![]()

![]()

As a fundraiser, your most important asset is your donor data. Having complete and accurate data helps you gain valuable insights to better know your donors and understand their motivations for giving. Studies show that the information you have about your donors (age, wealth, contact information) changes by as much as 20% every year.

As a fundraiser, your most important asset is your donor data. Having complete and accurate data helps you gain valuable insights to better know your donors and understand their motivations for giving. Studies show that the information you have about your donors (age, wealth, contact information) changes by as much as 20% every year.

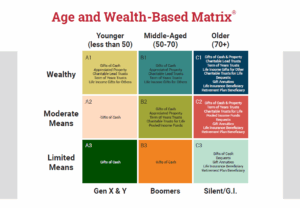

Sharpe Group created the Age- and Wealth-Based Matrix® to help charities divide their donors into groups to help with planning, budgeting and relationship building. By segmenting your donors, you can formulate specific marketing strategies and tactics. For example, those donors who are the youngest are most likely to use email, texting, social media and websites to maintain their relationship to your charity.

On the other hand, the oldest donors may not even be connected digitally and would prefer contact via telephone and mail. They continue to value printed communications, like a planned giving newsletter.

Crack the code

Matrix codes can be applied to your database to allow more targeted fundraising approaches based on income and wealth. This enables you to determine what types of gifts are most likely to be attractive within specific age groups and giving capacity levels. For example, gift plans, such as lead and remainder trusts, gifts of securities or life estates tend to have a more wealth-oriented profile.![]()

As part of Sharpe Group’s Comprehensive Data Services, Matrix codes can be applied to your database to allow more targeted fundraising approaches based on income and wealth. This enables you to determine what types of gifts are most likely to be attractive within specific age groups and giving capacity levels. For example, gift plans, such as lead and remainder trusts, gifts of securities or life estates tend to have a more wealth-oriented profile. ■