Spring falls in 2020

The global pandemic sent shockwaves through the economy and led to a major stock market correction and recession in the spring of 2020. The U.S. GDP fell 33.1% during the second quarter of 2020. Many would expect the overall number of wealthy Americans would fall significantly. Initial reports indicated this was indeed the case as the population sheltered in place and stock markets fell, along with commercial and residential real estate. As the pandemic worsened, things looked bleak.

Disaster averted

Prompt action by the federal government, including the U.S. Treasury and Federal Reserve, cushioned the fall, and the markets regained confidence in a low-interest-rate environment. The resulting increase in asset values led to larger gains in household wealth in the U.S. with much of those gains accruing for the affluent and wealthy population.

Record numbers of millionaires

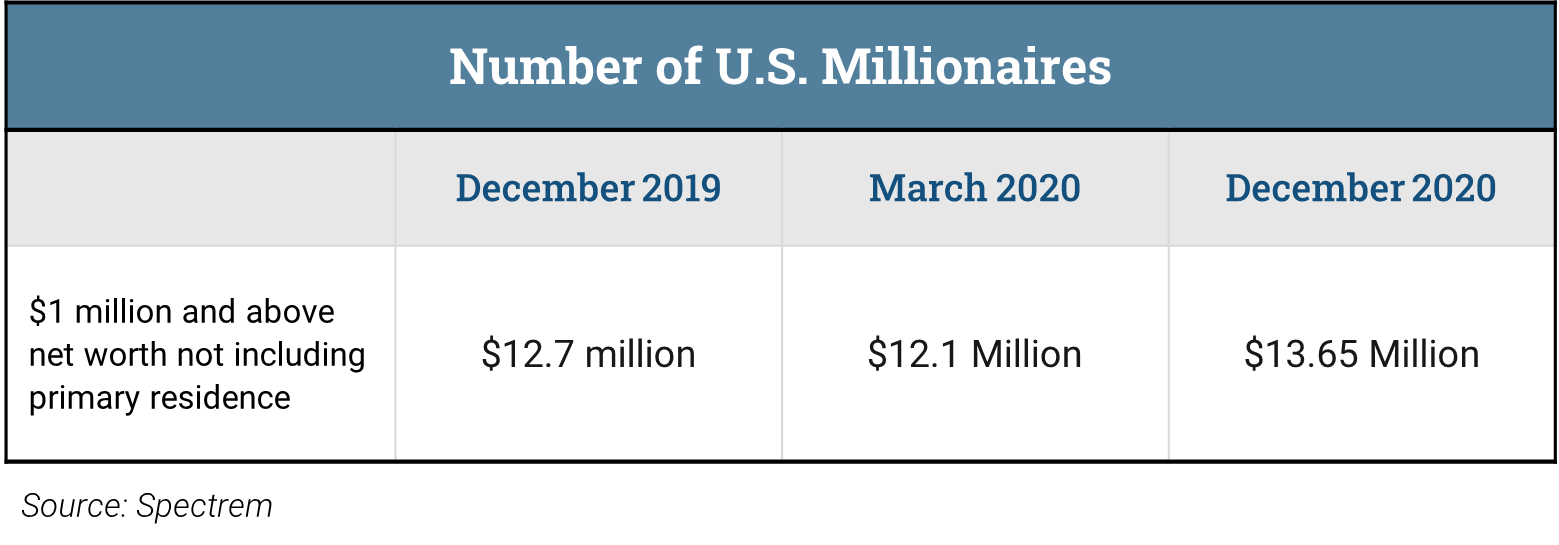

Wealth reports by Credit Suisse and Spectrem indicate that the number of affluent and wealthy Americans is at an all-time high and expected to grow. At the end of 2020, the estimated number of Americans worth at least $1 million was estimated to fall between roughly 14 million and 22 million. The chart below depicts those numbers from the end of 2019 (before the global pandemic) until the end of 2020 (after the wealth recovery). Some people permanently fell from the ranks of the wealthy in 2020, but others replaced them by buying stocks, real estate and other assets at bargain prices.

The Credit Suisse Research Institute Global Wealth Report included the value of the households’ primary residence and other assets and estimated that the U.S. was home to 22 million, or 39.9%, of the world’s millionaires. Furthermore, their study projects the number of U.S. millionaires will grow more than 25%, from 22 million in 2020 to more than 28 million in 2025.

A bright spot for philanthropy?

We know 2020 was a challenging year for philanthropy, but according to the Giving USA Annual Report on Philanthropy for the Year 2020, charitable giving reached a record level with living individuals providing the greatest portion of total giving, despite the percent of individual donors falling to an historic low of 69% of total giving. The growth in the value of individual giving was driven by a smaller number of affluent donors making larger gifts.

While this may be a long-term challenge, in the short term, the number of affluent wealthy and ultra-high-net-worth individuals has grown, thereby increasing their capacity to give. Additionally, there is a very strong likelihood that income, estate and capital gain taxes will be increasing in the very near future. This may lead to the sale of assets, stocks, farms, businesses, etc. this year which will create charitable planning opportunities to reduce or eliminate taxes.

If you are not sure who your millionaires are, we can provide the latest wealth and income data enhancement information for your donor files. A Sharpe consultant can also help you understand who your likely donors are based on demographic information gleaned from the IRS, Sharpe studies and generational interests.

By Barlow T. Mann, General Counsel

Sharpe Group will continue to post helpful information for you here on our blog and on our social media sites. If this blog was shared with you and you wish to sign up, click here.

We can be found on Facebook, Twitter and LinkedIn @sharpegroup.

We welcome questions you’d like us to address. Email us at info@SHARPEnet.com and we’ll share your question and our thoughts in this blog and on social media.