by Barlow Mann

Most fundraisers have a grasp of who their largest and most generous contributors are at present but are not necessarily sure where to find their leading donors in coming years.

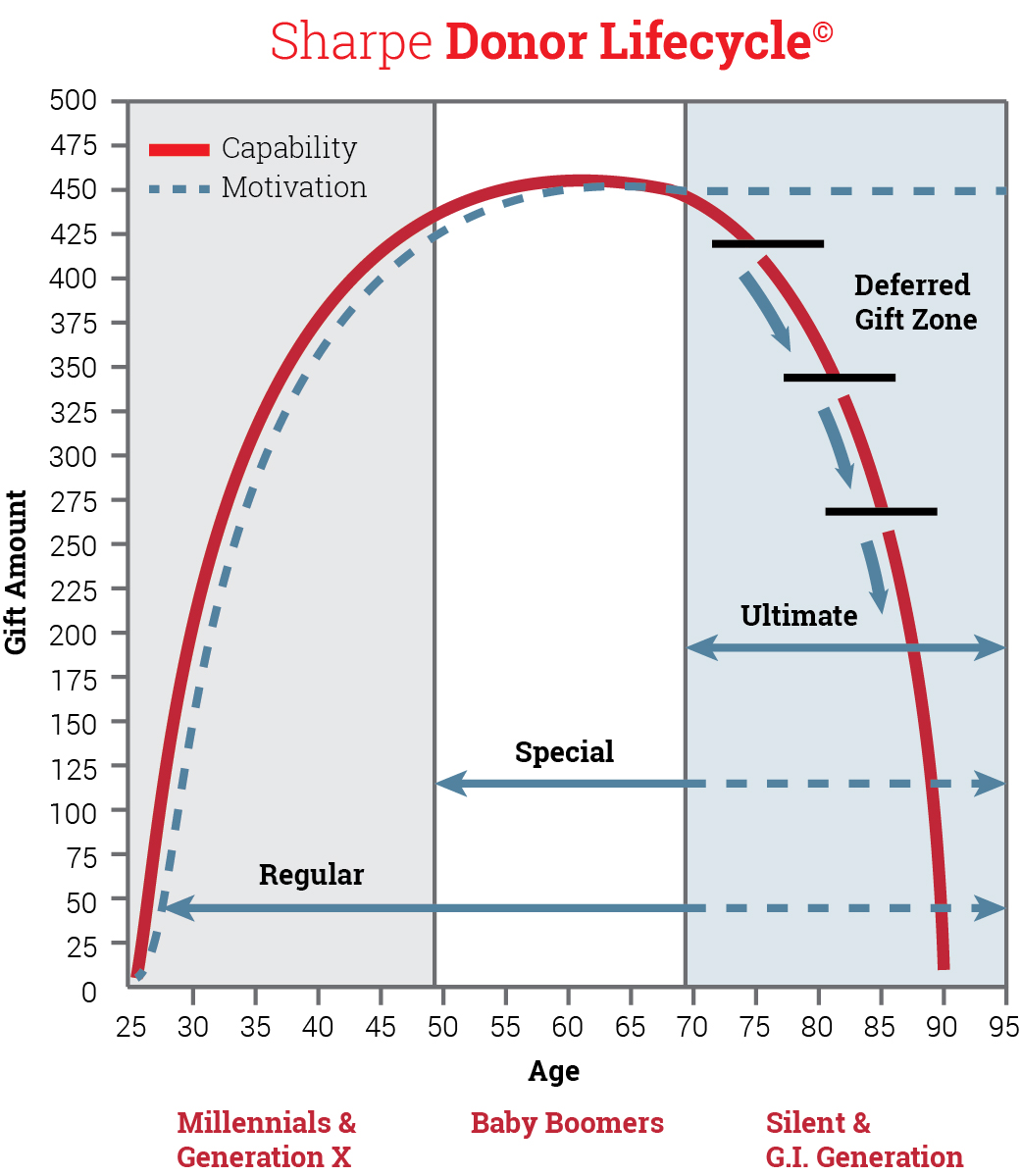

The Sharpe KnowledgeBase® has continually evolved over the past 54 years and has been the foundation of several tools designed to assist fundraisers in identifying and motivating those who are capable of making regular, special and ultimate gifts. Two of the most popular Sharpe tools can offer a place to start. Let’s begin with the Sharpe Donor Lifecycle©.

