The latest Giving USA report estimated that total giving in the United States reached an all-time record of $295 billion in 2006. Yet, when adjusted for inflation, giving actually declined in 2006. (See www.givingusa.org)

Many veteran and novice fundraisers alike are anxious about what this may mean for 2007. Charitable giving in the U.S. should exceed $300 billion this year, but will the philanthropic impact again be flat or down after considering the loss in spending power due to inflation?

This year has been one of uncertainty thanks to volatile energy and stock prices, a bubble in the real estate market, vanishing and injured hedge funds, increasing pressure on investment returns, a sub-prime financial crisis, and decreasing merger and acquisition activity, among other causes. It can be enough to make your head spin—whether you are a development officer or donor—especially as we approach the critical fourth quarter year-end giving period. Most charitable organizations receive the majority of their gifts in the second half of the year, and the lion’s share of those gifts are received during the year’s final quarter.

Promising returns

However, the outlook is not all gloomy. For example, Americans have seen tremendous increases in personal wealth in recent years. According to the Federal Reserve, the net worth of U.S. households exceeds $56 trillion. That’s an increase of over 40% in net worth since 2002!

In other good news for individual Americans, unemployment figures are at low levels, and household income has been increasing as well, particularly at the upper levels. The number of millionaire households in the U.S. now exceeds nine million, and over one million of those own assets in excess of $5 million.

On the nonprofit front, there is further evidence of optimism. Nonprofit endowments have been enjoying superior returns, and many charitable organizations have been conducting successful capital campaigns.

As you contemplate the various complex factors that are contributing to the fund-raising environment this fall, it may be useful to consider new data from a series of recent studies. These reports include the Bank of America Study of High Net-Worth Philanthropy, U.S. Trust Survey of Affluent Americans XXVI, 2007 World Wealth Report, and Northern Trusts Wealth in America 2007. While the methodologies and focus vary from study to study, there are a number of findings relevant to philanthropy that may affect your fund-raising strategy this fall.

A closer look

World Wealth Report 2007, published by Cap Gemini and Merrill Lynch, observed “irrespective of wealth band, philanthropic giving will continue to be driven not by corporations, governments, or foundations, but by the generosity and intent of individuals.” The report also noted the following:

- North America has the greatest number of high net worth and ultra high net worth individuals.

- Securities are the #1 investment asset allocation.

- Equities and fixed income investments account for the majority (52%) of the financial assets of high net worth individuals.

- Cash accounts for 13% of high net worth assets, while real estate and alternative investments total approximately one-third of the asset allocation.

Bank of America Study of High Net-Worth Philanthropy examined the characteristics of approximately 3.1 million households with incomes over $200,000 and investable assets of at least $1 million. According to the study, this relatively small group accounts for approximately two-thirds of household charitable giving in the U.S. Ninety-eight percent of these households give to charity. The average giving level is in the $80,000 to $120,000 range, depending upon whether giving to family foundations or advised funds is included.

The Bank of America study also reports the following:

- The top three reasons for giving cited by high net worth donors are meeting critical needs, giving back, and helping others.

- Almost one-third of high net worth households have given stock (31.8%).

- Approximately two-thirds have given to a major campaign within the last year.

- Over the past five years, while more than 70% experienced an increase in wealth, 60% reported that their income remained the same or even decreased.

- If the estate tax was eliminated, approximately 85% of high-net worth individuals who had named a charity in their estate plans would either keep their bequest giving at the same level or increase it.

- Current giving generally increases with age until age 70, when it then begins to decrease.

The U.S. Trust Survey of Affluent Americans focuses on an elite group of households—those with investable assets of $5 million or more. Equities are their number one investment category—stocks and bonds account for 59% of their investments, and 93% own securities.

