by: Barlow Mann

How many times do we see the terms “your tax-deductible contribution is welcomed” or language of a similar nature as part of charitable gift solicitations? Is it really that simple?

If an individual makes a gift to support a good cause, is the donor necessarily entitled to a charitable deduction? This seems like a straightforward question that should have a simple answer. There is evidence, however, that the IRS is increasingly disallowing deductions for gifts that do not comply with various “tax technicalities.”

Is the gift deductible?

A variety of complex tax rules and regulations must be addressed for a gift to qualify for a current income tax deduction.

Itemized deductions must first exceed the standard deduction; then the donor must not exceed the limitations placed on charitable gifts by Congress, among them the 50 percent of adjusted gross income (AGI) for gifts of cash and 30 percent of AGI for gifts of appreciated property. Fortunately, donors who exceed these limits may carry forward qualified charitable deductions for up to five future tax years.

Additionally, the so-called “good cause” mentioned above must be a charitable entity that qualifies as a recipient of tax-deductible charitable gifts for an appropriate purpose as set out in Sections 170 and 501 of the Internal Revenue Code and associated regulations.

Assuming these requirements are met, will the contribution be deductible for federal income tax purposes? Again, the answer is not necessarily clear.

A real problem.

Consider a recent tax court case where a California couple was denied a deduction for a gift of $18.5 million in donated real estate. The donors were U.S. taxpayers and the organizations receiving the donations were qualified nonprofits, but the deduction was disallowed for failure to comply with tax laws.

In this case, the donors failed to secure a timely qualified appraisal for the value of the contributed property. It made no difference that an appraisal after the gift was made actually valued the property at more than $20 million. According to the IRS, which brought the case to court, the U.S. tax code requires that a qualified appraisal for donated real estate and many other types of property other than publicly traded securities must be obtained by the time a donor files the relevant tax return. Because that requirement had not been met, the entire deduction was disallowed.

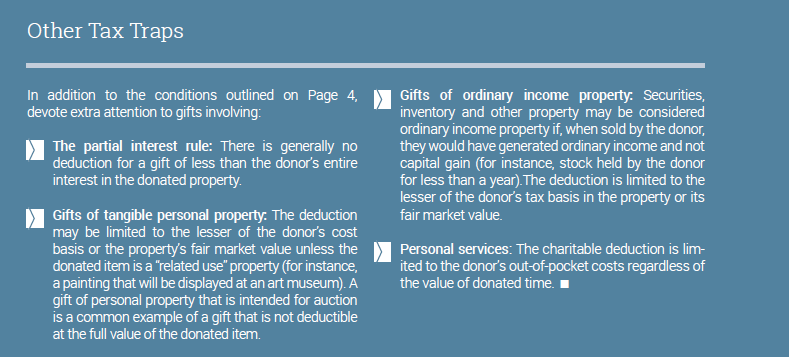

A number of other tax traps can reduce or eliminate the charitable deduction for gifts to qualified organizations and institutions. Some common pitfalls are examined below.

Gift substantiation.

If the taxpayer is audited, a cancelled check, credit card receipt or payroll deduction record may not provide sufficient documentation. If the gift is more than $250, the donor must have a “contemporaneous written acknowledgment” that meets all IRS requirements. The necessary paperwork must also be “timely,” according to the IRS.

Noncash gift valuation.

A donor of noncash items is subject to a variety of rules and regulations depending on the value of the gift and the asset used to fund it. Different thresholds apply for gifts under $250, gifts of $250 to $500, gifts of $500 to $5,000 and those valued at over $5,000. If a taxpayer is audited and does not have the required documentation, the otherwise allowable deduction could be disallowed.

For more information on these baseline issues, see IRS publications 526 and 1771. Also see the instructions for IRS Form 8283. All are available at www.irs.gov.

Help your donors.

Even though it is the donor’s responsibility to substantiate charitable deductions, recognize the rules are complex and donors whose deductions are disallowed on technical grounds may not be as generous in the future!

To avoid problems, make sure that your gift acknowledgments are up to date with current tax law. And most importantly, alert donors to their responsibility regarding gift valuations, substantiation rules and other requirements and limitations that may apply to their gifts.