Throughout the estate and financial planning community, preparations are under way to help Americans take advantage of the first steps in the scheduled reduction and eventual elimination of federal estate taxes enacted as part of the major tax law changes earlier this year.

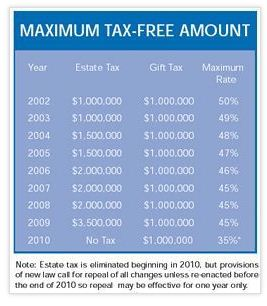

Note the initial changes in the law which take effect on January 1, 2002. See the chart below. Beginning next year, the amount that can be given to others during lifetime or at death will increase almost 50% from $675,000 to $1 million. But note that while the amount that can be left to heirs on a tax-free basis at death will increase over time, there are currently no plans to increase the amount that can be given to loved ones during life beyond the 2002 increase.

For this reason, many persons will be encouraged to take steps to maximize the benefits from the additional $325,000 in tax exemption amounts that will be available to them in January. Remember this amount is per person, so a married couple can transfer an additional $650,000 tax free to loved ones beginning next year.

Charitable opportunities

Looking forward to next year, it is important to keep in mind there are a number of ways that donors can use traditional planned giving tools to make significant gifts while also effectively increasing the amounts they can pass to loved ones tax free under the provisions of the 2001 tax act.

Giving a child a start

For example, suppose George G., age 57, would like to make a major gift but would also like to give a 25-year-old child a “start in life.” The donor has already used the $675,000 gift tax exemption amount that is currently available to him to fund trusts that own insurance on his life for the purpose of payment of estate taxes. George owns $1 million worth of securities that have greatly increased in value but yield no income. If he gives the securities to his child next year, as much as $300,000 could be due in gift tax, even after taking into account the additional $325,000 in exemption that will be available at that time.

On the other hand, George could create a charitable remainder annuity trust that would pay a fixed amount of 5%, or $50,000, per year for eight years to the child. The donor would enjoy a charitable deduction for the year of the gift of approximately $675,000, leaving a taxable gift to the child of $325,000. This amount would be offset by the additional gift tax exemption amount available to the donor on January 1, 2002.

If the funds in the trust earn a total return of 7%, more than $1.2 million should be available for charitable use in eight years. George is thus able to make a very meaningful charitable gift while providing assistance to his child over time.

Providing a future inheritance

Harold and Barbara T. do not want to provide much in the way of current financial assistance to their two children, both in their mid-twenties, but they would like them to both receive $1 million from them when they are in their forties, some 20 years from now. They would also like to fund a major project for a charitable interest they enjoy supporting. They are pleased to learn that they can place $2 million in charitable lead trusts that will pay 5.25%, or $105,000, annually for 20 years. They will be deemed to have made a taxable gift to their children of approximately $650,000, the additional amount they can give their children on a combined basis free of tax after January 1. Through wise use of the additional gift tax exemption amount to which they are entitled, they have provided for gifts to charity totaling $2.1 million along with tax-free gifts to their children of $2 million or whatever the trust assets are worth at the time they are received in 20 years.

Note in the chart the payout amounts and time periods necessary under the November 2001 discount rate of 5.0% to pass $1 million tax free over various time periods while resulting in a taxable gift that is approximately equal to the $325,000 additional amount allowed as of January 1, 2002.

Other options

Another option one might consider is a gift annuity for the benefit of a parent or other loved one. It is possible, for example, to provide for a gift annuity of up to $625,000 that would pay an income of nearly $59,000 per year for life to an 82-year-old parent while reporting a taxable gift of $325,000.

Communicate with donors

As the new year approaches, there will be no shortage of information available to donors from financial services providers who will be offering a variety of strategies to maximize the benefits of the new $325,000 gift exemption. It is up to charitable gift planners to point out the benefits of the plans outlined above that feature wonderful benefits to loved ones while resulting in a significant charitable gift.

The charitable remainder trust and gift annuity opportunities outlined above not only feature gift and estate tax benefits, they also afford donors substantial current income tax deductions and the full or partial avoidance, or delay, of capital gain tax that would otherwise be due on the sale of assets used to fund the gift.

The best prospective donors for considering such plans are generally those who have substantial means and who have already indicated their intention to include one or more charitable interests in their will or similar plans. Through the use of lead trusts, gift annuities, charitable remainder trusts, and similar plans, they can “accelerate” a bequest that may or may not afford estate tax savings, depending on future actions by Congress. The message should be to act now to assure maximum tax and other financial benefits for a gift they have already decided to make in the future. Their funds can thus be put to work today taking care of loved ones, while assuring their charitable desires will be met in what may be a more timely manner.