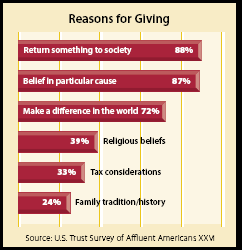

Just as previous surveys of donors of average wealth have found, tax considerations are among the least cited reasons for giving to charity by the ultra-wealthy (see chart to the right).

Finally, Wealth in America 2007, which evaluates the characteristics of an estimated 4.1 million U.S. households with $1 million or more in investable assets, reports that 20% of millionaire households increased charitable giving in 2006, with the wealthiest increasing their giving the most.

The report also points out generational differences in giving. For example, Generation X millionaires are touted as more generous than either Baby Boomers or members of the Silent Generation. More than one-fourth (26%) of Gen X millionaires made contributions in excess of $20,000, compared to 15% of Boomers and 13% of Silent Generation millionaires. Gen X millionaires were also approximately three times more likely to make gifts of $100,000 or more. This may be a result of life cycle factors, such as still working, considering retirement, or being retired.

Consider the matrix

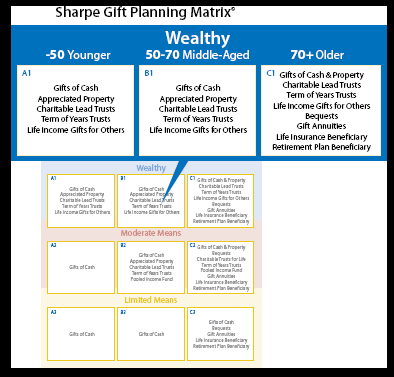

These reports and others provide valuable information if one knows how to use it wisely. Experienced fundraisers and anyone who has ever seen a traditional fund-raising pyramid recognize the importance of a relatively small number of large gifts to any type of fund-raising campaign. In the same vein, the Sharpe Gift Planning Matrix© may help you develop specific strategies for the various segments of your donor base.

To reach high net worth donors, we suggest that you segment your donor file in a way that will help pinpoint the wealthier portion based upon the wealth, income, and giving information that is available to you. If income or wealth data is not obtainable, giving history can help you identify high dollar and gift-in-kind contributors (those who give stocks, bonds, etc.)

Next, segment your high net worth group by age. We suggest the following groupings: under age 50, age 50 to 70, and age 70 and over. Note that the Bank of America study found current giving by the wealthy increased until around age 70, after which it began to decline (see chart below).

The top of the Matrix is a small and elite group of any organization’s donor base. If drawn to scale, the boxes that form the top of the Matrix would be very thin in comparison to the rest of the Matrix, and, even among themselves, the boxes of the upper groups would vary in thickness.

Recognize that both the Sharpe Gift Planning Matrix and Sharpe Donor Lifecycle can be useful in developing strategies to employ this fall. After considering gift history, wealth, and age, begin looking at other factors: Have they given stock in the past? Are they business owners? If they are corporate executives, are their companies’ stocks publicly traded? If they are retired and over 70½, are they likely to have an IRA they do not need? Are they single? Do they have children? Have they been volunteers? Do they have proposals pending? Do they have a life income gift?

Younger donors and prospects in the high wealth or income level should be given special attention based upon the Wealth in America 2007 study’s finding that Gen X millionaires are more generous than their older high net worth counterparts. Gifts of appreciated securities should be promoted across the entire top of the matrix, because the Bank of America study notes that almost one-third of affluent donors have given appreciated securities in the past. If good wealth information is not available, consider including corporate executives and those with better than average giving history.

Older wealthier donors over age 70 should also be exposed to information about the special opportunity for IRA giving. They may be able to make tax-free gifts up to $100,000 from an IRA prior to December 31, 2007. They also may be interested in possible gifts that can increase their income levels.

Those who advise donors and prospects about gift opportunities that fit their stage in the donor life cycle, based on age and wealth, are likely to find a few “diamonds” in the rough who can be “polished” before year-end. Another benefit may be finding others that will require more “polishing,” but who could shine just as brightly through future gifts in 2008 and beyond.