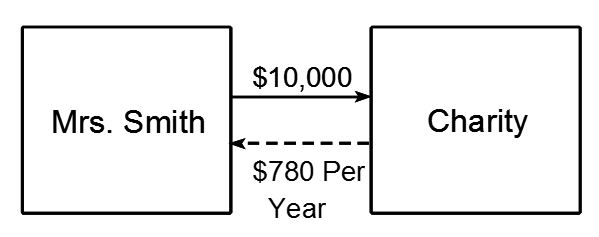

A gift annuity is a contract between a donor (or married couple) and a charity, whereby the charity promises to pay an annuity for either one life or two lives.

The underlined terms bear consideration. The fact a gift annuity is a contract means a gift annuity is formed by offer and acceptance. The charity offers to make specified annuity payments; the donor accepts by transferring cash or securities (or maybe some other asset) to the charity.

Sometimes the offer isn’t specific enough. For example: if the donor is going to wire shares of stock to the charity, the charity should make clear up-front which date it will use to value the stock for purposes of determining the annuity amount—the date the shares are wired out of the donor’s account or the date the charity receives the shares. Often, charities fail to make this clear up-front, and disputes occur.

Sometimes the offer isn’t specific enough. For example: if the donor is going to wire shares of stock to the charity, the charity should make clear up-front which date it will use to value the stock for purposes of determining the annuity amount—the date the shares are wired out of the donor’s account or the date the charity receives the shares. Often, charities fail to make this clear up-front, and disputes occur.

The fact the charity promises to pay the annuity means the charity makes a financial commitment. The financial commitment is specific—for example, to pay the donor a life annuity of $4,000 a year in equal quarterly installments of $1,000 at the end of each calendar quarter. This specific financial commitment has a certain value for federal tax purposes. This value is technically called “the investment in the contract” and is the amount the donor recovers tax-free over his or her “life expectancy.”

More on gift annuities next time. Read part two here.

by Jon Tidd

To learn more about gift annuities in gift planning, attend one of our popular gift planning seminars. Click here for more information. Sharpe Group also has a booklet and brochure to help you educate your donors on how gift annuities can work for them. Click here to request samples of these publications.