Introduction

The price index for American consumer goods rose at an annual rate of 4.2% for the month ending in July. This is the fastest pace since January of 1991. While Fed Chairman Jerome Powell believes the inflation spike is temporary, now might be an appropriate time to examine how an inflationary environment would impact the attractiveness of charitable gift annuities.

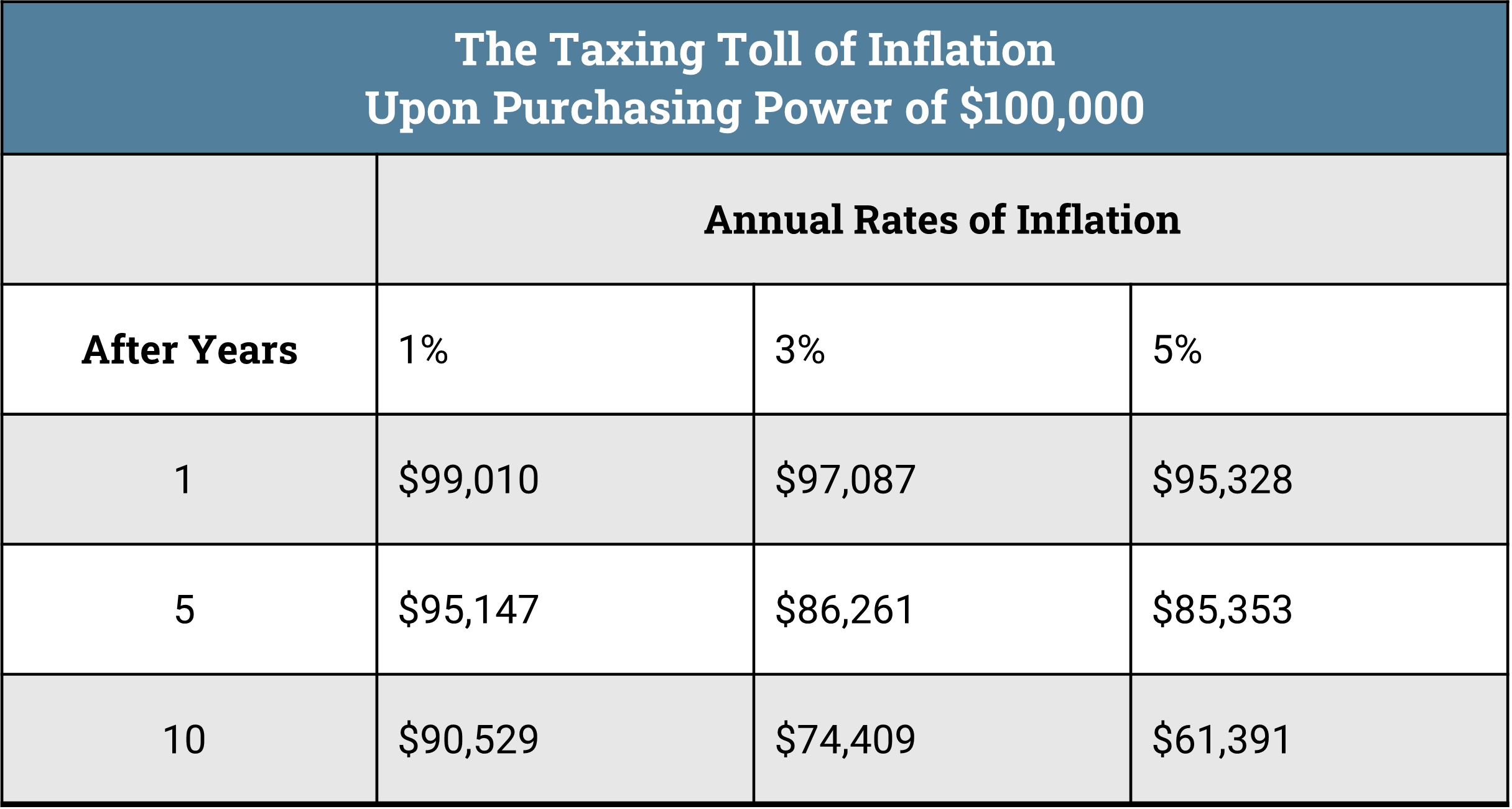

At first blush one might conclude the charitable gift annuities would be unattractive. As the chart below demonstrates, the purchasing power of the fixed payments would be meaningfully diminished even over short periods of time. But is there a way for an annuity agreement to provide a fixed payment yet be flexible enough to respond to inflationary environments?

Hedging against inflation using a flexible deferred gift annuity

In a conventional deferred charitable gift annuity, the start date for the payments is determined at the creation of the agreement. The flexibility in the flexible deferred gift annuity arises from the agreement offering a range of times for when the first payment starts. The longer the deferral of commencement, the greater the amount of the payments. The cost of this flexibility comes in the form of a smaller income tax deduction, which must be based on the smallest deduction amount allowed under any of the permissible payments. This cost may be more than reasonable to be borne to afford the opportunity for the highest payments, which are especially attractive in an environment of rising inflation.

In Private Letter Ruling 9743054 (Oct. 24, 1997), the IRS issued a favorable determination letter to a deferred annuity with a to-be-determined starting date. The arrangement permits a 60-year-old annuitant to elect payments to start no earlier than age 61. Once a donor begins the payments, the annual payment would be based on her age under the pre-existing tables incorporated as part of the annuity agreement. The charity was required to provide the donor-annuitant a calculation of the charitable tax deduction based on the maximum possible noncharitable value of the annuity.

Some planners were concerned that the ability to elect the start date of the income meant the annuitant was in “constructive receipt” of income from the earliest possible date of receipt. Private Letter Ruling 200742010 (Oct. 19, 2007) plainly stated that “no amount will be constructively received by the annuitant until the annuitant actually begins receiving payment.”

Example

Patricia Philanthropic is 57 and hopes to retire at 70, as she enjoys her work as a data scientist. She would like to support her house of worship “at some point before I die.” Her tax advisor recommends a flexible deferred gift annuity. The first payment could start as soon as 70 with a range of payment dates between age 65 to 85 (20-year maximum requirement). If she decides she needs the payments before age 70, she will receive payments, albeit reduced, to reflect her age at commencement of payments. She could even defer payments to 85 and receive a high payment to reflect the length of the deferral. In all cases, the income tax deduction will be based on the target start date of age 70.

The likely market

For the philanthropically inclined, the flexible deferred gift annuity might be coordinated with the retirement-income planning of the donor. Any high-earning professional participating in a qualified plan knows that all of their working income will not be replaced with their qualified plan benefit, and many have maxed out their retirement plan participation. ERISA imposes a cap known as the “covered compensation limit.” For example, only the first $290,000 of compensation is considered. A flexible deferred gift annuity might be a way to address at least a portion of the shortfall. Further, there is no maximum contribution limit imposed on the creation of charitable gifts, including those to create any form of gift annuity, such as the flexible deferred gift annuity.

Future planning

Since the letter rulings did not specify a minimum starting age for payments, the flexible deferred gift annuities afford additional opportunities in creative gift planning.

In my next blog, I will be suggesting other possible uses of the flexible deferred gift annuity and some of the design options which can enhance its philanthropic impact.

By Professor Christopher P. Woehrle, JD, LLM

Sharpe Group will continue to post helpful information for you here on our blog and on our social media sites. If this blog was shared with you and you wish to sign up, click here.

We can be found on Facebook, Twitter and LinkedIn @sharpegroup.

We welcome questions you’d like us to address. Email us at info@SHARPEnet.com and we’ll share your question and our thoughts in this blog and on social media.