The early years

The Sharpe Donor Lifecycle adapts an economic or consumer lifecycle for philanthropic planning purposes. During the early years when donors are younger, the vast majority are prospects for “regular” gifts from income, mainly in the range of $25, $50 or $100 from their checking accounts or credit cards. Over time, as their incomes increase and their level of interest rises, those $25 or $50 donations may increase to $100, $500, $1,000 or more.

The Sharpe Donor Lifecycle adapts an economic or consumer lifecycle for philanthropic planning purposes. During the early years when donors are younger, the vast majority are prospects for “regular” gifts from income, mainly in the range of $25, $50 or $100 from their checking accounts or credit cards. Over time, as their incomes increase and their level of interest rises, those $25 or $50 donations may increase to $100, $500, $1,000 or more.

The middle years

In the middle years, between ages 50 and 70, both discretionary household income and net worth typically increase. Consequently, more people begin to give. Regular gifts will still make up the bulk of philanthropic activity, but relatively few donors in this age range begin to have the capacity to make large “special” or “major” gifts from cash or noncash assets of five, six or even seven figures and above.

These larger gifts, made outright or over a period of years, are more likely to be in a form other than cash and may be structured in some combination of current and deferred gifts (a blended gift). Most donors in this age range are still working and making more money than ever before. Additionally, many are reducing debts and increasing savings and other investments and are focused on enhancing their net worth in anticipation of a potentially lengthy retirement.

The later years

During the later years, when most donors are retired, the youngest tend to be in their late 60s or early 70s, but many are older. In the early part of this later phase of life, some are still working and accumulating wealth. Those who are retired may have seen their net worth continue to increase because of the rising value of real estate, securities and other assets. Other donors in this age group may be receiving inheritances from their parents or others.

Many others are not so fortunate and find themselves living on Social Security and modest withdrawals from retirement plans. In fact, most find that their household income will fall below the national average during this phase of life, and they will begin “spending down” their lifetime’s accumulation of assets. As a result, regular and special gifts may become less frequent or cease entirely.

Meanwhile it is the third stage of the donor’s lifecycle where an individual may seriously consider the ultimate gift, which oftentimes comes from all, or part, of whatever assets remain after providing for family and friends. It is important for gift planning professionals to remember that actions speak louder than words or intentions, and even donors who have recently lapsed may choose to include an ultimate gift in their estate. The later years of the donor lifecycle, when donors make their final wishes clear, is when over 90 percent of the estate plans that actually include charitable provisions are completed.

