The IRS discount rate (7520 rate) has a big effect on charitable remainder annuity trust (CRAT), charitable lead annuity trust (CLAT) and gift annuity calculations but has almost no effect on unitrust calculations.

CRAT calculations: The 7520 rate adversely affects two CRAT calculations: [1] the charitable remainder calc and [2] the 5% probability calc … because the 7520 rate is the CRAT’s assumed earnings rate. The less the CRAT is assumed to earn, the less the charitable remainder beneficiary is projected to receive and the sooner the CRAT is projected to run out of money.

CLAT calculations: A low 7520 rate boosts the CLAT payout value, which increases the CLAT’s tax leverage.

Gift annuity calculations: A low 7520 rate lowers the charitable contribution; but it increases the tax-free portion of the gift annuity payments. It also increases the capital gain that’s realized if the annuity is funded with appreciated stock.

Bottom Line: A low 7520 rate is good for cash-funded gift annuities set up by individuals who don’t itemize.

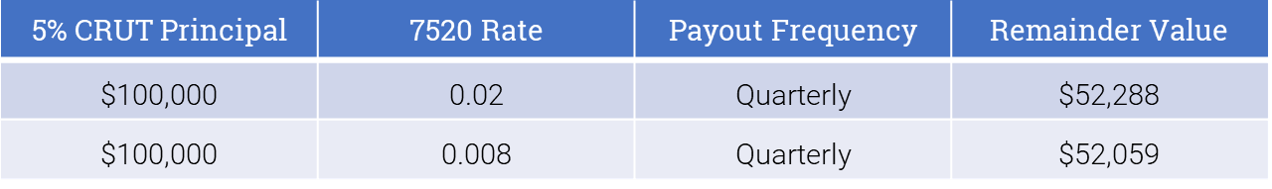

Unitrust calculations: The value of a charitable remainder unitrust (CRUT) remainder is almost unaffected by the rate, as seen from this table (recipient is aged 70):

The table shows there is little to be gained by electing a prior month’s higher 7520 rate in the case of a CRUT. What’s mainly achieved is the hassle of filing a 7520 rate election with the tax return on which the CRUT is first reported.

The reason the CRUT remainder value is almost unaffected by the 7520 rate is that the 7520 rate is not the assumed earnings rate of a CRUT. The 7520 rate only bears on how the payout frequency affects the CRUT remainder value.

The payout frequency has a larger effect on the remainder value than does the 7520 rate. The greater the frequency, the lesser the remainder value.

By Jon Tidd

Sharpe Personalized Publications

Every donor communications plan requires informational, motivational and educational content for different types of gifts. Sharpe Group publications offer your donors up-to-date information on gift structures that may help them give more than they thought possible.

Every donor communications plan requires informational, motivational and educational content for different types of gifts. Sharpe Group publications offer your donors up-to-date information on gift structures that may help them give more than they thought possible.

Use Sharpe Group’s online platform to personalize and order printed brochures targeted to your donors–uniquely styled with colors and images that brand your organization’s message and mission.

Choose an accent color and cover image from the provided selections, or upload your own image and your full-color logo to create a brochure that aligns with your fundraising strategy and fits your organization.

Click here to learn more.

Sharpe Group will continue to post helpful information for you here on our blog and on our social media sites. If this blog was shared with you and you wish to sign up, you can do so at www.SHARPEnet.com/blog.

We can be found on Facebook, Twitter and LinkedIn @sharpegroup.

We welcome questions you’d like us to address. Email us at info@SHARPEnet.com and we’ll share your question and our thoughts in this blog and on social media.