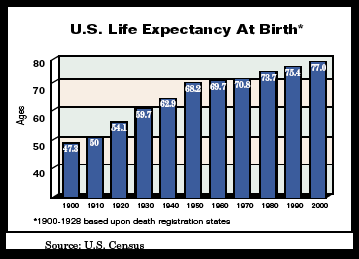

One hundred years ago, the average life expectancy in the United States was less than 50 years of age. In fact, government figures from 1900 report a life expectancy of only 47.3 years. Today’s U.S. life expectancy exceeds 77.6 years of age—an increase of over 30 years.

In light of these advances in longevity and quality of life, fundraisers may wish to consider the impact of longer life expectancies and other factors on the much-anticipated wealth transfer.

Life expectancy increases

In the early part of the twentieth century, infant mortality was a much greater factor in determining life expectancy. There was approximately a 25% chance that newborn babies would not live to celebrate their first birthdays. Thereafter, many succumbed to common illnesses like the flu and measles or fell victim to industrial and agricultural accidents.

However, over the past century the percentage of deaths of those under 65 has fallen dramatically. In 1910, 75% of those who died were under 65 with only 25% among those 65 and older. By 1990, over two-thirds of the deaths were among the 65-plus population and fewer than one-third among those under 65. At the dawn of the twenty-first century, death is even less common among younger and middle-aged persons.

Growth of planned gifts

Since most charitable bequests come from persons over the age of 65, this means that the number of planned giving prospects and donors relative to the number of persons born in earlier years has grown steadily in recent years. Additionally, economic factors such as the advent of Social Security and broader coverage by pensions have enabled more persons to leave substantial estates. The advent of defined contribution retirement plans, continued economic expansion, and increasing real estate and securities values have also helped to fuel the growth of planned giving over the past few decades.

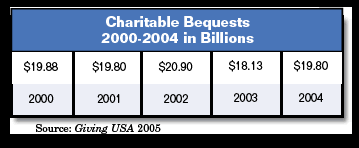

According to Giving USA figures, charitable bequests more than doubled between 1964 and 1969, from $950 million to $2 billion. It was not until 1984 that another doubling occurred—to the $4 billion level. Since then, charitable bequests have grown almost five-fold, but they have hovered around the $20 billion mark for the past five years.

Death takes a holiday

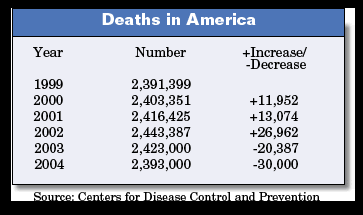

For many of us, these have been five very long years. We have experienced the aftermath of “irrational exuberance” in the nation’s investment markets; gift, estate, income, and capital gains tax cuts; increased competition; and a more uncertain world in general. Additionally, it appears that “Death” has indeed been taking a holiday. In general, as the population grows, so too do the number of deaths. However, in the most recent years for which figures are available, there has actually been a decline in the number of deaths in the United States. After a period of very slow growth, the number of deaths has been decreasing since 2002 (see chart below).

What this may mean

The decline in the number of deaths may result in slower growth or even a temporary decline in charitable bequests and other maturities. The amount of planned giving revenue is dependent on both the number of deaths and the amount of wealth held by the decedents. With more people living longer than ever before, there will be increased spending pressure on their savings, investments, and income.

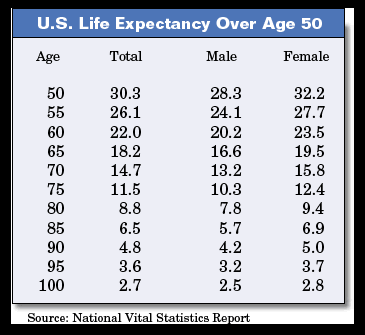

According to recent National Vital Statistics Reports, Americans currently have more than a 75% chance of surviving to age 70. Over half of the total United States population will live to see 80. Those with minimal or average savings may be forced to deplete those funds during a lengthy retirement period. Increasingly, seniors are choosing higher-paying commercial annuities to maximize cash flow while ensuring an income stream that cannot be outlived. In the case of the affluent elderly, charities may find that access will be limited by a growing number of gatekeepers, including friends, family, advisors, and others.

Be careful what you wish for

With increased longevity, many among the ranks of seniors are now combating the chronic effects of old age, the fear of running out of money, the loss of loved ones and friends, financial schemes that prey on the elderly, and a general sense of diminished control of their lives. Quality of life issues may become more important than quantity of life. Evidence of this development can be seen in the growth in popularity of “living wills,” durable healthcare powers of attorney, and “Do Not Resuscitate” medical orders.

Off to a slow start

Because of the factors outlined above, it may not be wise to count on the intergenerational wealth transfer to generate large amounts of funds in the short term. While an unprecedented amount of wealth is now being transferred through estates—with charities among the recipients—there are indicators that the wealth transfer is off to a slow start. In addition to the 55-year projections from 1998 to 2052, there were also 20-year projections for the period from 1998 to 2017. During this 20-year period, a transfer of at least $1.7 trillion was projected for charitable purposes. Now seven years into the wealth transfer, less than $130 billion has been received in charitable bequests. In other words, at 35% of the way through the 20-year projection, we have reached less than 8% of the anticipated results. Even if we could double the level of charitable bequests for the next seven years and double them again for the remaining six years, charitable bequests for the 20-year period would still reach only about half of the total originally projected.

While this may initially be perceived as bad news by some fundraisers, remember that despite various impediments, the level of charitable bequests has doubled during the past 10 years. The key to success may be to reevaluate your expectations for the next few years and recognize the increased importance of careful gift planning in light of the estate tax phaseout, lower death rates, longer life expectancies, and other factors. While death may have taken a holiday, it is sure to return and the passing of a growing number of Baby Boomers and their older siblings (the Silent Generation) will cause the number of deaths in the U.S. to grow in the future. In the meantime, it is more important than ever that America’s nonprofit community be prepared to help older donors make their gifts in ways that help them meet multiple financial objectives while still making what may be the largest gifts of their lifetime.