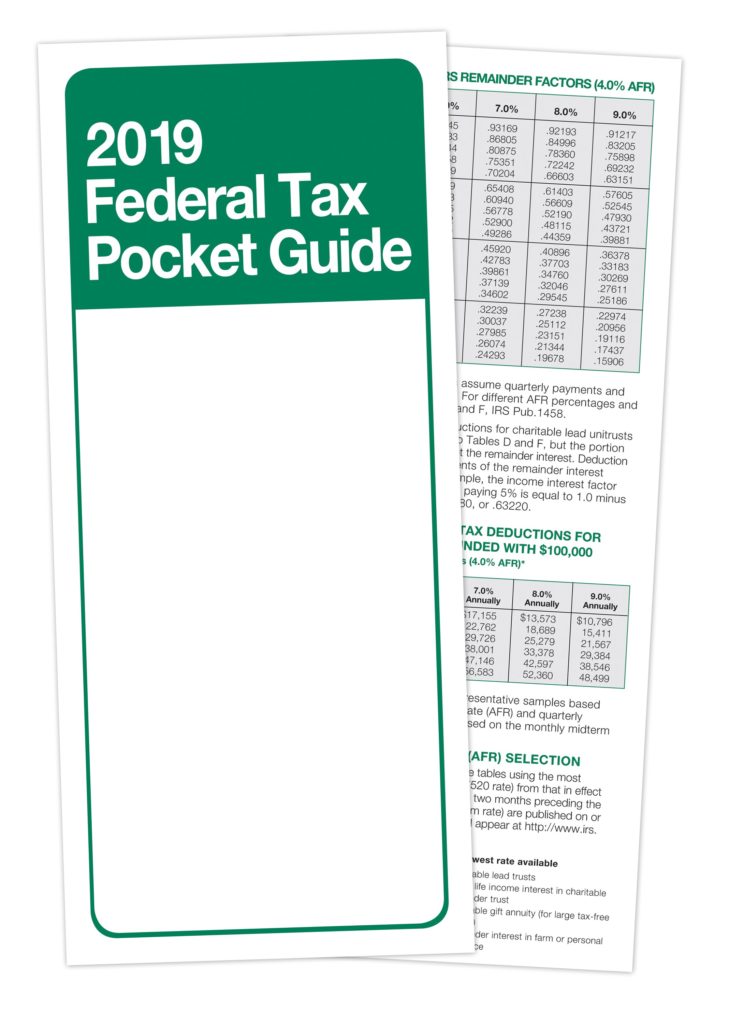

SHARPE newkirk is also pleased to offer the 2019 Federal Tax Pocket Guide. This reference guide is ideal for advisors and more sophisticated donors. It is an effective tool for keeping your organization top of mind with the professional advisors and estate planners in your community and building goodwill among your top donors and prospects.

SHARPE newkirk is also pleased to offer the 2019 Federal Tax Pocket Guide. This reference guide is ideal for advisors and more sophisticated donors. It is an effective tool for keeping your organization top of mind with the professional advisors and estate planners in your community and building goodwill among your top donors and prospects.

The 2019 Federal Tax Pocket Guide is designed to help communicate with advisors and more sophisticated donors:

- In a special mailing to attorneys, trust officers, financial planners, accountants and other centers of influence

- Information for high net worth donors in response to inquiries about tax reform

- As a handout at professional advisory council meetings

- As an insert with major and planned gift proposals

Download a preview of the 2019 Federal Tax Pocket Guide. Find out more about how to order copies of this guide. The pocket guide can also be personalized with your organization’s contact information.