This July, we undertook a poll to see how respondents were doing through the first half of the year.

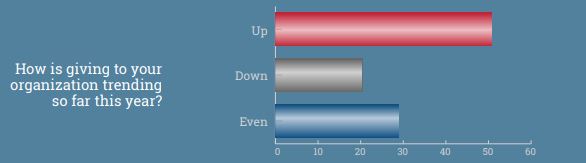

Slightly more than half (51%) of the respondents reported an increase in current charitable gifts through the end of June, while the remainder of respondents indicated their gifts were flat (29%) or down (20%). Given the historical importance of giving in the fourth quarter of the calendar year in determining annual results, data from the first half of the year may not be the best indicator of giving results for the full year. It does, however, provide an initial insights into giving under the new tax act. Perhaps more important than the exact percentage of those up, down or even were the factors that were most frequently cited as influencing giving so far this year.

Positive factors included:

- Capital campaign activity

- A strong economy

- Strong mission and communications outreach.

Negative factors included:

- Economic uncertainty going forward

- Aging donor bases

- Uncertainty about the tax law.

Anecdotal comments noted increases in Charitable IRA distributions, bequests, stock gifts and larger gifts associated with campaigns. One person attributed a rise in giving to a combination of an improving economy and tax cuts, which resulted in people having more disposable income. Another citied “larger gifts, fewer donors.”

Almost half of the poll respondents were from educational institutions (46%). Social services represented almost a quarter, at 23%. Health-related organizations represented 17%, and the balance were religious, arts, animals, environmental, cause-related or other.

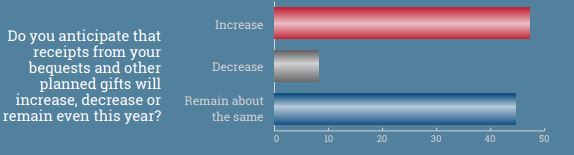

Planned giving expectations

Nearly 92% of respondents expected estate gifts and other planned gifts to stay about the same or increase. Slightly more than 8% expected a decrease.

At this point, it may be too close to predict how overall giving will fare for the year, but the final six months will be critical to the outcome.

For more information about helping your donors make the most of their gifts this year, contact us at 901.680.5300 or info@SHARPEnet.com or visit our website. ■