The current recession has brought with it increased unemployment and job fears; reduced dividends, interest and other earnings; and lower real estate and investment values. Many have seen their ability to make larger outright gifts decline in step with the market. Nonetheless, the field of philanthropy remains resilient and history reveals that Americans’ desire to give will continue for the most part unchanged, even in these tough times.

Where to turn

These days, retaining existing donors may be even more important—and cost-effective—than acquiring new ones. Current donors, especially those with a long history of support, should be specially cultivated and treated with the respect and gratitude they deserve. This includes giving them the option to break gifts into installments or otherwise being flexible with pledge fulfillment. It is also helpful to inform donors of other giving options that may be particularly attractive to them in today’s environment, including gifts of stocks that may still be worth more than they cost, lead trusts, life estate agreements, IRAs, remainder trusts, and bequests.

Gifts of appreciated securities

Despite the bad news on Wall Street in recent months, keep in mind that many donors, especially those in their sixties and older, still have significant amounts of securities that are worth more than they paid for them and yield little income. It can make sense for donors to give these securities and use the cash they might have otherwise donated to repurchase other investments and enjoy a new higher cost basis. The securities may also be good candidates to fund gift annuities and other gifts that result in immediate tax savings and increased income.

Charitable lead trusts

Charitable lead trusts have been the fastest-growing form of charitable trust in recent years, with a growth rate of 40% between 2001 and 2007. In fact, IRS figures reveal that nonprofits receive more funds from lead trusts than from the much more commonly executed charitable remainder trusts. This is, in part, explained by the fact that lead trusts provide income to nonprofits every year while remainder trusts typically benefit the charity only upon the termination of the trust.

Lead trusts are no longer a planning tool used only by the super wealthy. In fact, most lead trusts (63%) report assets to the IRS of less than $1 million. The average size of those trusts is just $374,000, roughly the same size as charitable remainder trusts holding assets under $1 million.

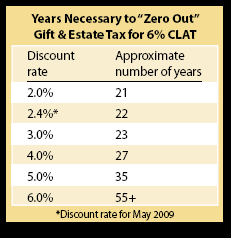

Further, the current low discount rate used in the gift calculation process makes the lead trust even more attractive. The February discount rate of 2.0 was the lowest ever for such calculations and the continued low rates mean that “zeroing out” for gift and estate tax purposes can be accomplished over a shorter term of years, with a lower payout rate, or through a combination of both.

With today’s lower asset valuations, many advisors are encouraging their clients to fund lead trusts with discounted assets they assume will regain value after the recession in the hope that the “real value” will ultimately be distributed to their family free of tax at the termination of the trust. Note that as of May 2009, it is possible to pass an unlimited amount to heirs free of gift and estate tax with a payment of just 6% to charity for 22 years.

The value of life estate agreements

The lower AFMR used in gift calculations can also add appeal to life estate agreements for farms and personal residences, including vacation residences. Such an arrangement can provide donors with substantial and immediate income tax savings without affecting their lifestyle. Some donors may be able to enjoy up to six years of tax savings.

Depending on whether the property has appreciated or if the deduction is too large to use even in six years, in some cases donors will benefit from taking the 50% election and basing their deduction on the cost basis of the property. This can allow them to claim a charitable deduction of up to 50% of their AGI instead of the 30% limitation for gifts of appreciated property.

For example, if a donor purchased a vacation home a few years ago that has seen little or no appreciation, this extra residence may provide significant tax relief that will increase after-tax spendable income for up to six years.

IRAs

Donors over the age of 70½ have until December 31 of this year to make tax-free charitable gifts up to $100,000 from traditional or Roth IRAs. Even though minimum required distributions have been waived for 2009, the charitable IRA provision still provides an important giving opportunity for individuals who do not anticipate needing IRA funds themselves. Under previous Pension Protection Acts, the majority of IRA gifts came from persons who enjoyed more than adequate retirement funds and chose to make large gifts up to the $100,000 maximum.

Using unneeded IRA funds for gifts allows donors to make larger gifts today without affecting their other cash flow or income. The best prospects may be those over 70½ who are covered by pension plans, business owners, or executives and professionals who took advantage of the “unlimited IRA” provision in the 1980s that allowed anyone with an income to establish an IRA. Though Congress later enacted income limits to stop those with high incomes from “sheltering income” with an IRA, these “orphaned” IRAs may represent an attractive pocket for giving for some seniors.

Keep in mind also that wealthier seniors may be well advised to give from these funds because they can be subject to both estate and income taxes when ultimately received by non-charitable heirs.

Getting their money back

Some prospects that would have been receptive to a six-figure pledge or gift before the recession may not be as comfortable with that possibility today. However, they may consider making a gift if they feel they could retain income equal to the value of the gift over time.

For example, a donor could establish a 10% ten-year CRAT. The donor receives an amount equal to the amount originally placed in the trust over the 10-year period and the charity receives the remainder. Depending on the assumption made, the charity might receive 50-60% of the initial value of the trust while the donor receives fixed payments over the trust term.

Bequests

Finally, do not forget to encourage bequests and other planned gifts from older donors that can benefit your charity in the relatively near term. Most charitable bequest maturities come from persons that pass away in their seventies, eighties, and nineties whose last will and testament, living trust, or other arrangement were finalized just a few years before death. In times like these, it may make sense to direct more time and resources to your oldest long-term constituents, who are more likely to be making their final plans in the next few years.

During the early years of the Great Depression, charitable bequests from older donors provided a much higher percentage of larger gifts and helped many charitable organizations survive those turbulent economic times. As was noted earlier this year, seven of the ten largest gifts reported in 2008 came in the form of charitable bequests, so it would appear that this trend may already be underway.

The big picture

Now is not the time for business as usual. Those charged with fund-raising responsibilities must think creatively to find ways to make giving more appealing and effective for donors. By looking at the big picture—including market conditions, family and other donor obligations, and changing tax laws—development officers can help their supporters fulfill their personal and charitable goals.