In recently released articles on the top gifts of 2008, Slate magazine and the Chronicle of Philanthropy reported that seven of the top ten charitable gifts last year came in the form of bequests from estates.

The Slate 60, the listing which tracks the largest charitable gifts of the year in America, also found that 13 of the top 61 gifts (21%) on the list were bequests, amounting to $11.64 billion of the $15.78 billion total (74%).

Bequests—the bedrock of development programs

Gifts to charity from estates are nothing new. Charitable bequests—testamentary gifts of cash or personal property— have been used since ancient times, when, for example, Plato bequeathed his school to his followers, along with an endowment of land to support it.

Many of America’s leading institutions and organizations were founded thanks to bequests from the estates of generous, affluent individuals—Harvard University and The Smithsonian Institution being noteworthy examples.

Bequests have historically provided a reliable and growing source of income for America’s nonprofit community. For example, according to the Council for Aid to Education (CAE), over the last 25 years, bequests as a percentage of individual support to higher education have averaged some 23%.

According to Giving USA 2008, bequest giving has risen three out of the last four years, reaching $23.15 billion in 2007, the most recently reported year.

Spike in bequests

Why did bequests, one of the most prevalent types of planned gifts, become an even greater source of giving among the wealthiest givers last year?

According to Slate, perhaps even the superwealthy are giving more cautiously during these trying economic times. After all, none of 2007’s top ten gifts were bequests, 2006 saw only four bequests in the top ten, and only one bequest was reported in the top ten gifts of 2005.

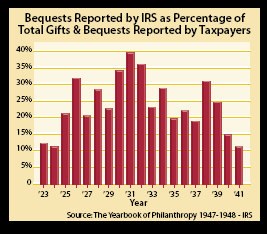

This may be the beginning of a similar trend seen in the giving data from the years of the Great Depression. Statistics from that time show that the importance of bequests increased substantially during the mid-1930s.

For example, IRS figures reveal that bequests rose to record levels as a percentage of the total of lifetime and estate gifts deducted from tax returns.

Bequests also became a much higher percentage of publicly reported substantial gifts. The New York Times reported that, like the recent Slate and Chronicle reports, bequests peaked at some 70% of larger gifts reported in 1933, before dropping to more normal percentages by the end of the 1930s.

What can we expect from donors?

Among today’s broad population of middle-income donors, there are likely a number of reasons why bequests and other planned gifts will continue to be a resilient source of gift income during these challenging economic times:

- Bequests are generally made by older, retired persons whose timetables are less affected by prevailing economic conditions.

- During times of economic uncertainty, bequests can provide donors with much needed certainty and control over their assets for the remainder of their lifetime.

- Retirees may be more interested in gifts that feature retained income in times of lower interest rates and dividends.

Major donors who would make outright gifts during times of greater affluence or optimism may be more open to considering certain types of planned gifts, such as term of years trusts and lead trusts, which allow them to make significant gifts over a somewhat longer time period than a traditional pledge agreement without the necessity for a 50-year-old with a 34-year life expectancy to pass away.

As you and your donors continue to cope with ongoing economic uncertainty, planned gifts such as bequests and life income arrangements are likely to be of interest to an even broader group. Apparently, according to Slate, such gifts are already holding broader appeal for the uber-rich.

As a development executive, it is important to empathize with your donors and understand the current economic challenges they face.

We should be ever-mindful that committed, long-term supporters in many cases still want to provide meaningful gifts to your organization despite reductions in the value of their assets and the amount of their disposable incomes.

Be sure to inform your donors about the various planned giving tools that can help them achieve their philanthropic goals while helping to maintain their financial security.

For creative suggestions for communicating with your donors, visit www.sharpenet.com