What factors must be considered before starting an in-house gift annuity program? Consider these guidelines:

- State regulations for gift annuities vary drastically, so first, review your state’s requirements. Several states, particularly New York and California, have strict regulations to qualify for a program and have ongoing requirements that involve reserves, reporting and compliance. Be certain you qualify financially and have the internal administrative support to always comply before proceeding.

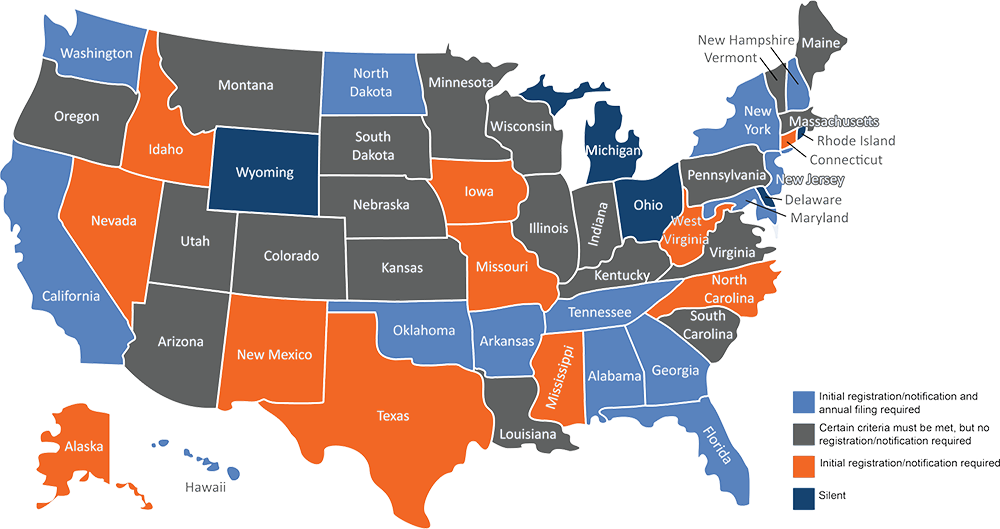

- State regulations also govern offering gift annuities in states outside your home state. Thus, your charity must comply with the regulations in the state of residence for each donor before you can offer them a gift annuity. For example, Alabama treats gift annuities as securities rather than as insurance products, and the Secretary of State must issue a letter of exemption prior to offering an Alabama resident a gift annuity. Hawaii requires a deposit of reserves within a state bank before your charity can offer gift annuities to a resident. You can find information about each state’s requirements on the American Council on Gift Annuities (ACGA)’s website. See the map below from the ACGA.

- Your charity’s demographic makeup of donors over age 65 needs to be sufficiently large to justify offering a gift annuity program. Gift annuities are not for the young; the older the donor, the better the chance of a gift annuity benefitting both the donor and your charity. The gift annuitants will be connected to your charity for life!

- The promotion of gift annuities to your older donors requires an adequate budget to market the concept of giving in exchange for fixed payments. This older donor group requires hard-copy mailings that would indicate the program is credible for them to achieve two goals: 1) They want to give more to your charity, and 2) They want to receive a fixed payment that they cannot outlive. This requires they transfer an asset to your charity in exchange for the payments. Thus, an email, text message or phone call may be insufficient to motivate the gift.

- Strong internal administrative support is a requirement to ensure the payments are delivered ON TIME and all the ongoing documentation requirements are met! When donors depend on fixed payments, late payments are unacceptable. Of course, direct deposits reduce the likelihood of such delays. The payments are a general obligation of the charity.

What if our charity wants to issue gift annuities but would not qualify as indicated above?

- There are community foundations and other organizations that will issue gift annuities on behalf of your charity and will also ensure payments are delivered on time for the life or lives of the beneficiaries. Your charity’s research will determine which organization is best for you to select for the arrangement.

- Your charity may receive an up-front transfer of funds once the gift annuity is established and/or receive a remainder interest at the death of the (last) beneficiary. Your charity would establish a written agreement with the organization who issues the gift annuity and who will discount the value your charity will receive and when your charity will receive it. Thus, you must verify that the arrangement makes financial sense for both parties.

- The budget for promotion and marketing using mail remains a requirement.

- The substantial number of older donors is no longer such a strong requirement.

By Lewis von Herrmann, CFRE

If you have questions about starting a charitable gift annuity program, please reach out to us. We’d be happy to help! Contact us at info@sharpegroup.org or 800.342.2375.

Our in-person and virtual seminars also present great opportunities to learn more about giving vehicles, such as gift annuities. Our next Sharpe Online Academy is “Planned Giving #103: Integrating Major and Planned Gifts” February 15-16. Click here to register.