Inflation adjustments for 2019, released recently by the IRS, are slightly lower than they might otherwise have been, due to a new calculation method. Increases are now determined using the chained consumer price index (C-CPI), which recognizes that when certain prices rise, consumers find cheaper alternatives. Among this year’s adjustments:

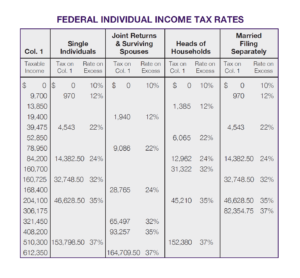

Income tax brackets

Capital gains rates

0% bracket Taxpayers in the 10% and 20% income tax brackets

15% bracket Taxpayers in the 22%, 24%, 32% and 35% income tax brackets

20% bracket Taxpayers in the 37% income tax bracket

The 3.8% tax on net-investment income, which applies to taxpayers with modified adjusted gross income in excess of $200,000 for single filers and $250,000 for joint filers, is not adjusted for inflation.

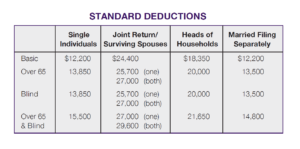

Standard deductions

Estate, gift and generation-skipping transfer tax exemption equivalent

A credit of $4,505,800 shelters transfers up to $11,400,000 in 2019.

Annual gift tax exclusion

The $15,000 exclusion remains the same as in 2018.

Insubstantial benefits for charitable fund raising

“Low cost articles” in 2019 are those costing $11.10 or less. Insubstantial benefits may be received by a donor in return for a contribution, without causing the contribution to fail to be fully deductible, provided (1) the fair market value of all benefits received by the donor is not more than 2% of the payment or $111, whichever is less, or (2) the contribution is $55.50 or more and the only benefits received in return are token items costing the charity no more than $11.10.

By Kathy Sperlak