After several years of interest rates trending downward, on June 30th the Federal Reserve raised its benchmark interest rate charged to banks by .25% to 1.25%, the first increase in four years. It now appears likely that short-term interest rates will continue to rise gradually in coming months.

Mortgage rates have also begun to climb from levels a year ago, and the discount rate

used in charitable gift calculation for split interest gifts is increasing as well.

Rising interest rates will affect donors and gift planners in a variety of ways. For example, retirees and others who depend upon interest rate-sensitive investments will be affected. Many will see their disposable incomes begin to rise again as interest rates increase. At the same time, others will see the market value of long-term bonds and other interest-sensitive investments go down as rates go up.

Gift planners will find that the relative attractiveness of various gift options will likewise be affected. Low discount rates have made charitable lead trusts more attractive in recent years. A higher discount rate will, on the other hand, increase the size of the charitable deduction for other types of gifts such as gift annuities and charitable remainder trusts.

Gift planners who understand the interplay of rising interest rates on donors and gift plans may thus be more effective than others in the coming months.

What you need to know

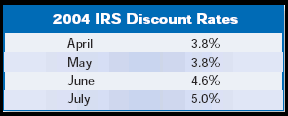

Until the late 1980s, the federal government published tables that utilized a fixed discount rate for gift calculation purposes. The fact that the rate was artificially fixed made it possible to take advantage of periodic interest rate fluctuations when planning charitable gifts. In 1989, however, a switch was made to a floating discount rate based upon the “applicable federal midterm rate” (AFMR), the rate of interest the government pays on intermediate term debt obligations. Today, as a result, the discount rate used in the charitable gift calculation process changes monthly and, with the of calculation, a donor may elect to use that month’s discount rate or the rate from either of the two previous months.

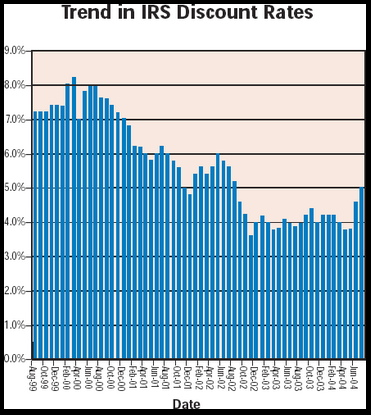

This rate has fluctuated dramatically over the years ranging from 11.6% in 1989 to 3% in 2003. This in turn affects the attractiveness and viability of various gift planning techniques.

After a downward trend that began in early 2000, the discount rate has been steadily rising in recent months.

Note the following chart that depicts the trend in the AFMR over the past five years. The July rate of 5% is the highest that it has been in nearly two years.

Interest rate fluctuations affect different gift plans and the donors they attract in various ways. For example, slight rises in interest rates will have little or no affect on the attractiveness of gift annuities for older persons but may tend to make the lower rates for those in their fifties or sixties less attractive. This may signal a need to slightly adjust marketing strategies. With higher interest rates, charitable lead trusts may need to run for a longer period of time or have a higher payout rate to achieve the desired result. On the other hand, as total returns on investments rise with interest rates, an increasing number of donors and their advisors may find that charitable remainder trusts are more viable planning strategies.

During the low-interest rate environment of recent years, the pooled income funds of many charities have languished with little interest on the part of donors. In a period of sustained higher interest rates, however, pooled income funds can be expected to hold new appeal for donors.

The world in which we work is ever changing and affects the type of gifts donors and their advisors are considering. Take time today to make sure that your marketing materials and proposals are accurate and up to date in light of rising interest rates, tax rate changes, and other relevant factors. Materials that contain out-of-date tax rates or ignore changing economic conditions not only reflect poorly on the charitable organization but may actually mislead potential donors and result in future liability.