Over the past few years, much has been written about the gradual aging of the U.S. population and the inevitable impact on housing, health care, travel and leisure, and many other industries.

The most forward-looking nonprofits in America have also become increasingly aware that changes in the age distribution of donors will increasingly affect the ways in which they seek funding.

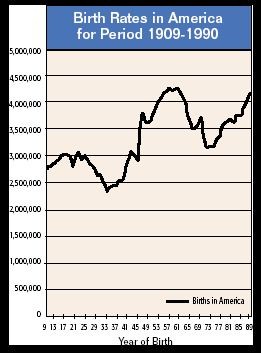

Note the distribution of births in America during the period from 1909 to 1990 in the chart at right.

As the chart indicates, approximately three million persons were born in America each year prior to 1925, when birth rates began a 25% decline that ended nine years later during the depths of the Great Depression. Between 1935 and 1955, some 70 million persons were born. While the term “baby boomer” generally refers to the persons born between 1946 and 1964, a lengthier upturn in births occurred between 1935 and 1955.

Impact on fund development

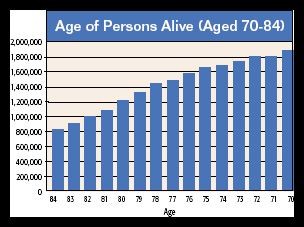

For those planning their fund development efforts for the future, this means that the number of persons now aged 70 and older can be expected to grow relatively slowly as those born before the Depression begin to pass away with fewer persons to replace them. According to census reports, approximately 30 million Americans are currently aged 70 and older. Of this group, some 60% are female and 40% male. Among those in the 80-and-older age range, there are approximately 17 million persons still living. Notably, some 63% of those persons are female and 37% male.

According to Sharpe Group studies and IRS data, the average age at death of persons who leave funds to charity through their wills and similar planning tools is approximately 84 years of age. There are now about 27 million persons between the ages of 70 and 84, the majority of whom can be expected to pass away during the next 20 years. The passing of this generation will comprise the first phase of the unprecedented transfer of wealth that has been predicted to occur in coming years. The following chart illustrates the gradual increase in the numbers of persons at or approaching the age at which charitable bequests are typically received.

Despite the demographic trends that will form the basis for increased funding from estates in coming years, charitable organizations and institutions that wish to participate in the ongoing wealth transfer should make certain that their donors know that they welcome bequests, gift annuities, and other gifts that come to fruition only at the death of one or more persons.

The challenge for some will be communicating the benefits of bequests and various other planned gift options to the appropriate persons at the most opportune time. Studies have shown that many long-term donors tend to lapse in their late 70s and early 80s, about the same time that they are making their final estate plans.

It is therefore important to take steps where possible to delay the point at which older persons discontinue their current giving to increase the probability of being in touch with them when they are making final plans.

It is also vital to keep in mind that the majority of people in this age range are women. In many cases their husbands have predeceased them and left to them the ultimate decisions concerning the division of what may be substantial sums accumulated during marriage. Not surprisingly, then, some 70% of bequests typically come from women.

Men, on the other hand, do not leave as much property through their wills to charitable recipients and others because they often own their homes, securities, and other assets jointly with a spouse. In addition, other assets such as insurance proceeds and retirement plan assets are transferred via contract or beneficiary designations. For that reason, the bulk of their estates usually passes outside probate to their wives automatically at the time of their death.

Women, however, tend to own property outright at the time of death and distribute their property under the terms of a will. This is one of the reasons it is important when communicating planned gift concepts to older donors to continue to concentrate on bequests via wills.

The younger group

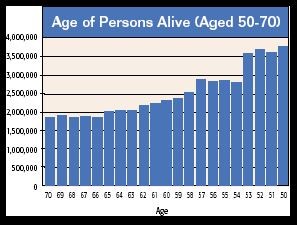

As noted above, the group of those who will leave bequests in the near term is now passing from the scene and will be “replaced” by a much larger total group of persons now in the 50-to-70 age range (see chart at right). The oldest of this group, however, enjoy a life expectancy of 15 years or more. The youngest may live an additional 35 or 40 years or even longer, depending on future medical advances.

For that reason, with the “young old” group it is less important to emphasize gifts that will take place at their deaths in 15 to 35 years, and more important to emphasize gift planning options that will result in gifts in a relatively short period of time. Term of years charitable remainder trusts, lead trusts, and life income gifts for the benefit of parents and other loved ones of advanced years are examples.

Keep in mind also that this younger group will be made up of a higher proportion of men and married couples. The percentage of the 70-and-older population with one or more years of higher education will also be increasing as a result of the G.I. Bill and other factors that made higher education more widespread among this group. In addition, these persons have spent much of their careers contributing to IRAs and other taxfavored savings plans. They may thus be considerably more “financially literate” than the preceding generation.

First things first

While it is important to communicate deferred gift concepts to the coming generation of seniors, don’t forget that many of them will continue to be current donors for a decade or longer. One of the best ways to discover those among this emerging segment of donors who may have the inclination to make major gifts is to periodically sweep the group in search of those who will say they have already considered or would consider leaving a bequest. This can be one of the best indicators that a younger person of means may have donative intent that is not fully revealed by his or her current level of giving. Careful attention to these persons could yield welcome increases in current giving.

These are just a few of the implications of the changing demographic makeup of the U.S. donor population. Many organizations have found that time dedicated to analysis of the age distribution of their constituency will result in newfound opportunities that are unique to them. Now is the time to reach out and encourage donors of all ages to consider how they can more effectively plan their gifts for the benefit of themselves, their loved ones, and their charitable interests.

This article is excerpted from Session One of the popular Sharpe seminar “Major Gift Planning.” Join the over 4,000 representatives of charitable entities who have attended this seminar in recent years. See page 3 for details on upcoming sessions.