Another Sharpe tool

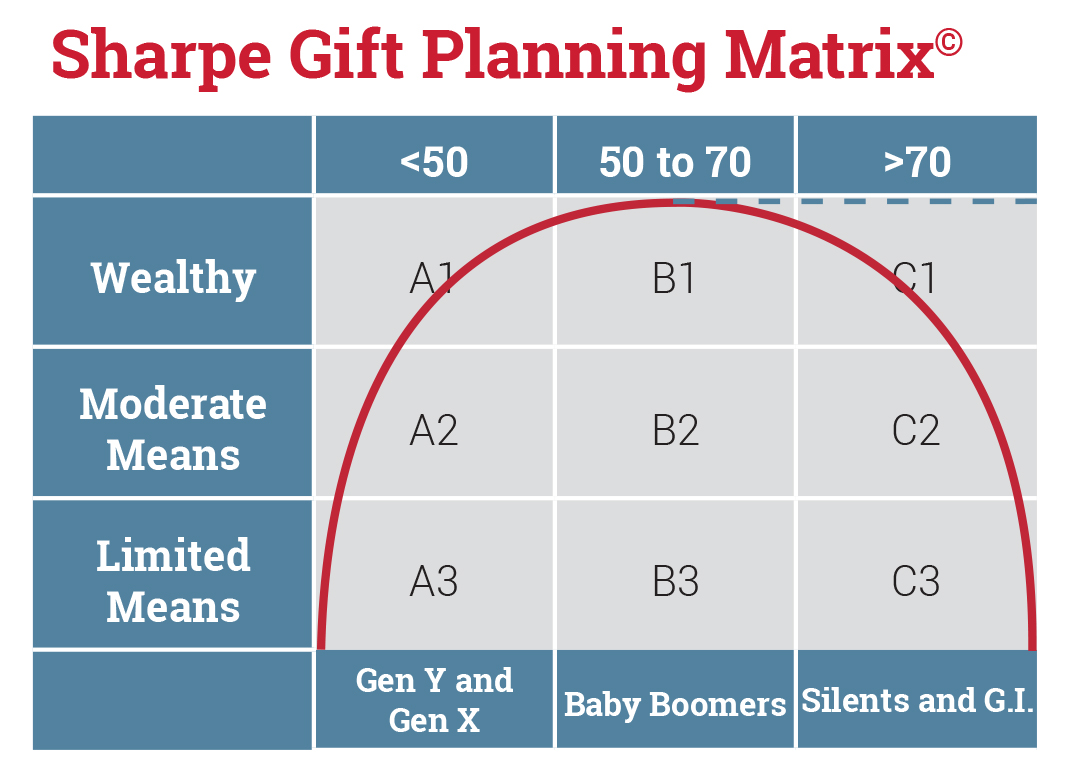

Consider a second popular Sharpe tool, the Sharpe Gift Planning Matrix©, a logical extension of the Donor Lifecycle. Donors tend to fall into one of three categories: younger, middle-aged or older. Additionally, the matrix includes groups of three income or wealth levels. The first group is considered wealthy, usually with high six-figure incomes and seven-figure wealth levels. The second group encompasses those of moderate means with above average income and assets (mainly household incomes between $50,000 and $200,000 and net worth, excluding principal residence, of $250,000 to $2,000,000 depending on where they live).

Consider a second popular Sharpe tool, the Sharpe Gift Planning Matrix©, a logical extension of the Donor Lifecycle. Donors tend to fall into one of three categories: younger, middle-aged or older. Additionally, the matrix includes groups of three income or wealth levels. The first group is considered wealthy, usually with high six-figure incomes and seven-figure wealth levels. The second group encompasses those of moderate means with above average income and assets (mainly household incomes between $50,000 and $200,000 and net worth, excluding principal residence, of $250,000 to $2,000,000 depending on where they live).

The third group includes those of more limited income and wealth levels (household income from below $50,000 and estimated net worth below $250,000). Note that age, income and net worth levels may vary depending on the charitable organization and its donor demographics and location.

Upwardly mobile donors

Studies by Pew Charitable Trusts and the Federal Reserve indicate that a growing number of the upper range of the middle class are transitioning to the next level. While many donors of the B2 matrix box will transition horizontally into the older C2 box, such studies indicate that another group will move vertically into the wealthier B1 and C1 boxes and that those already in those boxes will find their wealth continuing to grow. Such movement will expand the market for special, major and ultimate gifts over the next 20 years, as a segment of affluent Boomers continues to accumulate higher levels of wealth.

First gifts first

According to Sharpe’s studies of many thousands of estates in recent years, the median age at death of bequest donors is now 87 and the most common age is 90. Considering medical advances, it is anyone’s guess how long the average Baby Boomer will live, but it is a safe bet that the oldest Boomers are likely to live another 15 to 20 years. In the meantime, many of them are now just entering their prime years for regular and special gifts. Thus, many charitable organizations will find a large percentage of their overall donor base is comprised of individuals in the 60-plus age range, which bodes well for outright major gift fundraising efforts in both the near and long term. ■

For more information on ways to use the Sharpe KnowledgeBase tools to enhance the results of your fund development efforts, consider attending an upcoming presentation of the popular Sharpe seminar, “Integrating Major and Planned Gifts.” Click here for details.