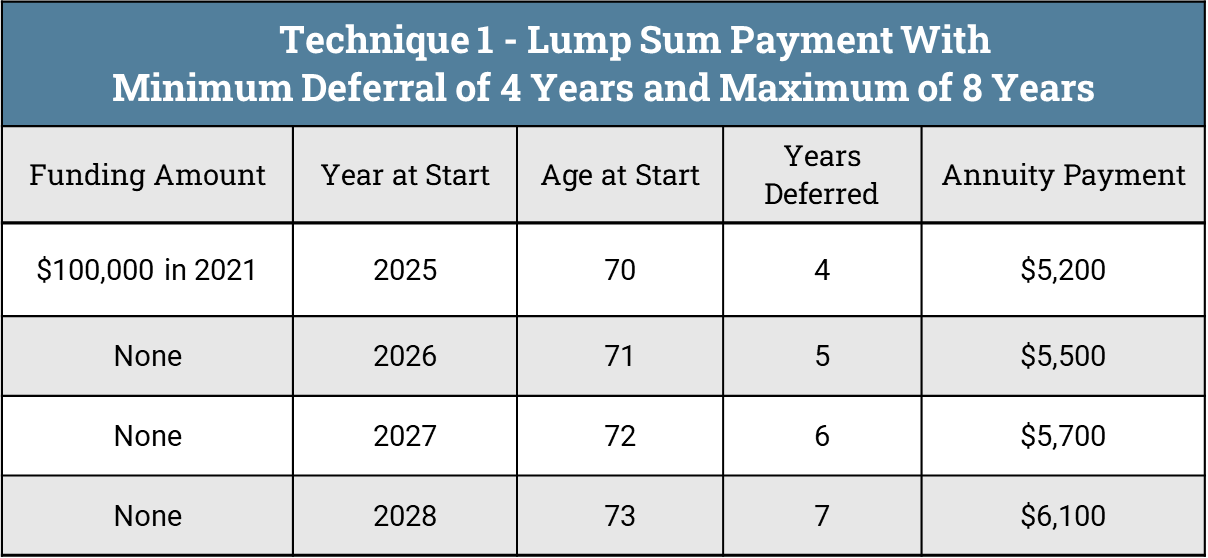

A flexible gift annuity permits payments to be deferred until a commencement date of the annuitant’s choosing. A schedule of possible start dates with payment amounts is created when the annuity is funded. The longer the deferral of commencement, the greater the annuity payments. The income tax deduction will be based on either a set target date or the earliest possible date payments could begin. Let’s examine the two broad ways of structuring the flexible gift annuity.

Technique 1 – Flexibility with a single lump sum gift

Dorothy Deferral is 66 years old and the owner of a successful management consulting company. While enjoying her position, she knows no one works forever, regardless of how much their work fulfills them. While she would like to work to age 74, Dorothy believes 70 would be the earliest likely time to retire and the latest point for receiving the maximum Social Security benefit. Pandemic-related spending and deficits convince her inflation is likely to be much higher than it has been in the last 20 years. She intends to begin traveling extensively for her favorite charity during retirement and wants to supplement her retirement income as soon as she retires.

A flexible gift annuity could be structured to meet this plan with a minimum deferral of four years and a maximum of eight. In fact, the range of deferral periods can be whatever a donor deems useful within a maximum of a 20-year deferral.

If Dorothy is willing to delay the payments to age 74, the annuity increases by $1,200 ($6,400-$5,200), an increase of 24%. The major disadvantage of a single gift flexible annuity is she must make a $100,000 gift to create the flexible gift annuity.

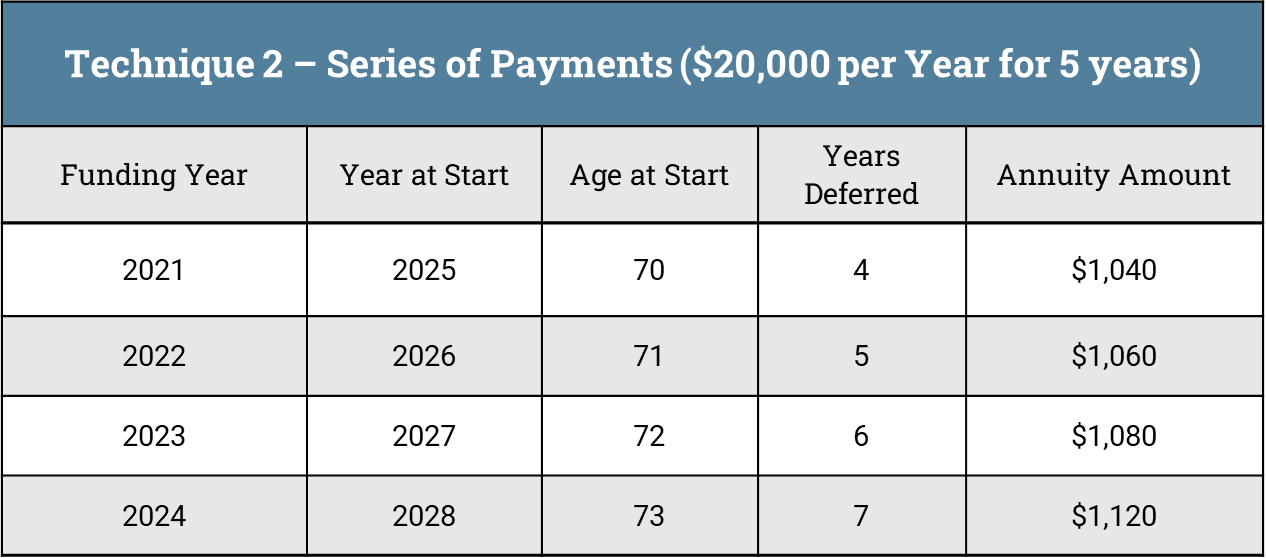

Technique 2 – Flexibility with a series of “step” gifts

After consulting with her advisors, Dorothy asks to review how a flexible annuity would work if the same gifting amount of $100,000 creates five agreements using five (5) equal installments.

The notable difference would be the income from all the annuities once elected would be $5460, which is less than $6,400 from the lump sum arrangement. The reduced income will be attractive enough to Dorothy because she is not losing access to the principal of $100,000 at once. Should her financial plans or philanthropic objectives change, she need not make any additional installment gifts.

Documentation

Dorothy decides the simplest approach would be to execute multiple agreements for the five flexible gift annuities she funds.

Target audience

Donors can coordinate the election of the annuity payments with their other retirement income sources based on their unique lifestyle plans. Also, the flexible gift annuity offers a way for those who have maxed out their contributions to regular retirement plans to expand their retirement income further while achieving their charitable goals. More on this in a future blog.

One additional group could be those donors with bequest intentions. Many of your legacy society members often have the capacity to make lifetime contributions but are reluctant to do so out of an abundance of caution. The flexible gift annuity provides an income stream to your supporters if needed. The charity has not only the certainty of result of the commitment but also the potential for donors to give more in the future through their estate.

By Professor Chris P. Woehrle, JD, LLM and Lewis von Herrmann, Senior Consultant

Sharpe Group will continue to post helpful information for you here on our blog and on our social media sites. If this blog was shared with you and you wish to sign up, click here.

We can be found on Facebook, Twitter and LinkedIn @sharpegroup.

We welcome questions you’d like us to address. Email us at info@SHARPEnet.com and we’ll share your question and our thoughts in this blog and on social media.